Multichannel fashion to homewares retailer Next has seen its sales shift from mostly in-store to mostly digital.

Even back in 2019, Next customers were already buying more from the retailer through its website than through its stores, yet this trend further accelerated during the Covid-19 pandemic.

Some 60% of sales took place online in its latest full year, with 37% through its 466 shops. Next currently has about seven million online customers in the UK as well as a 6% share of the women’s clothing market, 9% and 15% of the menswear and children’s markets respectively, and 3% of UK homewares sales.

Next chief executive Simon Wolfson said in Next’s 2023 full-year results statement that the retailer

has “endured three considerable shocks” in recent years. These are: “the structural shift in shopping habits from retail to online; the pandemic; and now the cost of living squeeze.”

Stay informed:

Our editor carefully curates a daily newsletter filled with up-to-date news, analysis and research, click here to subscribe to the FREE newsletter sent straight to your inbox and why not follow us on LinkedIn to receive the latest updates on our research and analysis?

The change in the way that shoppers buy has meant investing in online infrastructure while also closing shops, including a net 11 stores over the last year.

Next has already laid the foundations for this shift since it has been investing in digital technology and infrastructure for more than three decades. And as already mentioned, its customers have been buying

more online than in-store for years.

Next’s customer promise includes next-day delivery on orders placed before 11pm, in-store collection and returns and fast refunds. It uses machine learning for personalised search results and intelligent recommendations.

Third-party fashion brands Gap, Reiss, Victoria’s Secret and Laura Ashley are customers of its Total Platform service. Next has also invested in these brands, except Laura Ashley.

It is now scaling up its infrastructure to serve more third-party fashion and homewares brands, while also taking a stake in them. It has bought made.com and made significant investments in JoJo Maman Bébé and Joules, which will all join its platform over the next 12 months.

By doing so, Next sees a wider financial benefit from the value that its services create for its clients. “When we first appraised Total Platform, it appeared to use that the value created for clients was likely to exceed the relatively modest profit generated for Next as a service provider,” said Wolfson, in its full-year results.

“So it seemed sensible to invest in our future clients. So far, the group has made more profit from these equity investments than from the service itself.”

He continued: “In a world where many retail businesses are regularly bought and sold by private equity owners, total platform gives Next a means of adding value to an investment unavailable to purely financial buyers.”

The retailer posted full-year sales of £5.03 billion in the year to January 2023, 8.8% up on the previous year. Pre-tax profits of £870.4 million were 5.7% ahead of last time.

Looking ahead, Wolfson notes that Next’s prospects feel, “more positive than they have done for some time,” with much of the costs of shifting from stores to online now paid for and clear new routes to future growth opened up.

Click to download:

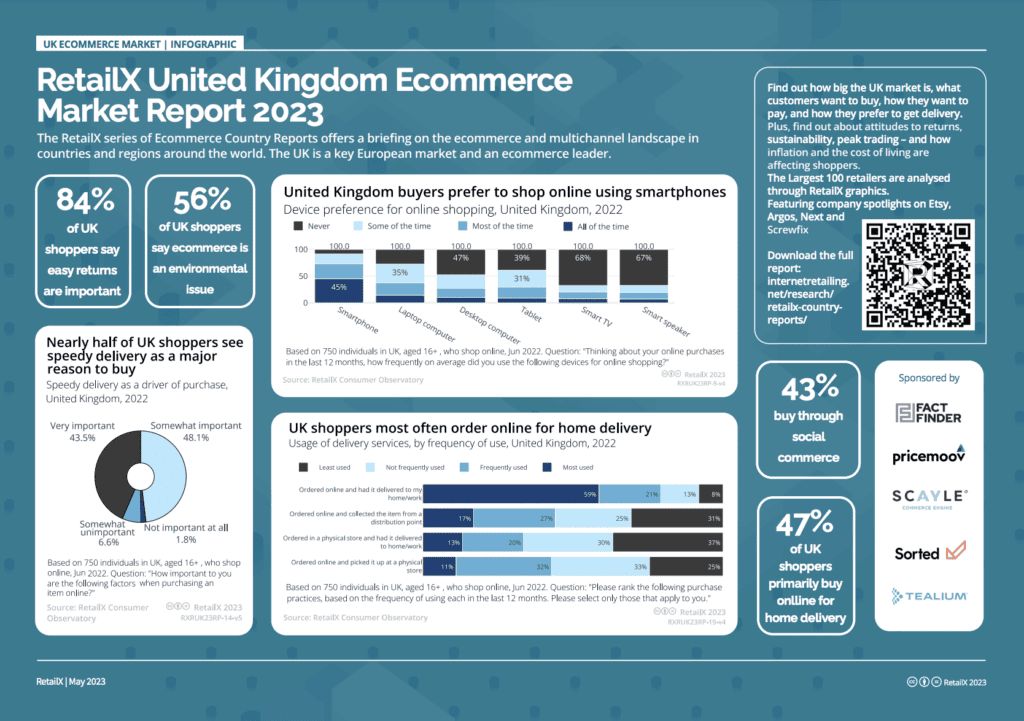

This company profile originally featured in the 2023 RetailX United Kingdom ecommerce country report, which brings together the latest findings on how UK shoppers buy online and across sales channels – and on how leading retailers and brands in the market sell to them.