Most of us rely on our smartphones to help us organise our lives. It follows that if retailers don’t have a strong Mobile presence, we will look to companies that do when we’re out and about. Jonathan Wright reports on RetailX research into Growth 2000 companies here.

Website navigability and the ease of finding the right product, discussed in the Search section of this report, has emerged as a key discipline within retail, but it’s by no means enough just to have these capabilities,they also need to work on mobile. There’s a growing realisation among leading retailers that they need to be with customers, offering goods and services via mobile in ways that suit these customers. Yet for retailers in the Growth 2000, this poses particular challenges, in that mobile technology requires a combination of investment and strategic expertise that may be more difficult for such companies to access.

Nevertheless, our research uncovers plenty of examples of companies that have sophisticated mobile offerings, with equipment hire company Brandon Hire performing especially strongly. This is not unexpected – not only is Brandon among the largest 100 retailers in the Growth 2000 by Footprint, but many of its customers, such as tradesmen working on building sites, will of necessity need to access Brandon’s services via mobile rather than desktop.

For other kinds of companies, the push factors towards using mobile may be weaker. Regional retailers, for instance, often rely on a small chain of stores as a principal point of contact with customers. Others may be slower to develop expertise because they have more to learn, such as direct-selling brands that were previously wholesale-only and are finding their feet as retailers.

Nevertheless, the central point that retailers need to invest in acquiring mobile technology and expertise remains, so how are the Growth 2000 doing? Our researchers looked at three key areas – user experience (on mobile), multichannel journeys and mobile apps – and we outline some of the main results below. These show there are big gains to be made for many retailers if they can reach the standards of the best of the best, and therefore big opportunities too.

User experience

RetailX researchers focused on mobile web performance, with assistance from Knowledge Partner Eggplant (eggplant.io). While bearing in mind that many retailers in the Growth 2000 don’t yet operate mobile-optimised websites, those that do seem to be achieving results that compare favourably with Top500 retailers.

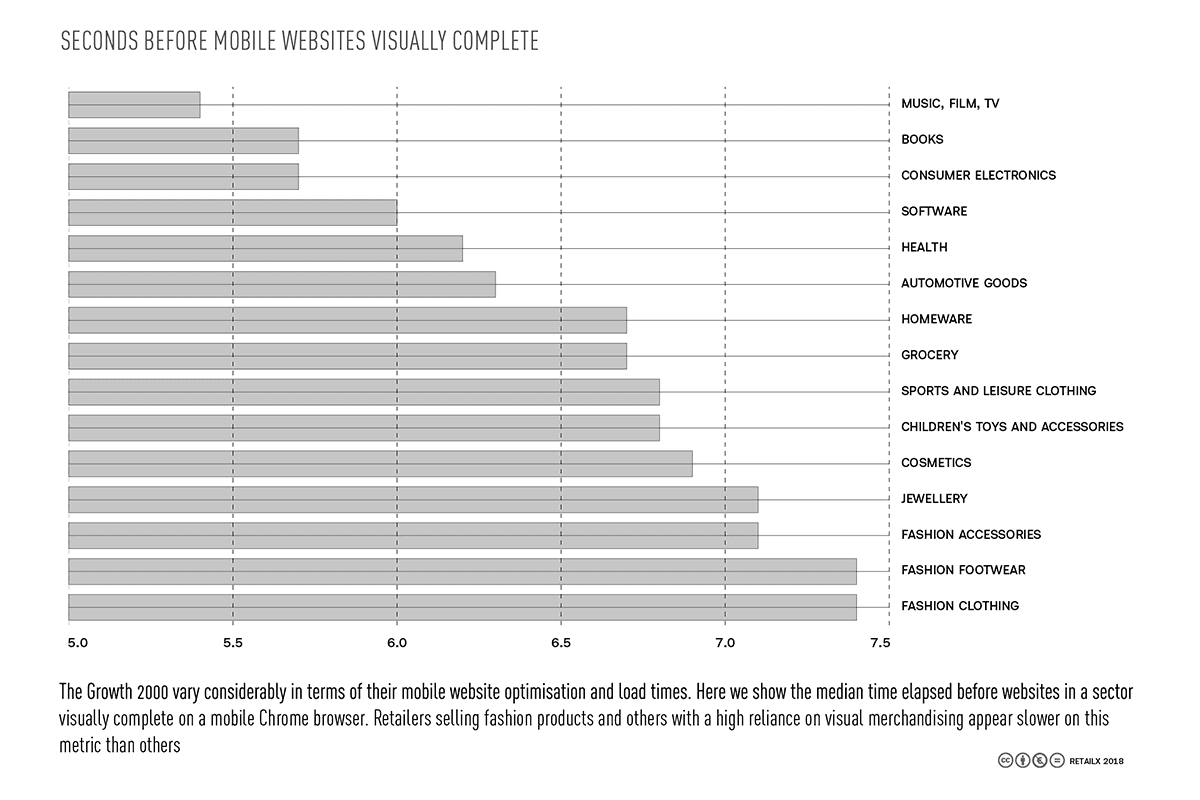

More specifically, the median size of a mobile page is 2.1MB, slightly smaller than the 2.3MB of the Top500. Median load times are quite similar and correlate to the difference in page size, with the G2K pages we measured loading fully on average in 6.7s, compared to 7.3s for Top500 retailers. It’s interesting that the G2K perform better than their larger counterparts in this respect but it should be taken in context. We have noticed over the years that these responsiveness tests often highlight the trade-off between adding functions to websites and reducing load times.

Multichannel journeys

Offering click-and-collect services is no longer in itself a mark of sophistication amongst Top500 retailers. However, this is an area where G2K retailers lag behind their bigger competitors. While click-and-collect is offered by 61% of Top500 retailers, just 12% of G2K retailers offer this facility.

Intriguingly, though, the median time offered is far quicker among G2K retailers – just one day, compared to 2.5 days for Top500 retailers. It’s outside the scope of the research, but this may be because being regionally based, retailers find it easier to get goods to where they need to be, or that a disproportionate share of the 12% are multichannel retailers fulfilling from stores often on the same day the order is made.

Mobile apps

Just 5% of G2K retailers have an app, either iOS or Android. This is a much lower rate than the Top500, where 48% of the Top500 have an iOS app and 46% have an Android app. Here, we suspect, the comparative newness of the technology, along with cost and debates about what constitutes a ‘good’ app, may have an effect on the figures.

Sectoral analysis

Fashion retailers have the longest-loading websites, with a median page load size of 7.3s, yet this may be partly because the sector uses strong imagery as a merchandising tool. Retailers selling fashion goods (clothing, accessories, footwear) are more likely to have an iOS app than those in other sectors, but it’s worth noting that the equivalent figure for the Top500 is 52%.

The consumer electronics sector performs strongly in mobile web performance, with sites taking on average 5.7s to load. The homewares, consumer electronics and appliances sectors perform strongly in click-and-collect, offering collection in a day, compared to three days for fashion retailers.

Strong performers

In addition to Brandon Hire, retailers that stood out in mobile include clothes retailers Desigual and Yoox, TV shopping channel Ideal World and Danish furniture retailers JYSK. It’s also a list that contains some names that say much about how retail is changing. The Whisky Exchange claims to be “the internet’s number-one specialist retailer of whisky and other spirits” and delivers a near-bewildering variety of spirits, with many sourced from small and specialist manufacturers.