This year’s list of key companies for this RetailX Luxury Sector Report has been streamlined from the 2021 report and contains a better spread of the different kinds of luxury retailers that are operating in the market. There has also been an attempt to focus on those companies that have a truly global reach and which are each impacted by regional fluctuations in sale relatively equally.

This year’s list features eight companies: Burberry Group; Capri Holdings; Christian Dior; Estée Lauder Companies; FarFetch; Hermes International; LVMH Moet Hennessy Louis Vuitton; and TheRealReal.

RetailX’s analysis of how these companies performed paints a good picture of how the whole luxury sector’s fortunes have rollercoastered across the past five years.

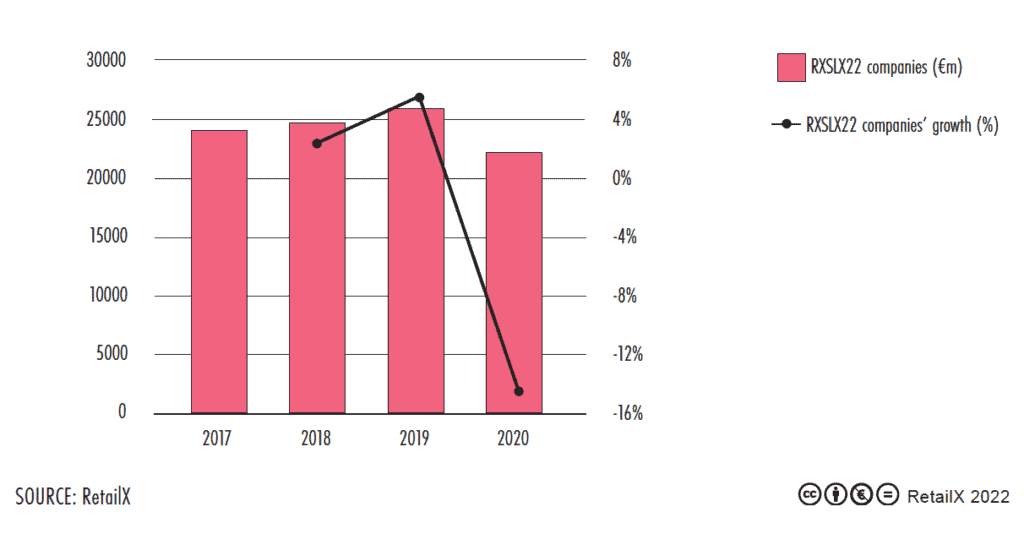

Pre-pandemic, the whole sector saw slow and steady growth up until the pandemic struck. 2020 saw revenues and profits drop across the sector, taking the industry back to levels last seen more than a decade ago.

Revenues (see Figures 1), have seen sharp declines for most of the sample across 2020, with Capri Holdings and FarFetch registering positive growth. For Capri this has been driven by the breadth of its luxury offering, selling clothes, shoes, watches, handbags and accessories.

At FarFetch, revenues have grown steadily through the sample period as the platform, which uses a marketplace selling model to sell products from more than 700 boutiques worldwide, tapped into the growing consumer penchant for both affordable luxury and the easy of marketplace shopping across the pandemic. Being online before the pandemic also set the company up to continue to grow.

Together these two companies showcase how changing consumer habits – both in terms of what they want to buy, how much they want to spend and where they want to buy it – shifted rapidly in the pandemic and those that had the platform the meet these needs saw revenues continue to rise.

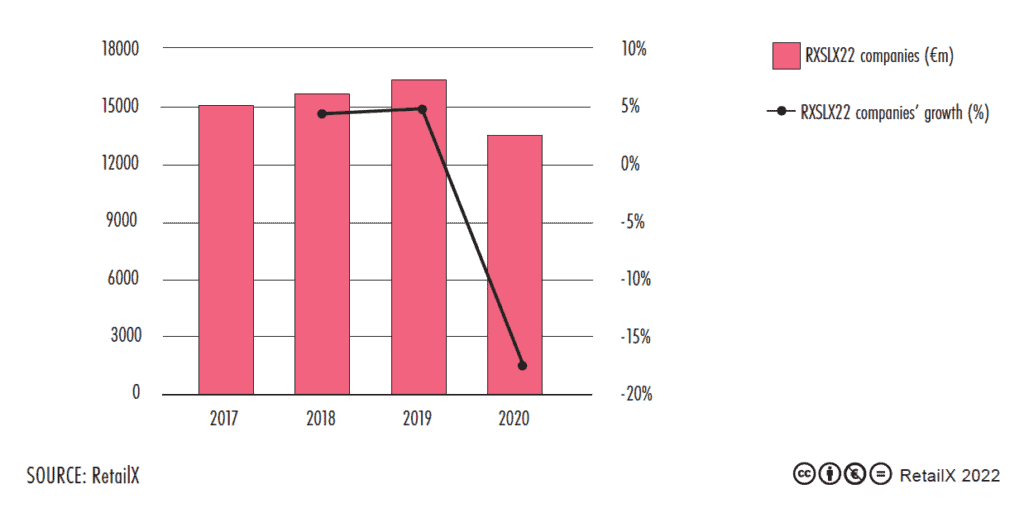

From a profit point of view (see Figures 2), those companies that had managed to be online pre-pandemic and which offered the breadth of product and/or the marketplace-like platform saw profits rise while the sector as a whole declined.

However, recovery has begun. Early data for 2021 indicates that grow is back in the positive for most retailers, with our published data showing that revenues are slowly coming back, but profits are more healthy.

This has been the result of consolidation and vigorous cost-cutting seen across the pandemic as all businesses strove to gain efficiencies. Profits have also been eased upwards by the investment in ecommerce slowly starting to bear fruit in operational savings too.

Traffic

Back in 2019, ecommerce was viewed by most luxury retailers as something that they should look to invest in, yet saw no real immediate imperative nor much advantage. Sales from these brands and retailers came mainly from the physical retail footprint and the in-store customer service was all part of the exclusivity and luxurious experience that helped create brand and woo customers.

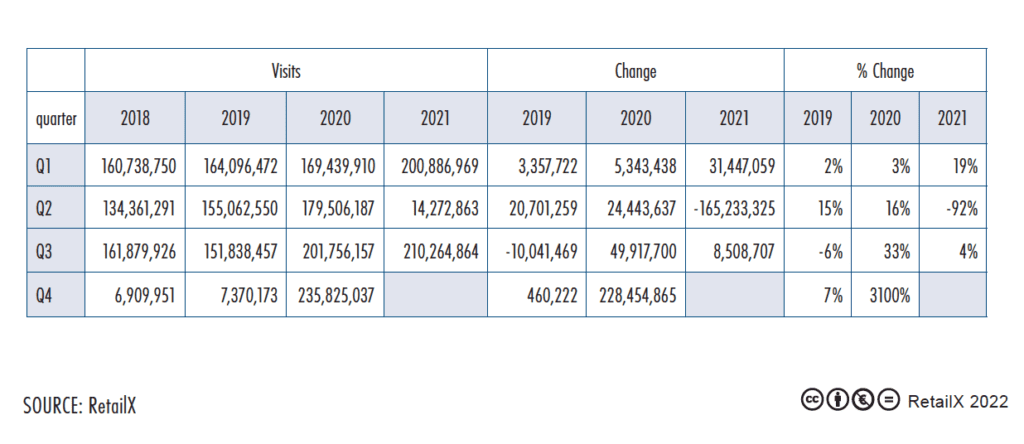

This can be seen in the low or negative traffic rates across the RetailX sample in 2019 (see Figure 3).

2020 changed all that. With stores closed from March of that year for many months, revenues and profits took a hit and the lack of meaningful ecommerce options for these brands is patently apparent in the data.

Where credit should be levelled at the luxury sector is in the rapid turnaround from low ecommerce to high that occurred across 2020. By Q2, the data shows that ecommerce traffic was seeing double digit growth in the same, up from 3% in Q1 to 16% in Q2. By Q3 this had hit 33% growth in traffic as more retailers got their ecommerce services fit for purposes and started to delight consumers. By Q4 growth exploded, with traffic levels up by 3100%.

This trend for growth – albeit more tempered – continued into 2021, with Q1 seeing a traffic rise by almost a fifth.

What is telling is that come Q2 2021, when lockdowns ended and many restrictions worldwide started to lift, luxury ecommerce traffic dropped considerably, falling 92% that quarter. In context, this fall looks large, but in fact comes nowhere near close to reversing the gains that luxury ecommerce made during 2020 and it continues to be a vital part now of all luxury retail businesses.

The drop in traffic more shows that consumers are now much more omni-channel in their behaviour, still looking for the in-store experience, but with the added dimension of the online – largely mobile – interaction that they can now also get. This partially explains why in Q3 of 2021, traffic again started to rise.