Shoppers buying online do so because they want an easy and convenient shopping experience, the RetailX UK500 2025 report highlights.

Home delivery is one of the main reasons why shoppers buy online, according to ConsumerX research, with 46.4% of UK adults questioned giving that as a reason.

Collection and returns also matter to most, with 57.4% saying that being able to pick up from a store or locker is very or somewhat important to them. Similarly, more than 86% rate the importance of easy returns.

WHAT DELIVERY PROMISES DO THE UK500 MAKE?

While home delivery is a primary reason for shoppers to buy online, attitudes towards the speed of delivery vary. 26.3% consider the option of next-day delivery is very important and 17.8% say same-day delivery is very important but in practice, shoppers report variable use of these services.

Asked about how they used them in the previous year, 6.2% say they always paid extra for next-day delivery, 15.5% did so most of the time and 36.9% some of the time. Same-day delivery was used slightly less, with 5.6% always paying extra for the service, 11.2% doing so most of the time and 29.2% some of the time.

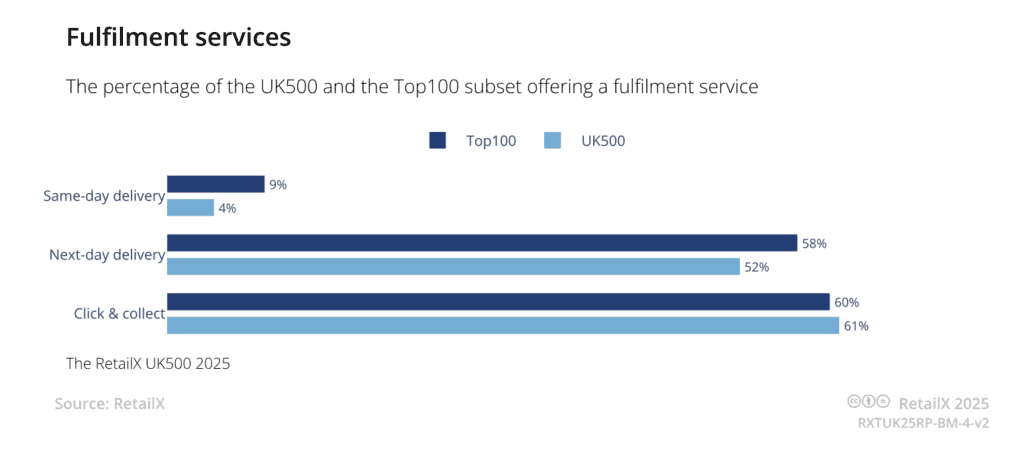

Standard delivery takes an average of 5.15 working days and a median of five days to arrive, across the UK500. Shoppers can opt for a faster, next-day delivery service when buying from 52% of the UK500. This is most common when buying baby and maternity products (73%), cosmetics and stationery (both 72%). However, relatively few (4%) offer same-day delivery, most likely because it is expensive to offer and has relatively low use.

Those that will deliver same-day may benefit from the scarcity of the service, which is most commonly offered by those selling sexual lifestyle products (17%) and by supermarkets (12%). The graphic shows how the leading Top100 offer these premium delivery services at a higher rate than the full UK500.

Saturday delivery is more widely offered (29%) than Sunday delivery (13%). However, if shoppers have a question about their delivery, they likely face a wait for a non-automated response to an email enquiry. These arrived in an average of 1.8 days, although the median response arrived in just over 20 hours.

HOW DO THE UK500 MANAGE COLLECTIONS?

UK shoppers say having the option of collection matters to them. Being able to pick up their online order from a store or locker is very important to 13.9% and somewhat important to 43.5%. Members of the UK500 respond to that need, with 61% offering a collection service – from an average of 571 shops, while the median – or halfway point – UK500 member makes collection available from 11 shops.

Items are ready to collect in an average of three days and six minutes and a median time of two days, five hours and 54 minutes. Faster collection is available from the 17% that offer next-day collection and the 10% that offer same-day collection. 15% offer collection through lockers.

This is an excerpt from the RetailX UK500 2025 report. In its 11th year, the report measures how these businesses deliver value across the entire retail ecosystem, taking into account evolving consumer behaviour, economic headwinds and disruptive technologies such as AI.

Stay ahead of consumer trends, operational challenges and technological shifts shaping the UK retail landscape. Access the RetailX UK500 2025 to refine your strategic roadmap for the year ahead.

Stay informed

Our editor carefully curates two newsletters a week filled with up-to-date news, analysis and research, click here to subscribe to the FREE newsletter sent straight to your inbox and why not follow us on LinkedIn to receive the latest updates on our research and analysis.