CTV, AI and identity are the the core pillars for marketing growth in H2 2025, as marketers lean into personalisation, performance and connected systems to fuel cross-channel, full-funnel strategies. More than a third are set to increase their retail media spend, a new report reveals.

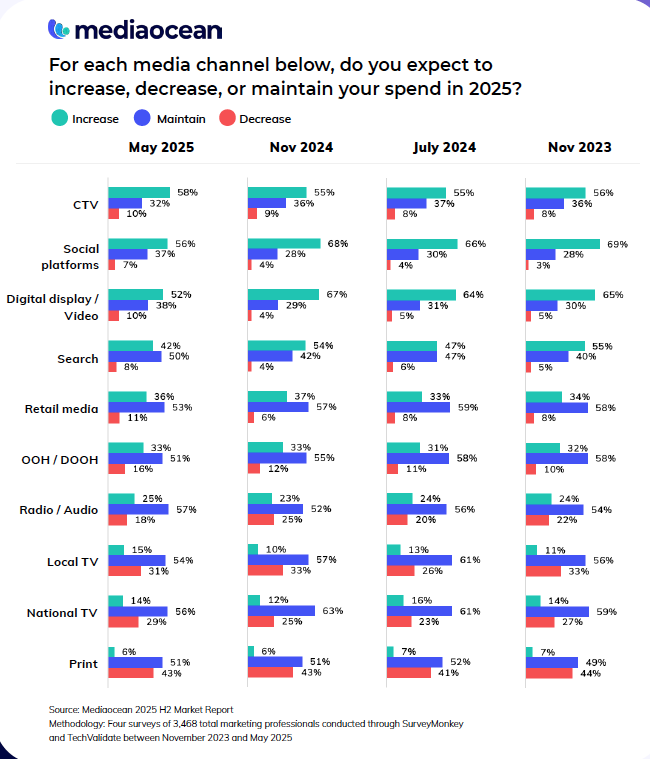

According to Mediaocean’s 2025 H2 Market Report, which draws on a global survey of hundreds of marketing professionals, CTV remains the top channel for planned budget increases, with 58% of marketers intending to spend more in H2.

Retail media, meanwhile, figures fifth in priority for marketers, with 38% expecting to spend more in the next six months and 53% the same as H1. This comes close behind social platforms (56%) and digital display/video (52%), which also lead in planned increases, although all three saw modest declines from earlier this year.

Search saw the biggest drop — down 22% versus H1 — likely tied to GenAI’s impact on how consumers discover content and products, the report says. Traditional media held steady, with National and Local TV showing little change in planned investment. While not surging, these channels may still offer perceived stability and proven reach amid digital complexity.

OOH/DOOH and print held steady with little change and, while only 25% plan to increase radio/audio, that still marks gain over the prior wave.

Overall, while budgets are tightening, most marketers continue to maintain or grow spend — pointing to caution, not contraction, says Mediaocean.

Leaders of the pack

As CTV matures, marketers’ focus is no longer just on reach, but also on precision and performance. Personalisation was the top driver of CTV effectiveness, while cross-platform frequency management and measurement were noted as persistent challenges. Creative versioning, cross-platform optimisation and identity-informed targeting are now considered essential to unlocking CTV’s full-funnel value.

Generative AI, meanwhile, tops the list of consumer trends for the second straight wave, with 72% of marketers citing it as a priority, up 15% from H1. This growth was consistent across all vertical industries. Marketers are moving past experimentation, applying AI across the ad lifecycle, from creative production and copywriting to media planning, data analysis, and campaign optimisation.

Identity and demand generation grew as strategic priorities, rising 41% and 33%, respectively. Marketers can’t drive demand without knowing who they’re talking to. With cookies on the decline and media channels multiplying, marketers are leaning into multi-ID strategies that blend first-party data, partner IDs, and other signals to keep continuity across screens and platforms.

Cultural and political sensitivity also saw a rise in importance, with an 82% increase in marketers flagging it as a priority since H1. As political and advocacy issues increasingly intersect with brand communications, marketers are rethinking messaging and positioning with more nuance, using AI-powered creative tools to adapt in real-time and speak authentically across diverse audiences and contexts.

“Marketers are meeting change with a blend of resilience and reinvention,” says Karsten Weide, Principal & Chief Analyst, W Media Research. “As legacy IDs fade and AI transforms every corner of the ad tech stack, brands are building smarter, more flexible systems—rooted in identity, demand generation, and the measurable performance of channels like CTV. This report shows that the future isn’t something marketers are waiting for, it’s something they’re actively engineering.”

“When it comes to omnichannel advertising, we’re seeing a transition from experimentation to expectation,” says Aaron Goldman, CMO, Mediaocean. “Marketers are no longer testing AI, CTV, or multi-ID strategies—they’re building with them. The second half of 2025 will be defined by how well brands align their technology, data, and creative to deliver connected, outcomes-driven experiences.”

The 2025 H2 Market Report is the eighth installment in Mediaocean’s bi-annual research series, bringing together more than 5,500 perspectives from agencies, brands, publishers, and platforms over the past four years. Download the full report to explore what’s shaping advertising in H2 and beyond.

Join the live webinar, The Mediaocean Current: 2025 H2 Market Research, on Tuesday, July 29, 2025, to hear takeaways from Mediaocean and featured speakers, including Weide, IAB’s Angelina Eng, and Lafayette Media Group’s Jon Lafayette.