Watching linear TV may seem very 2010, but a surprising number of US consumers still tune in to non-streaming TV services – and they are second screen online shopping while they do so. So, does linear TV advertising have a role to play in retail media?

According to a June 2024 survey by Emarketer, US adults spend an average of 2 hours 55 minutes (2:55) a day watching traditional TV, way ahead of subscription OTT services (1:49), social videos (0:52) and YouTube (0:36). The time is decreasing – with subscription TV watching passing it this year – but there are still some 230 million US consumers watching a sizeable amount of linear TV each day.

The key thing is that they no longer just watch TV. While doing so, a growing number are second screening, according to a separate study by Walmart and Morning Consult also carried out in 2024. This puts these linear TV ads surprisingly close to the point of purchase. With EMarketer finding that 77% of people second screening – 37.3% of whom are looking at related content to what they are seeing – the push to encourage retail advertising on linear TV is a strong one.

Your attention please

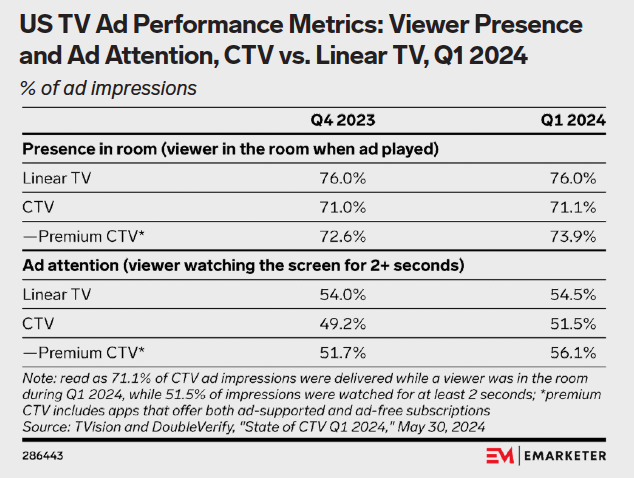

Linear TV has some other surprising tricks up its sleeve. Data, again from Emarketer, suggests that viewers are more likely to be in the room and paying attention when linear TV ads play, compared to those on CTV services.

Consumers are also more attentive to these ads if they can save them some money. According to Hub Research, two thirds of US TV viewers would rather watch ads to save a few dollars than pay extra to not see ads on streaming services. That is up from 58% in 2021. However, they want less of their viewing time occupied by ads.

Linear TV ads are also cheaper – and their cost is declining – as viewing figures fragment across platforms, suggesting that 2025 may well be the sweet spot for tapping into this platform while it offers a cost effective way to reach a sizeable and engaged audience.

Advertisers know

Increasingly, US brands get this opportunity. Linear TV accounted for 14.4% of total media ad spend share in the US in 2024 according to the IAB, the second largest share behind CTV and OTT.

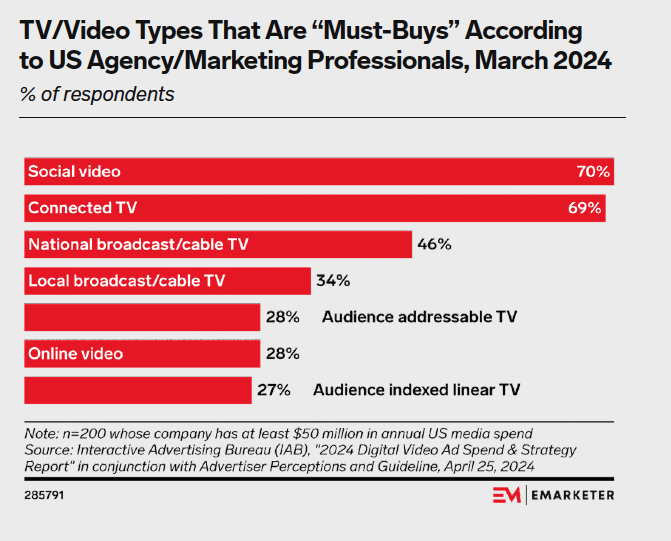

One advantage of linear TV in the US at least is that it allows agencies and brands to target national, regional and local markets as they see fit. Some 46% of US agency and marketing professionals consider national broadcast and cable TV ads a must-buy, and 34% think the same of local broadcast and cable TV, according to data from the IAB in conjunction with Advertiser Perceptions and Guideline.

In 2025, 65.1% of US TV ad spend will go to national TV, while 34.9% will go to local, per May 2024 Emarketer forecast. These shares have remained fairly consistent over the past few years.

Global perspective

Linear TV advertising in the US is a very specific thing. The market has grown up with TV being saturated with adverts and so consumers there are much more open to such offerings. Does this translate to other retail media markets geographically?

Most developed markets where there is a healthy TV and advertising play are likely to see similar levels of audience engagement.

In 2024, approximately 50% of UK households (around 14 million) watched linear TV with adverts. This figure is based on data showing that linear TV’s average daily reach remained steady at about half of UK households, despite declining total viewing hours. Additionally, commercial linear TV viewing averaged 1 hour and 47 minutes per day for adults, reflecting a significant portion of time spent on ad-supported content, finds ThinkBox.

A similar picture is likely across most markets – making linear TV advertising another area that is retailers, agencies and brands need to factor into their burgeoning retail media network strategies for 2025.