Post-pandemic, fashion has seen strong ‘bounce back’ and, in many regions, has also started to recover from the macro-economic impacts of inflation and supply chain issues that impacted the world during 2021 and 2022. This growth looks set to continue apace, the soon-to-be-published RetailX Global Fashion 2024 report has found.

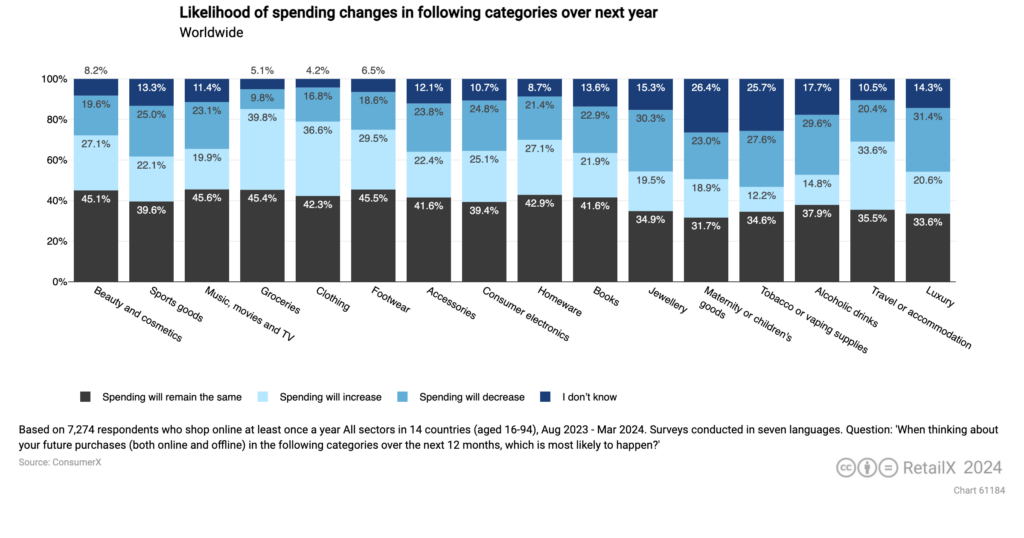

Globally, apparel, footwear and accessories are in the higher ranking sectors for consumers saying that they are likely to spend more in the year ahead, with 38.9% saying that their spend on clothing will grow, 31.1% will spend more on footwear and 24.7% saying they’ll spend more on accessories. This places fashion second only to grocery in terms of predicted spending increase.

Regionally, this spend is going to be most pronounced in India, China and the Middle East, with clothing spend set to increase by a whopping 64% in India over the next 12 months. Spending on footwear here is also set to rise by 49%, while spending on accessories will see growth of 52%.

The picture is similar, although slightly less pronounced, in China, Egypt and UAE, with all three seeing strong predicted growth in consumer spending across all three fashion segments in 2024.

It is in more developed markets such as the UK, Australia and South Korea where there are a relatively high proportion of shoppers who are looking to reign in their fashion spending across all three segments.

This is in part a corrective return to normal spending habits after a short, sharp rise in spending across late 2022 as the global economy improved. It is also in part down to continued economic pressures and relatively high inflation persisting in these markets.

The UK market is particularly vulnerable, with all three segments seeing an overall predicted decrease in spending on fashion in the coming year. This is a reflection on how the UK market has still failed to fully emerge from technical recession in 2023 and it exemplifies the ongoing low state of UK consumer confidence, even among the young, tech-savvy shoppers who tend to buy more fashion items.

This is an except from the new RetailX Global Fashion 2024 report. The report looks at how the fashion sector has recovered from the pandemic; the channels of choice including online, mobile, social, subscriptions; and sustainable fashion.

There are 11 key player profiles and company snapshots on Shein, Trendyol, lyst, Musina, Eobuwie and Myntra.

Stay informed

Our editor carefully curates two newsletters a week filled with up-to-date news, analysis and research, click here to subscribe to the FREE newsletter sent straight to your inbox and why not follow us on LinkedIn to receive the latest updates on our research and analysis.