Despite a dip in consumer spending on subscriptions overall, two thirds of UK consumers remain signed up to at least one digital or direct-to-door service.

More than a third are using subscriptions to help them manage their finances as the cost-of-living rises, while value for money, convenience and trialling new products cited as the most appealing subscriber benefits.

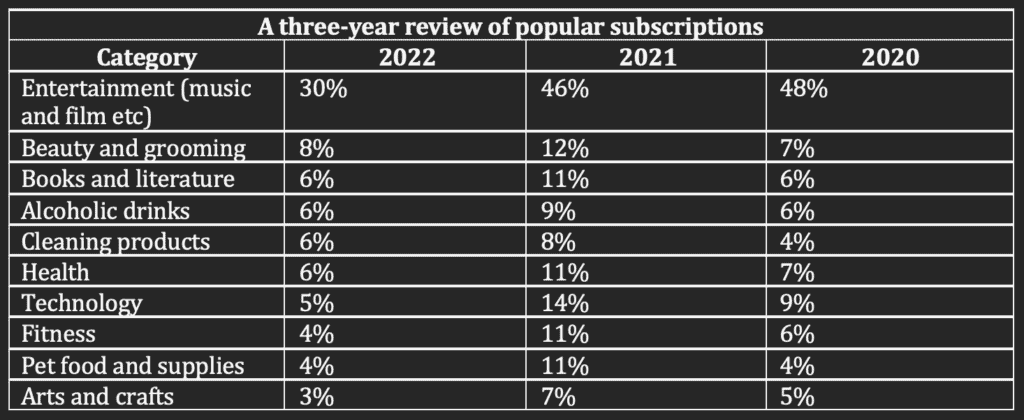

Entertainment platforms, beauty & grooming kits and books & literature are the most popular subscriptions.

New data from Barclaycard Payments on the ‘subscription economy’ sheds light on how demand for sign-up products and services is evolving following growth during the pandemic – and the impact on consumer spending as the cost-of-living takes its toll.

The third annual study from Barclaycard Payments found two thirds (67%) of shoppers remain signed up to at least one digital or direct-to-door service and many see them an important tool to help manage finances (cited by 34%) at time of rising costs.

While proprietary Barclaycard data shows spending on subscriptions declined 4.2% in June 2022 when compared to May 2022; almost four in 10 (38%) Brits believe subscriptions offer good value for money, and 37% feel they help them to be more organised.

Three fifths (59%) of shoppers say they are signed-up to subscriptions for exclusive access to content. Meanwhile, 45% believe subscriptions offer a personalised experience. Other benefits appealing to shoppers include: the ability to try new items which they may not normally purchase (55%), convenience (42%) and reassurance that key products will be delivered regularly (42%).

Flexible and convenient subscriptions

As the cost-of-living continues to rise, almost four in 10 (38%) consumers cited good value as the most important factor when signing up to new subscriptions, followed by a free trial (32%), free delivery (27%) and flexible contracts (21%).

Barclaycard Payments found that the average UK household spends £41.70 a month on subscription services, compared with an average of £51.65 in 2021, and £45.50 in 2020.

Despite consumers cutting back on non-essential spend, analysis into subscription categories over the last three years found that most sectors are stabilising after substantial growth during the pandemic – when restrictions meant more time was spent at home.

The business response

As consumer preferences change, the research found that subscription providers are responding to the challenges of the rising cost of living in different ways. While over half (51%) of businesses offering subscriptions plan to cut prices on their products, almost as many (47%) intend to increase them due to rising inflation and supplier costs. Three in five (61%) plan to launch lower-cost subscription products and services to give customers more choice, and two thirds (65%) will do this in time for key retail moments, such as Black Friday.

Harshna Cayley, Head of Online Payments, Barclaycard Payments, says: “As the cost-of-living continues to increase, we’re seeing consumers engage with subscriptions in new and smarter ways. Our data not only shows the importance consumers continue to place on subscriptions, but also highlights how the benefits of recurring payments play an important role in the management of day-to-day finances.

“Value for money, convenience and control will continue to be important factors for cost-conscious customers. This means to remain successful in the subscription economy, businesses need to focus on going beyond these current demands. Added extras, such as exclusive content, may no longer cut-it, so providers need to ensure contracts and delivery models remain flexible too.”