Some 69% of consumers go straight to the search bar when they visit an online retailer’s website, but 80% admit leaving because the on-site search experience didn’t meet their expectations.

Leading retailers surveyed across North America and the UK accept that their site-search isn’t up to scratch, attributing around 39% of all traffic bouncing immediately to poorly performing search—or because shoppers can’t find relevant products.

The research from Nosto, a Commerce Experience Platform (CXP), underlines the crucial role of on-site search in online shopping. The findings are based on a combination of surveys of 2,000 North American and UK consumers and 308 senior ecommerce professionals at retail brands as well as real-world testing of the on-site search experience served by 100 leading ecommerce brands across fashion, beauty, and home/garden/DIY. They paint a picture of merchants losing potential sales and frustrating shoppers with search experiences that fail to meet consumers’ expectations.

A snapshot of retailers’ on-site search failings

Among the key shortcomings is a lack of relevance: despite 99% of retail brands’ senior ecommerce professionals believing their search results are relevant, 69% of consumers complain that they often see irrelevant results (with real-world site testing revealing that 81% of ecommerce websites display irrelevant items when shoppers search even two-word queries).

Similarly, even though 70% of consumers say they are likely to make a purchase if results are personalized, 66% of ecommerce professionals admit that they fail to offer personalized search results—this is despite 82% of them agreeing that personalized search is critical for higher conversions.

Additionally, 60% of brands admit their on-site search doesn’t display content (such as articles or FAQs) that relate to the products people are searching for, even though 59% of consumers say they are likely1 to make purchases after consuming this kind of content.

Rising living costs makes on-site search a bigger priority

These shortcomings are even more significant in the current economic downturn: 68% of consumers agree5 that, with living costs rising, they like to compare products from different online stores—and good ecommerce search makes this easier. Merchants themselves are aware of this, with 81% agreeing5 that increasing inflation makes ecommerce search more important as it allows customers to easily find and compare similar products before making purchases.

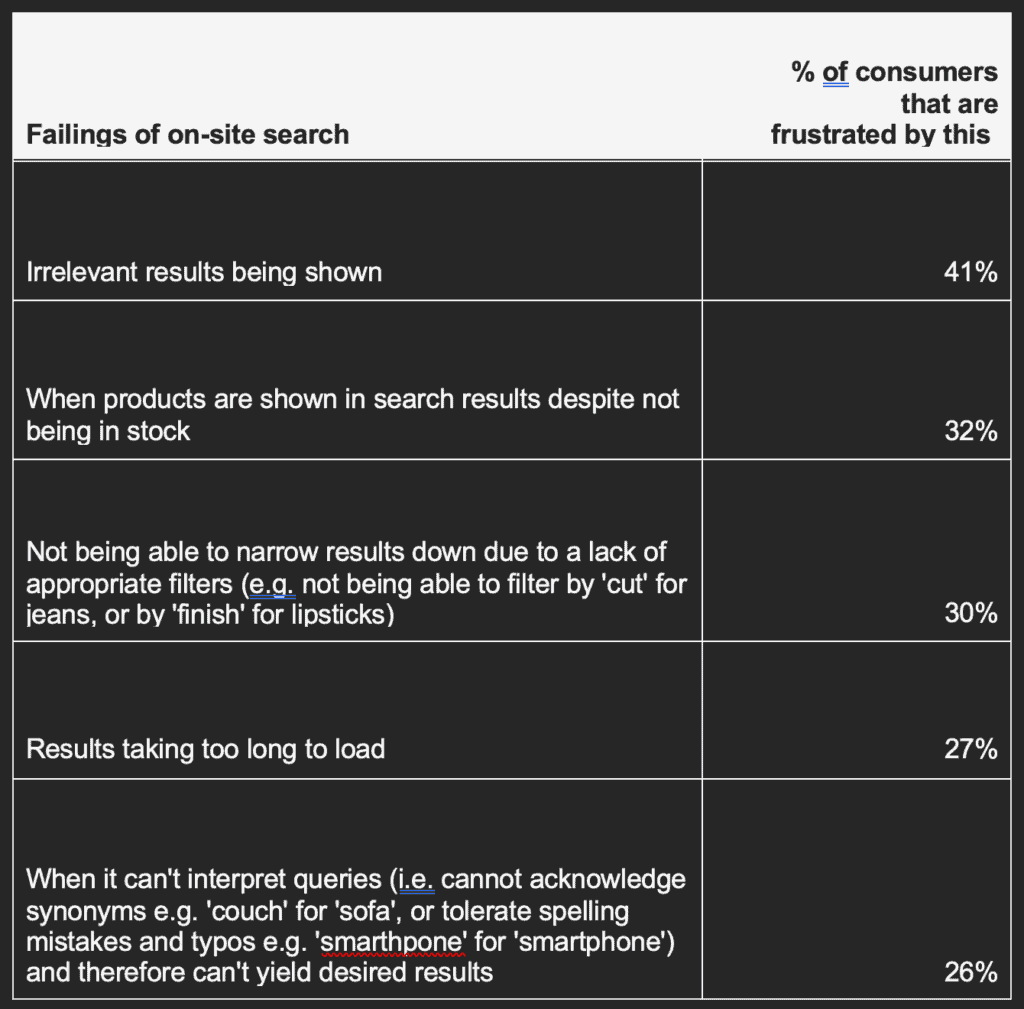

What frustrates consumers most about on-site ecommerce search?

“This research highlights just how important search is for the performance of ecommerce stores. Shoppers don’t simply want a personalised and relevant experience every time they shop online–they expect it and are frustrated by not having it. Relevancy is critical and it’s clearly a huge pitfall of merchants, with 80% of shoppers exiting online stores due to bad search experiences,” says Guy Little, head of brand marketing, Nosto.

Ecommerce brands held back by their current technology

It would be wrong to assume that ecommerce brands are ignoring the importance of on-site search or that they don’t want to improve. 81% of brands questioned in the survey acknowledge that good, fast, accurate site search is essential for a successful ecommerce store and 84% said that they plan to invest in continually improving this area.

Part of the problem is that the technology many brands are using does not let them easily do all the things they would like, with 95% of ecommerce professionals in the survey experiencing at least one pain-point with their current search solution. The top pain-point (mentioned by 29%) wasa lack ofadvanced product data processing, meaning they are unable to serve complex queries and provide relevant matching (e.g. when searching for ‘belt’, the results serve dresses or pants with belts, not belts). Other notable pain-points include ‘too much time making improvements’ (26%) and ‘too many manual configurations needed to get relevant results’ (25%).

“What’s interesting in this research is that, while 95% of brands are citing pain-points with their current search provider, 84% agree5 that they are planning to continually invest in their search technology meaning they understand the importance of this critical piece of the ecommerce equation,” says Antanas Baksys, head of search product, Nosto.

What can retailers do about it?

Nosto’s research highlights six important considerations for online retailers:

Relevance remains a key challenge – Irrelevant search results are a major bugbear for shoppers, with 41% of consumers placing this among their top three most frustrating things about on-site search. Moreover, 69% of consumers say they see irrelevant results often and 35% admit leaving a site after seeing irrelevant results. The real world site testing reveals 81% of brand websites return irrelevant results for two-word search queries. Many brands seem unaware of the problem, with 99% of ecommerce professionals perceiving their on-site search as relevant (35% extremely relevant). Only 1% rate their search relevance as poor.

Better personalisation – 70% of shoppers reveal they are likely to complete a purchase if on-site search results are personalized. The vast majority (82%) of ecommerce professionals at retail brands agree5 that personalized search is critical for higher conversions. However, 66% of those same ecommerce professionals admit their ecommerce store currently doesn’t offer personalization as part of its on-site search offering.

Personalisation is even more important to younger shoppers—24% of 16-24 year olds and 29% of 25-34 year olds said they are likely to leave a site if on-site search is not personalized.

Reduce friction in search – Brands are not doing enough to make the on-site search experience easy and frictionless for their shoppers. 27% of shoppers have left a site because the results showed too many options and it wasn’t possible to narrow down the search using appropriate filters, while 26% have left because search results listed out-of-stock products, and 25% have left because results were just too slow to load. 56% agree that ecommerce site-search should be quicker.

Not being able to narrow down search results with appropriate filters (eg the cut of jeans or the finish of lipstick) is one of the top three on-site search frustrations of 30% of consumers. But more than half (56%) of retail brands’ say they don’t provide this kind of dynamic filtering facility that is specific to the products being searched for.

Error tolerance (the ability to account for spelling mistakes or similar words within a query) is another gripe; 76% of ecommerce professionals said they did not offer this, but 26% of consumers name this among the top three most frustrating things about on-site search. Error tolerance is especially important as so many consumers now shop using mobile devices, making typos more likely.

Shoppers want to see content in search results as well as products – 61% of surveyed shoppers are likely1 to engage with relevant content such as articles, FAQs, and collection pages if it is shown in search results—and 59% say they are likely to make purchases after consuming that content. Quite specifically, 51% say they are likely to engage with relevant influencer or user-generated content (UGC) shown in the search results (such as reviews, images, or comments from other customers), with 54% agreeing they are likely to make purchases after consuming it. Despite this, 60% of ecommerce professionals at retail brands admit they don’t currently serve content (articles, FAQs) in search results and 57% don’t include influencer or user-generated content specifically.

Younger consumers aged 34 and under want more of this content. 31% of those aged 25-34 and 30% of those aged 16-24 said providing influencer or user-generated content in search results would improve sites by allowing them to see items on real people other than the brand’s models, for instance.

Lack of adequate merchandising is costing retail brands – By merchandising their search results, retail brands can promote specific products based on performance attributes like margins or inventory levels. This allows them to focus on business goals such as profitability (instead of just, say, revenue) while still ensuring relevancy. But 65% of brands say they don’t currently offer merchandized results—in fact, a lack of desirable merchandizing (27%) is the second biggest pain-point they have with their current search solutions.

An important example of merchandising is the ability to show alternative products when the retailer doesn’t have the searched-for product available. This is an effective way to keep shoppers from immediately bouncing — 56% of shoppers say they are likel1 to continue their journey on an online store if alternative products are suggested in this way. But only 34% of brands say they are currently able to show alternative products if searches return zero results.

Few brands achieve a high maturity level for on-site search – Real world testing of the on-site search performance of 100 leading ecommerce websites suggests that only 10% achieve a high level of maturity (ie are Leaders) based on 8 factors defined by Nosto (including relevance, the ability to show content as well as products, to deliver personalised results, and to allow merchandising of search results). The majority (60%) fell into the Followers (or medium maturity category) while 30% were defined as Laggards with a low level of on-site search maturity.