The first edition of the RetailX Australia 360° 2023 report looks in detail at this fast-developing market and how the leaders perform on fulfilment and sustainability measures.

Understanding how the Top100 retailers manage their operations in areas ranging from delivery to returns and sustainability can help those trading within this market, or those considering doing so, to benchmark their own performance and gain useful insights into the expectations of shoppers.

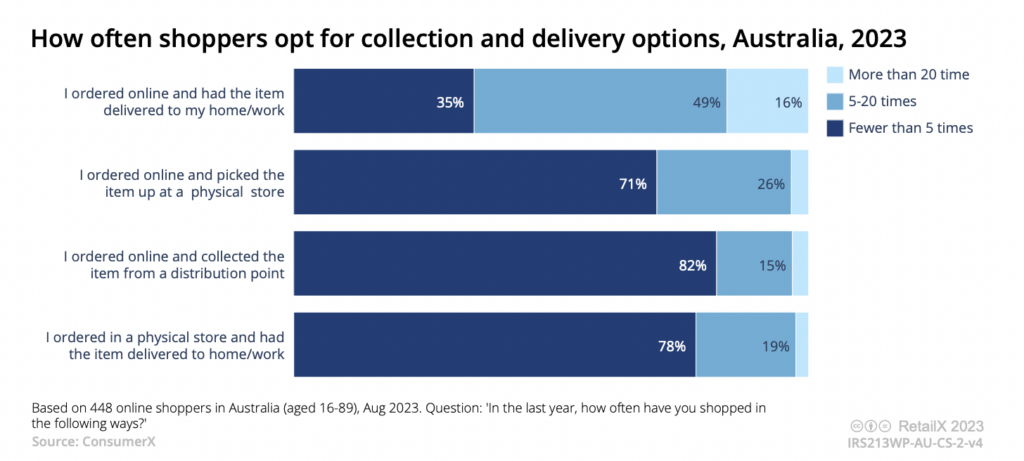

Looking at those consumer expectations, ConsumerX research found home delivery is the most popular fulfilment channel for Australian shoppers. Data suggest that 49% choose this option between five and 20 times a year, while 16% go for it more often than that. 26% pick up an online order from a physical store between five and 20 times a year, while 3% do so more regularly.

Pick-ups from distribution points and ordering from stores for delivery are less frequent. 37.5% say that next-day delivery is important for all or most of their purchases, with 62.5% saying it is only relevant for some or none of their orders.

Considering the leading Australian retailers, the research found that less than a third of the businesses selling to the market offer premium delivery services such as next-day (29%) or same-day (15%) delivery. 30% offer click and collect, while 31% offer free delivery when shoppers spend a minimum amount. Only 8% offer free delivery on all orders.

Shoppers are most likely to be able to return an unwanted item by post (31%), while 29% of multichannel retailers enable customers to return an item to store and 15% enable returns via pick-up from the house.

Sustainability

Given the physical impacts of climate change in Australia – summer bushfires during 2019 and 2020, along with coral bleaching events that have ravaged the Great Barrier Reef – Australians have strong attitudes towards retail purchases in terms of their sustainability.

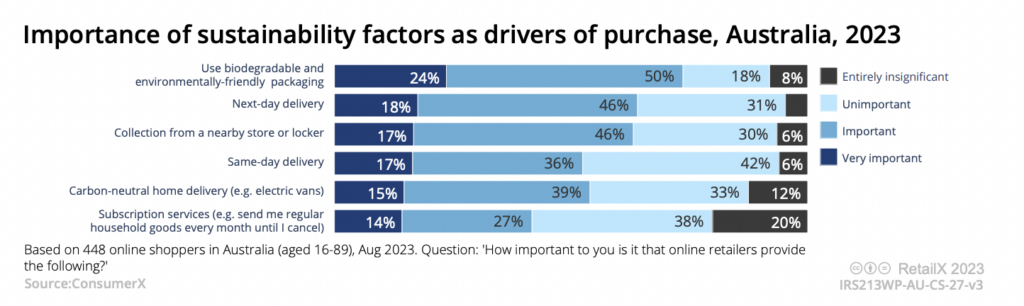

Asked to rank different factors for how relevant they are during the customer journey, 24% say environmentally friendly packaging is very important, while 50% rank it as important. This puts it ahead of other logistical choices, such as next- or same-day delivery, collection and, indeed, carbonneutral home delivery (very important to 15% and important to 36%).

ConsumerX research also finds 75% agree or strongly agree (26%) that they want retailers to be ecologically sustainable. A similar proportion say that they want retailers to make the impact of their purchases clearer to shoppers (73% and 23%).

Commitment to sustainability is most commonly reflected by Top100 retailers that operate mending or repair schemes (17%) to help products last longer. 11% of the Top100 offer instructions so that customers can repair their own times, while 12% have a supplier code of conduct.

This feature is a combination of analysis that originally appeared in the RetailX Australia 360° 2023 report. Download it in full to discover:

- The leading retailers, brands and marketplaces selling to this market, ranked

- Analysis: understanding the Australian ecommerce market and the need-to-know trends and opportunities

- Key learnings – Australia is developing quickly as an ecommerce and multichannel market