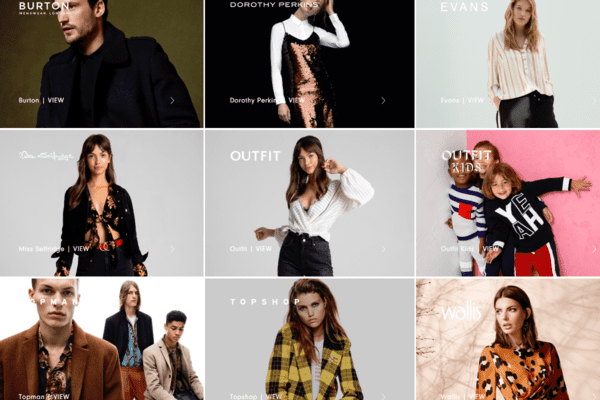

Boohoo is buying Arcadia brands Dorothy Perkins, Wallis and Burton out of administration in a £25.2m cash deal that will see the high street brands become online-only.

All of the 214 shops run by the three brands will close, with 2,450 jobs reported to be lost. Some 260 members of staff in the brands’ design, buying, merchandising and digital teams will transfer to Boohoo as part of the deal.

Boohoo says the deal, which includes ecommerce, digital assets and intellectual property including customer data, as well as inventory, represents a significant opportunity to grow the Boohoo business, and will also transform three “heritage” brands for the future. In 2020, the three brands had more than two million active customers.

Boohoo Group chief executive John Lyttle says: “We are delighted to announce the acquisition of the assets associated with the online businesses of the three established brands Burton, Dorothy Perkins and Wallis. Acquiring these well-known brands in British fashion out of administration ensures their heritage is sustained, while our investment aims to transform them into brands that are fit for the current market environment. We have a successful track record of integrating British heritage fashion brands onto our proven multi-brand platform, and we are looking forward to bringing these brands on board.”

The three brands will trade both through their own websites and in future through the Debenhams site that Boohoo bought last month with plans to transform it into a marketplace. For the moment, however, the Debenhams website continues to clear stock for the currently-in-liquidation Debenhams business.

In the meantime, they will continue to trade online as Boohoo integrates them onto its multi-brand platform. It expects to have completed the process by early May, when it announces its full-year results for its current financial year, which closes at the end of this month. By then, Boohoo will have more than 15 brands on its platform. Boohoo says the acquisition of Burton will strengthen its position in the menswear market, alongside BoohooMan and Debenhams’ brands Maine and Mantaray.

In their latest financial year, Dorothy Perkins, Burton and Wallis turned over £427.8m across all channels, including £178.8m from the online business that Boohoo is now buying. Overall, it made a loss of £14.3m. Boohoo is paying £25.2m in cash for the three brands – as of December 31, it had £386.9m cash to spend on acquisitions including its January 25 acquisition of the Debenhams website business for £55m, following its move to raise cash for acquisitions last May. It is also taking over some forward orders for new stock. Arcadia will provide some transitional services, including distribution and some head office functions as the brands are integrated into Boohoo in coming months.

Mahmud Kamani, Boohoo Group executive chairman, says today: “This is a great acquisition for the group as we extend our market share across a broader demographic, capitalising on growth opportunities as more and more customers shop online. We continue to grow our portfolio of brands and customer base, strengthening our position as a leader in global fashion ecommerce.”

The context

Dorothy Perkins, Walllis and Burton are the last of Arcadia’s retail brands to be sold, following the £295m sale of Topshop, Topman, Miss Selfridge and HIIT to Asos last week, and the £23m sale of Evans to plus size specialist City Chic in December. In total, the sale of the brands has raised more than £500m to pay creditors. Administrators at Deloitte continue to work on raising cash from the sale of the group’s remaining assets, primarily its property portfolio.

The Arcadia brands failed to survive the pandemic, given their previous reliance on high street trading and relative underinvestment in online. The group went into administration following second Covid-19 lockdowns in England and Wales during November.

Commenting, Matthew Furneaux, director at commerce and location intelligence specialist GBG, says: ”2020 had major repercussions for retailers, as they surrendered their store fronts and swapped in-store for online experiences. One thing is clear as we move forward: retail may never return to pre-Covid normality. Retailers should all be looking to the future and asking, ’how can we boost our online experience to attract and retain new customers?’ This year, choice and convenience will be crucial. Home shopping for many is just too convenient to pull back from, and customers will want simple, intuitive online experiences from the comfort of their sofa.

“The next three months could be brutal for our retail sector – but we must look ahead and resolve any trade challenges expected, as a result of the EU exit. Conversations with customers and our own research has uncovered that retailers are selling across borders more than ever – but with supply chain problems already grabbing headlines, shoppers are now anxious about buying from international sellers online. Building back trust and making ecommerce experiences as smooth as possible will be critical to survival for many retail brands this year – and will help build solid foundations for a post-Covid economy.”