Wickes this week set out how it won both trade and DIY customers in a year in which sales grew but profits took a hit from cost inflation

The DIY retailer said it had won customers by adding services including 30 minute click and collect, Klarna payment options and a Wickes eBay store. The eBay store was launched with 4,000 lines in order to reach younger customers. Wickes is now looking at adding further marketplace platforms, including on eBay, to its channels.

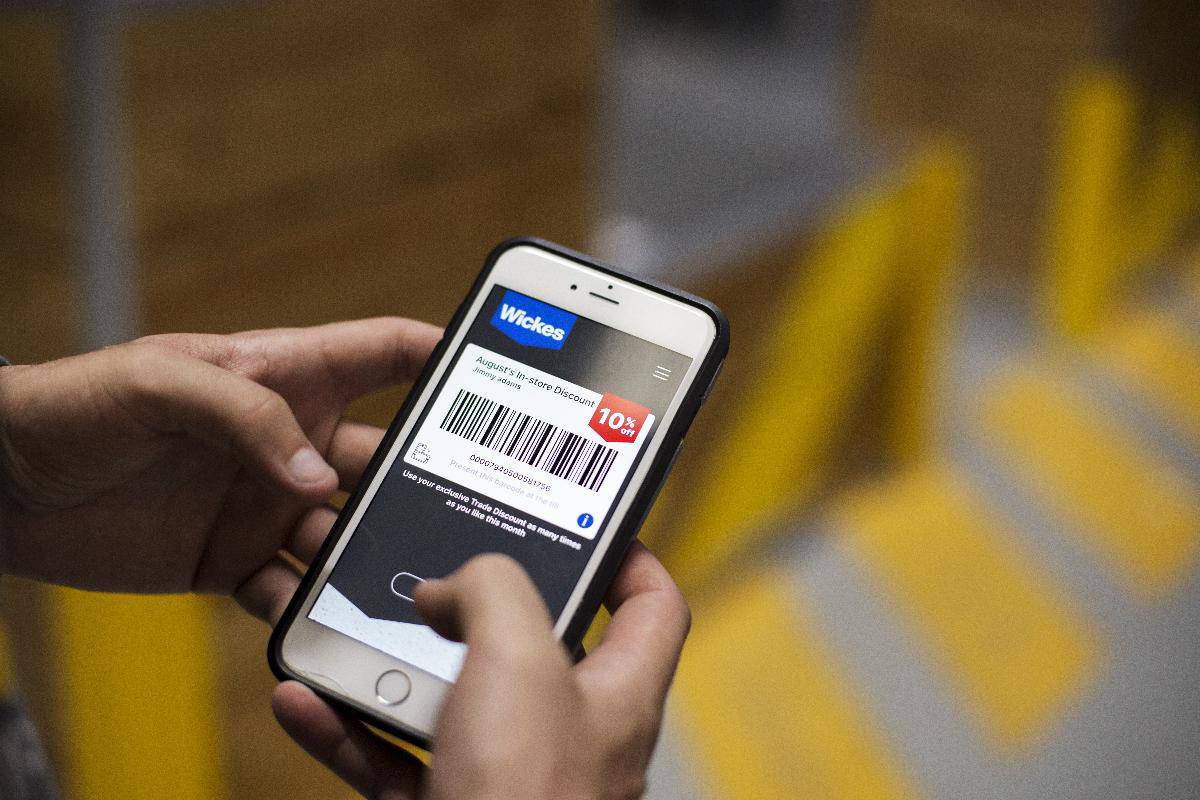

Click and collect also appears to have boosted membership of its Digital TradePro scheme, which grew by 18% as it added 112k members to take its total to 746k. Trade customers, it says, appreciated the trade discounts it offered in a year in which it kept product price rises below inflation, at a hit to profits. “Sales from TradePro customers in the year increased by 19% compared to 2021, says Wickes in its full-year statement. “Our TradePro customers continue to represent strong strategic value to Wickes in terms of average order value and frequency of visit, and we have plans to evolve our offering in 2023 to drive further loyalty and engagement.”

Wickes points to rising inflation and interest rates that mean the housing market has slowed, in terms of both house prices and sales. But the retailer says it continues to benefit from post-Covid changes that still see more people working from home and consequently investing more in their homes, while the need to improve energy efficiency is still a key driver for its market during sharp rises in energy prices.

The retailer says it has efficiency plans in place to offset its own inflationary pressures, with the exception of energy – set to cost it £10m more in 2023 than in 2022.

Full-year figures

The update came as Wickes this week reported revenues of £1.6bn in the year to December 31 2022. That’s 1.8% up on the previous year. On a like-for-like basis, which strips out the effect of store openings and closures, sales were 3.5% up.

Pre-tax profits before one-off costs came in at £75.4m, down 11.3% from £85m in 2021 as the retailer kept its prices below the rate at which inflation increased its costs. At the bottom line, after one off costs of £35.1m, primarily relating to the £24.4m cost of separating Wickes’ IT systems from its former parent company Travis Perkins, pre-tax profits of £40.3m were 38.4% down on the previous year.

In the first 11 weeks of its current 2023 financial year, Wickes says that its core product sales are “moderately” behind the same time last year, trade sales are growing and DIY is normalising. DIFM (do it for me) sales are “slightly ahead year-on-year due to the elevated order book”.

Wickes chief executive David Wood says: “This was a period in which we achieved record sales and made further market share gains. While profit declined, the outcome is still significantly ahead of the pre-Covid period. Our performance was underpinned by our balanced business model, digital leadership and ability to offer the best value and service across trade, DIFM and DIY.”

Wickes is ranked Top50 in RXUK Top500 research.