Ocado has reported growing sales in its retail and technology businesses over the last year, but its losses have widened as costs grow.

Group sales came in at £2.5bn in the year to November 28. That’s 7.2% up on the same time last year. Retail sales of £2.3bn were 4.6% ahead of last year, while sales of Ocado Group’s commerce and robotic fulfilment solutions grew both in the UK (+8.6% to £710.4m) and internationally (+301.2% to £66.6m).

At the bottom line, Ocado Group reported a pre-tax loss of £176.9m as distribution and administration costs grew as logistics wages rose and the business expanded its technology team to 2,600. The loss would have been greater but for a £42.8m payout by its insurers in relation to fires at its Erith and Andover warehouses. Nonetheless, Ocado Group’s losses were £124.6m greater than the previous year, when it reported a loss of £52.3m.

Growing costs

Distribution and administrative costs grew by £163.1m to £976.7m as the retailer expanded in the UK and internationally. Costs in its UK business included engineering costs related to the three customer fulfilment centres (CFCs) that went live during the year at Bristol, Andover and Purfleet, while the cost of labour also rose at a time of skills shortages, particularly in relation to LGV and delivery drivers. Technology costs grew from £77.1m to £107.2m as Ocado Group increased its headcount in this area from 2,100 to 2,600 over the year.

Ocado says investment in its Ocado Re: Imagined project will pay back through sales growth for its own retail business and for partners who buy into its commerce platform and fulfilment technology to operate their own ecommerce businesses. So far it has 10 third-party partners, from supermarkets Morrisons in the UK and Kroger in the US to, most recently Alcampo in Spain, of whom seven are live on the Ocado Smart Platform. It has 13 live customer fulfilment centres (CFCs), and expects to open six more by the end of the year.

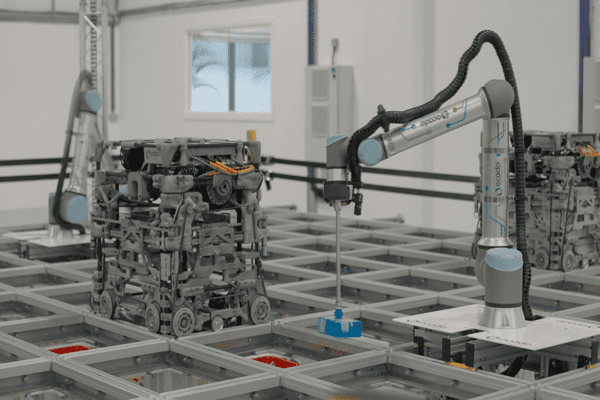

“Game changing” innovation is anticipated through its Ocado Re: Imagined project, which envisages services from new, lighter robots picking goods in virtual warehouses to opening fulfilment centres in existing buildings using more flexible infrastructure. Same-day deliveries in between one and three hours will be enabled as robots pick previously placed orders overnight and then add same-day orders into vans in the morning.

Ocado Group chief executive Tim Steiner expects that 20% of UK grocery sales will soon be online, up from 12% at the moment. He says: “The past year has further reinforced that demand for online grocery is here to stay. In the majority of mature markets, the fastest growing channel is online and to truly win here food retailers need to deliver the best offer with the best economics across all customer missions. The innovation that is powering the development of the unique and proprietary Ocado Smart Platform is focused on providing an unequalled customer experience through ground‐breaking technology which leads to an unrivalled low cost operation.

“The new generation of Ocado technology, which we have called “Ocado Re: Imagined”, represents a transformational leap forward allowing our partners to comprehensively out‐compete peers online. Partners ordering CFCs today will be able to go‐live quicker, at lower cost, and achieve higher margins and return on capital. For Ocado Group, this means a bigger addressable market, the opportunity to win new partners more quickly, and fresh opportunities to accelerate growth.

“Over the last twenty years Ocado Group has been a pioneer in the development of online grocery retailing. With the innovations to the Ocado Smart Platform announced in January 2022, we have again re‐set the bar, demonstrating decisively that an online grocery service powered by OSP is able to offer what the customer wants with the economics the retailer needs.”

Ocado’s multichannel retail strategy

Sales at Ocado Group’s UK grocery business Ocado Retail – now owned in a joint venture with Marks & Spencer – grew by 4.6% compared to the previous year, and by 41.5% compared to 2019, as shoppers continued to buy more of their groceries online. When lockdown restrictions ended in spring 2021, customer spending patterns started to return to pre-pandemic levels, as shoppers returned to the office. Average basket values came in at £129 in 2021, higher in winter periods and lower in the final quarter of 2021 (£118, +12% on 2019). Sales growth reduced in the second half, constrained in part by the fire at the Erith CFC in July 2021. But as three new CFCs opened, average orders per week for the year grew to 357,000, up by 11.9% on last year and by 16.3% on the previous year, and active customers grew by 22.4% to 832,000.

Ocado says it has now upgraded its robots to a new series that will prevent fire breaking out for th esame reasons.

Ocado plans to open a second Ocado Zoom hub – at Canning Town – in the second quarter of this year, enabling Ocado Retail deliveries in less than an hour, before a further three – one in London and two in other UK cities – open over the next three months.

Ocado Group’s earnings before interest, tax and one-off costs (EBITDA) at the retail business came in at £150.4m, up from £148.5m the previous year.

Ocado.com ia Leading retailer in RXUK Top500 research,