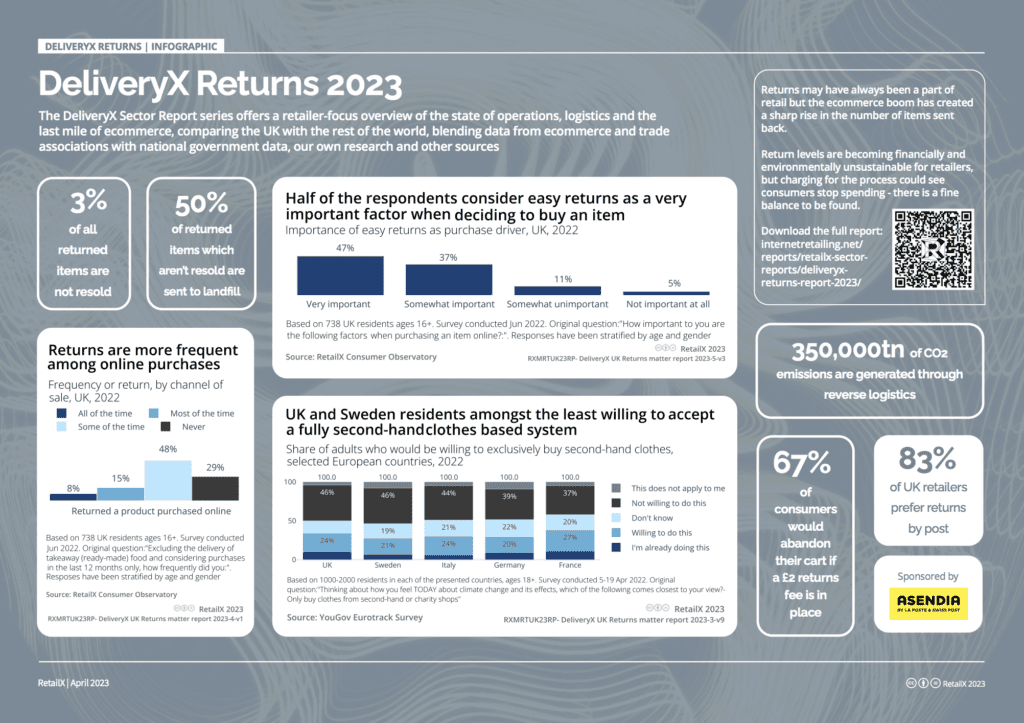

The growth of ecommerce and multichannel shopping provides retailers with so many opportunities, however such a shift and growth doesn’t come without challenges – one very well documented and discussed challenge from ecommerce is returns.

Download the DeliveryX Returns Report to discover how Covid played its part with shoppers not physically able to visit stores and try items on in fitting rooms, their homes became the safe space for this. Free delivery, free returns and often month-long return policies gave consumers the freedom to order multiple pieces, in a range of colours and sizes. Being able to send any unwanted pieces back at no cost to themselves, shoppers took full advantage of this change. It is one that remained after shops reopened.

2022 saw retailers responding to returns like never before, in some cases charging for the reverse logistics of ecommerce returns. Even those who have brought in this change, many still allow shoppers to return in-store for free, this enables the opportunity for in-person customer services, experience and the potential for add-on sales.

This in-depth report explores how technology could be key, not only in reducing returns through better fit platforms, but also in understanding the reason consumers are sending items back in the first place. A better consideration of the returns process could be critical in a year impacted by record-high inflation and faltering consumer confidence.

Download the full report to read more about:

- Why returns are most frequent among online purchases

- How some retailers are deploying loyalty schemes to deal with the returns problem

- How Zara has set the precedent by charging for returns

- What are the two return trends “Bracketing” and “Wardrobing”?

- The main reasons for the post-Christmas and January sales ‘returns tsunami’

- Could repair and recommerce be the key to reducing the financial and environmental price of returns

- Why the UK and Sweden are amongst the least willing to accept a fully second-hand clothes based system

- How the growth of PUDO (pick up and drop off) networks could change the returns landscape

- Exclusive company profiles: Zara, Schuh and Amazon

Download the accompanying datagraphic