A new InternetRetailing report looking at the UK luxury retail space highlights that consumers are still drawn to the perceived quality of luxury, with a growing number embracing pre-loved luxury items. However it has also highlights that the UK luxury market is pretty static in terms of spending patterns

ConsumerX research found three quarters (74%) of shoppers cite quality as the main reason why they buy luxury products over others that are available, far outstripping all other reasons for choosing luxury by a comfortable margin.

Trust in brand (51%) and fashion (27%) are the next closest, but lag far behind. However, looking further down the list of reasons a picture of what really drives luxury purchasing in the UK emerges – 22% of shoppers see the products enduring or resale value as a key driver for purchase.

Couple this with the high quality that most say pushes towards luxury and it becomes apparent that what luxury items represent to the majority of UK shoppers is actually good value. Yes, they are expensive, relatively, but they last longer and there is always the prospect, realised or not, of the items being saleable and that investment being redeemed.

This is backed up by ConsumerX data that shows that some 78% of consumers buy at least some second hand and vintage items. According to the data, 39% buy a little, while 20% less than half. However, some 20% buy all, almost all of more than half of their luxury goods as vintage or second hand.

This is very telling. The UK market for luxury, like many others in Europe, is rapidly embracing this world of vintage luxury. While it offers the quality of luxury brands that consumers want, it also delivers value for money for them too. There is a third driver of this vintage play and that is sustainability. Consumers increasingly value sustainable retail and, as part of that, see buying (and selling, for that matter) vintage luxury as part of a more sustainable approach to fashion.

How long will it last?

Vintage aside, the overall UK luxury market is however pretty static in terms of spending patterns. The majority of shoppers (63%) are planning to spend the same on luxury next year as they have this, while 13% are looking to up their spend.

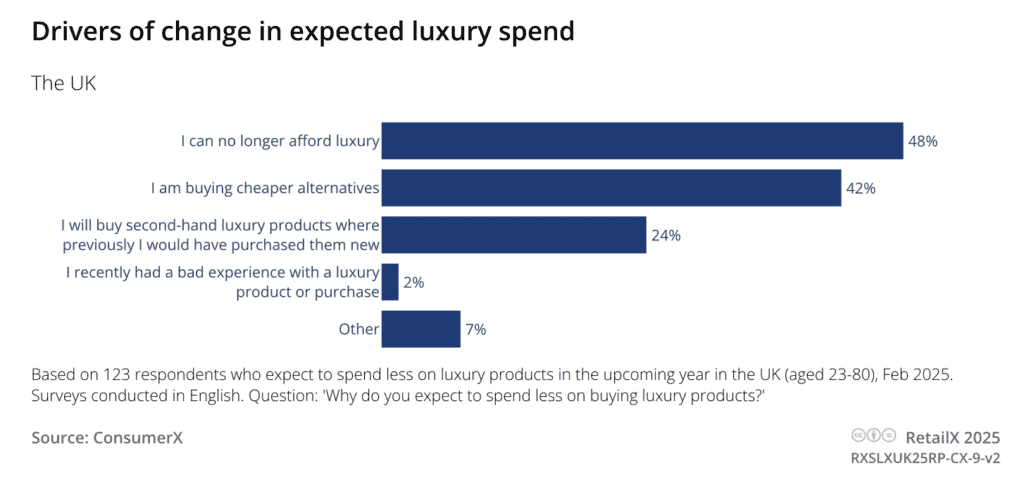

In terms of growth, a quarter (25%) are looking to decrease their spending, which has implications for the continued rise of luxury in the UK.

Half of consumers (48%) are planning to downgrade their luxury spend in the year ahead because they can no longer afford these items, with many (42%) opting for cheaper alternatives.

This is driven by a multitude of factors. The cost-of-living crisis that has plagued European markets since the energy crisis inculcated by Russia’s invasion of Ukraine in 2022 continues to impact both spending and consumer confidence. The uncertainty around income that this lowered confidence brings stymies spending in luxury by those consumers that aren’t in the upper spending bracket of online shoppers.

Similarly, US tariff rises and talk of a trade war – or indeed a real war – have also seen confidence among consumers start to wane further. With the world a more chaotic place in 2024/25 than it was even during the immediate post pandemic, consumers are holding onto their cash as they assess how the dice will fall.

This is an excerpt from the brand new UK Luxury 2025 report.

The full report examines the market dynamics of the luxury sector across the UK. It highlights the growing influence of sustainability, and the increasing importance of technology and mobile-first shopping.

Barbour, Burberry, FarFetch, Harrods, Lyst and Paul Smith are profiled.

Stay informed

Our editor carefully curates two newsletters a week filled with up-to-date news, analysis and research, click here to subscribe to the FREE newsletter sent straight to your inbox and why not follow us on LinkedIn to receive the latest updates on our research and analysis.