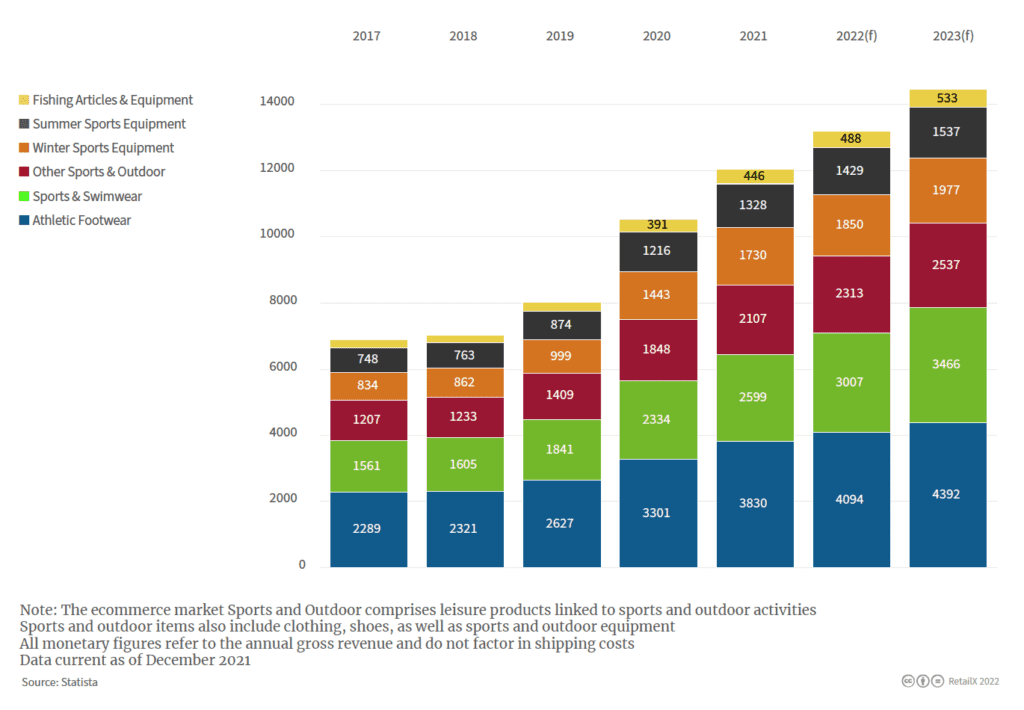

According to the RetailX European Sports Goods sector report, the online sporting goods and outdoor sector in EMEA was worth €12.04bn in 2021, markedly up from €10.53bn seen in 2020 and continuing impressive growth that the sector has enjoyed since around the end of the credit crunch in 2008. It is further forecast to hit €13.18bn in 2022 (see Figure 1).

The results are all the more remarkable since the global pandemic and the lockdowns that it necessitated had an enormous impact on sports from professional level downwards.

The curtailment of team sports and many indoor sports caused a fundamental shift in what was shopped in sports across the continent in 2020 and 2021. This was compounded by a downshift in sales of Winter sportswear, impacted by travel restrictions lessening the number of people going on skiing and other winter sports holidays across these two years.

However, the lockdowns and the pandemic didn’t wipe out consumer spending on sports and outdoor apparel and equipment. Instead, it produced a shift in where that spend went, with more consumers taking up individual sports including yoga and Pilates.

The market also saw growth in outdoorwear and walking apparel and equipment as, in many countries in the region, walking was one of the few things locked down consumers were able to undertake. Many also bought dogs, which also required walkies.

The sector was also bolstered by the growth in lockdown of athleisurewear. With the majority of consumers working from home, this category of clothing – combining tropes of yoga wear, sportswear and relaxed leisurewear – became a staple of homeworking; smart enough for zoom meetings from home, sporty enough to fit in a walk at lunchtime.

An increased interest in shopping for sustainable goods also impacted the sector during this time too, with those brands that could demonstrate sustainable production, recycled materials and ethical working practices seeing a surge in sales.

The third influence on how consumer spending in the sports sector has shifted has been the embrace of digital health apps. These have driven more people to take up some form of exercise and has lifted sales for both sports apparel and equipment – a trend that is set to continue.

Impact on traffic

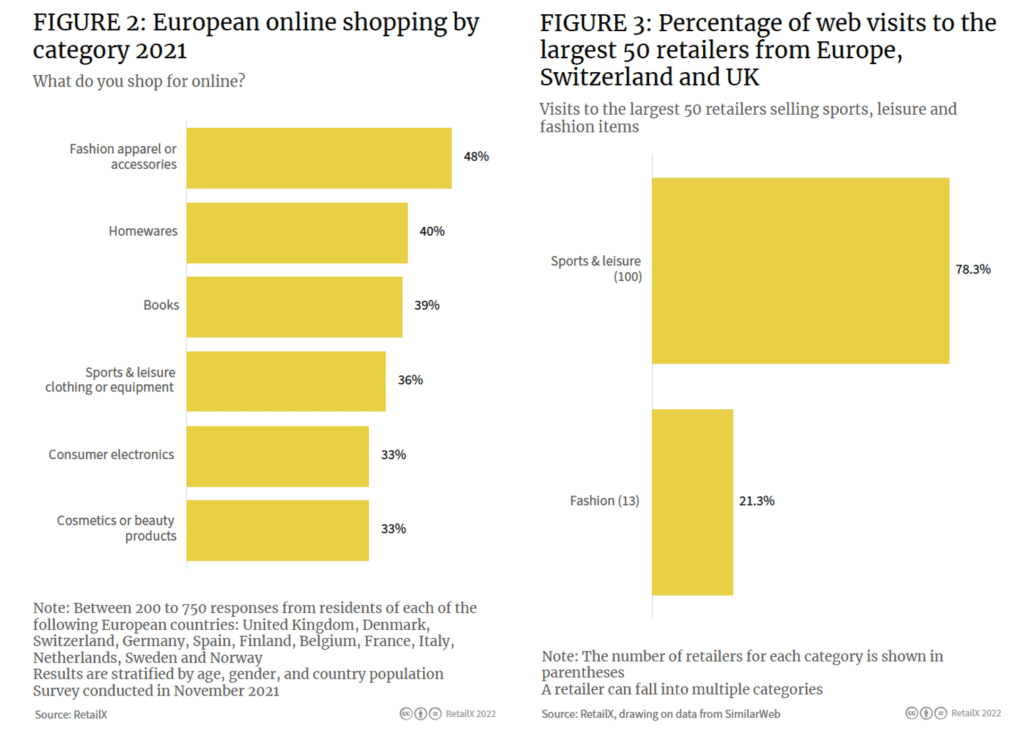

As a result of these macro-economic effects, the sports sector is a key ecommerce performer in Europe. Data shows that 36% of European consumers that are shopping online in 2021 were looking for sports and leisure apparel and equipment. This is only marginally behind books (38%) and homewares (40%), both also seeing a boost from the pandemic and lockdown (see Figure 2).

This compares favourably to fashion and apparel, which at 48% isn’t too far ahead. It is also worth noting that the shift in consumer behaviour towards athleisureware also ushered in the sale of such goods – along with some sportswear brands – by fashion retailers. This suggests that the reach of the wider sportswear market is perhaps deeper than such segmented data presents and places sports apparel and fashion sports apparel as a significant opportunity for both sports retailers and those in fashion.

Looking at the relative percentage of web visits to the largest 50 retailers from Europe, Switzerland and UK reveals that more than three quarters (78%) are looking for sports and leisure, compared to 21% seeking out pure fashion (see Figure 3).

The implication is that sports apparel, athleisurewear and ‘sports fashion’ are leading the dance for many apparel retailers, with sportswear cementing its entrenchment as a sector that straddles both.

Read more in the RetailX European Sports Goods Sector report, which you can download here