The RetailX European Marketplaces 2022 report gives a detailed breakdown of how Europe’s Top 500 brands and retailers use the Top 15 marketplaces – showing how powerful these platforms now are in the wider retail environment. Here we take a look at how those brands are using marketplaces

DOWNLOAD THE FULL REPORT HERE

Brands and retailers are increasingly using marketplaces, often as part of a wider omnichannel approach to sales. Statistically, marketplaces are becoming the first port of call for many shoppers, so despite misgivings about ceding some brand identity and perhaps handing over their hard-won customer base to these up-start new entrants, for many retailers and brands, there is a real impetus to swallow these worries and go where the customers are. If they don’t, the customers will go to the marketplaces anyway.

Marketplaces also offer retailers and brands a range of other incentives to sweeten the pill. For many, they offer a low-cost, low-risk means of entering new markets, trialling new ranges and selling old stock. They can also help aid delivery and payments, as well as taking some of the marketing burden from brands and retailers.

Brand and retailer sample

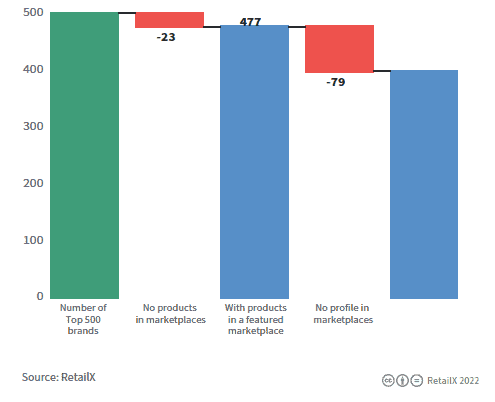

RetailX has assessed how its bespoke list of Top500 retailers and brands use the Top 15 marketplaces. This extensive list covers the top players in online retail in Europe and features, among many, Elite retailers Marks and Spencer, H&M, L’Occitane, Claire’s and Tripp. It also features a wide range of well-known retailers from across the region, from Apple to Ikea to Ubisoft[1].

Of these Top 500, 477 of them have a presence on at least one of the Top 15 European marketplaces, with at the very least their products being available either as a branded store or being resold by merchants and third-parties. Of these, 421 have an actual dedicated profile on at least one of the marketplaces.

This shows how important marketplaces increasingly are to brands and retailers selling in the European market, with just 5% not having a presence on any of the Top 15 marketplaces studied. The data also indicates that the vast majority of those that are using marketplaces are doing so with their own dedicated presence. Some 84% of Top 500 retailers and brands in Europe have a profile within at least one marketplace, showing that not only do many see their products sold by third-parties, but are also leveraging marketplaces to create their own branded spaces and storefronts. This points to brands and retailers proactively tackling fears that using marketplaces erodes brand identity and can risk handing over hard-won and valuable customers to the marketplace. Instead, the retailers and brands are using these platforms to create and extend their reach.

This demonstrates not only how important marketplaces now are in the sales mix for Top 500 retailers, but also shows that Elite and Leading brands, which typically sought to tightly control their brand image, are prepared to work with marketplaces to reach a wider audience.

For both brand and marketplace there are advantages, with each basking in the halo of the other: a union of brand and marketplace brand being seen as a powerful consumer marketing strategy.

DOWNLOAD THE FULL REPORT HERE

What do they sell?

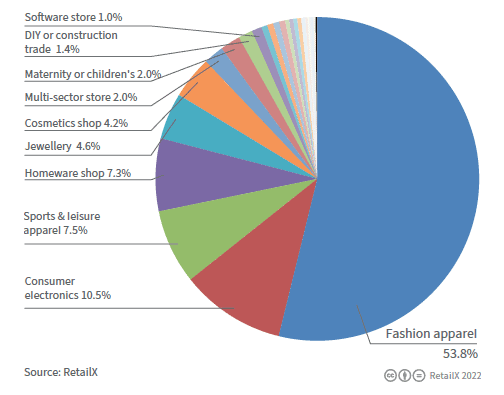

These companies cover a very broad range of sectors, from fashion to garden furniture. As shown in the Figure above, the majority (53.8%) are fashion brands and retailers. The next 25% is made up of consumer electronics sellers (10.5%), sports and leisure apparel and equipment (7.5%) and homewares (7.3%). The remainder of the group consists of a long tail of sellers that cover pretty much everything else. Notable sectors in this tail are Jewellery (4.6%) and cosmetics (4.2%). All other sectors account individually for no more than 1-2% of the total.

This skew towards fashion is driven by it being one of the biggest growth sectors in ecommerce. As outlined in RetailX’s Fashion Sector Report[2], the global fashion ecommerce market is worth some $970bn in 2022, with growth averaging 10% per annum since 2020 and predicted to continue to rise at this rate through to 2026.

This ecommerce growth for fashion is reflected in how fashion brands use marketplaces. For example, Amazon’s share of US online fashion retail was 35% in 2020. That means gross merchandise volume of apparel and footwear has grown to $41bn – including sales from third-party retailers through the marketplace [3].

In EMEA there are many other fashion marketplaces that offer strong competition to Amazon. Zalando and Asos are the best known, selling most leading brands and, in the case of Asos, selling its own label items also.

These fashion marketplaces have been disruptive to the fashion industry, offering both a new channel to the market for many brands, as well as creating rampant competition – with marketplaces often seeking to undercut mainstream pricing.

Across Europe, retailers and brands selling on Amazon’s Clothing category – such as Puma, Tommy Hilfiger, Under Armour, Adidas, Calvin Klein – also sold their products the most on European marketplaces: Cdiscount (42.9%), Spartoo (38.1%), eBay (37.4%), La Redoute (25.9%), Zalando (13.7%) and Privalia (9.3%).

France is an example of the fragmented European online fashion market. A poll of 20 representative retailers in the fashion sector was analysed regarding turnover on various fashion marketplaces in France. The findings show that Amazon comes in fourth place by average sales per month, just behind Spartoo, La Redoute, and Vente Privée [4].

Marketplaces are also increasingly making inroads into the luxury fashion end of the market, with the likes of Lyst, FarFetch and Secret Sales seeking to carve out niches in broadening the reach of luxury fashion brands. Secret Sales specialises in giving a platform to known brands to sell their end of line and last season goods and has, as a result, tapped into a growing middle market for affordable luxury fashion. FarFetch, meanwhile, specialises in giving an online platform to smaller boutiques alongside big brands, to extend their reach into new markets.

Together, marketplaces have shifted how fashion brands sell and are also tending to push prices down for consumers globally.

DOWNLOAD THE FULL REPORT HERE

References

[1] RetailX, https://retailx.net/product/europe-2022/

[2] RetailX, https://retailx.net/product/fashion-2022-ecommerce-sector-report/

[3] RetailX, https://retailx.net/product/european-marketplaces-report-2021/

[4] IMRG/Wells Fargo, https://www.imrg.org/blog/the-clothing-category-on-amazon-broken-down/