With reports that US private equity group TPG is in talks to buy a stake in Vinted at a €5bn valuation, the RetailX UK Fashion 2024 report looks at why UK consumers love buying and selling on the pre-loved platform.

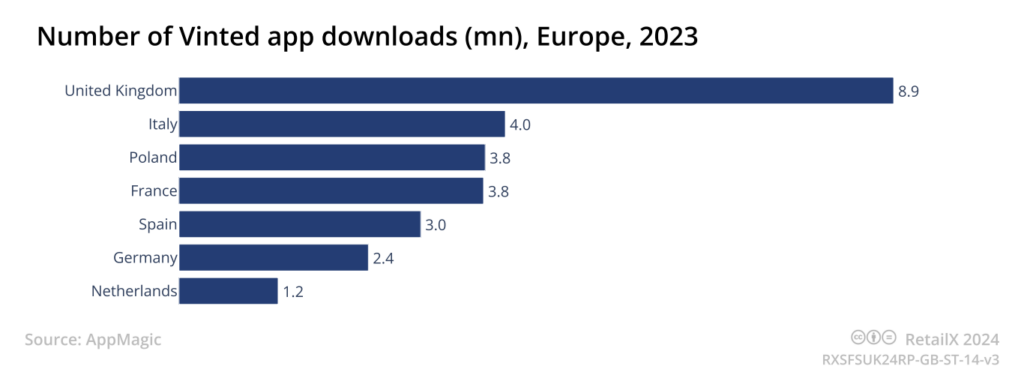

The Vinted app had been downloaded 8.9mn times in the UK in 2023, more than double the rate of downloads in other countries such as Italy, Poland and France, and its growth continues to accelerate.

Vinted’s popularity is driven both by the fact that customers can buy fashion so cheaply on the site and also by how seamless the company has made the shopping experience.Vinted originally launched in the UK in 2014 but it wasn’t until 2021 that its growth really began to accelerate.

Vinted sponsored the UK TV drama Hollyoaks in 2021, while in 2022 Love Island partnered with eBay to dress contestants in second-hand outfits. The marketplace repeated the partnership after ITV research showed 53% of viewers who were aware of the sponsorship had bought second-hand or pre-loved clothes in the previous three months. But the question is are consumers being driven by a desire for sustainability, or simply the cheap price tag?

Sustainable preference

ConsumerX research shows that, when compared to countries worldwide, UK consumers are among the least likely to have bought sustainable clothing in the past year, with only 35% having done so, compared to 72% in India, for example. Only 19% have bought sustainable footwear and 8% have bought sustainable accessories.

Could more be done to encourage more purchases of sustainable goods as well as more sustainable shopping behaviours? The ConsumerX research suggests that more than two-thirds of UK fashion shoppers believe the ecological impact of purchases needs to be made clearer to them.

This is an excerpt from the RetailX UK Fashion 2024 report, authored by Liz Morrell.

The report uses the results of ConsumerX surveys and data partners to explore the modern UK Fashion consumer, illustrated with RetailX graphics, charts and case studies. M&S, Kurt Geiger, Secret Sales, Zara, Boohoo and Cider are all looked at in detail.

Stay informed

Our editor carefully curates two newsletters a week filled with up-to-date news, analysis and research, click here to subscribe to the FREE newsletter sent straight to your inbox and why not follow us on LinkedIn to receive the latest updates on our research and analysis.