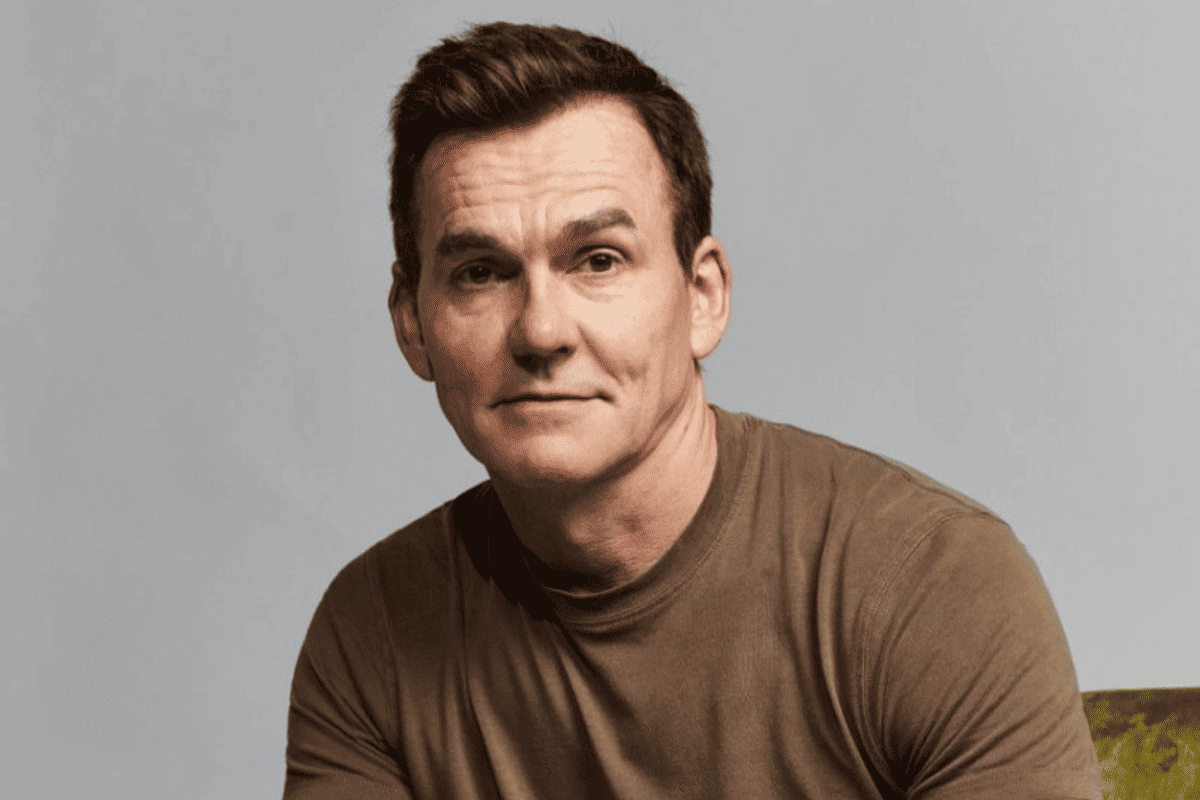

THG’s founder and CEO Matt Moulding has given up his “golden share” rights, which allowed him to veto hostile takeover approaches.

As a result, the move allows the business to join the FTSE 250 premium segment of the London Stock Exchange.

According to the ecommerce giant, the move is subject to Financial Conduct Authority approval, for reform of the listing regime.

Subscribe to Internet Retailing for free:

Click here to sign up for our daily newsletter

The surrendering of the “golden share” follows corporate governance criticism, resulting in Moulding giving up his chairmanship of the group, which owns LookFantastic and MyProtein, appointing Charles Allen, Lord Allen of Kensington CBE, as non-executive chair to focus on the position of chief executive.

The news comes as, just today, the group also revealed it expects to announce a significant rise in first-half profitability, following a strong second quarter.

In an update, the company said it expects adjusted EBITDA to be in the range of £44 million to £47 million, compared with £32 million in the same period last year.

It also predicts continuing adjusted EBITDA in the range of £47 million to £50 million.

However, it revealed that guidance for FY 2023 “remains unchanged”.

In a statement, the company said: “For the group, Adjusted EBITDA margin accretion into FY 2024 and beyond will be driven by annualised commodity pricing benefits, ongoing automation efficiencies and operating leverage, in addition to normalised capital expenditure, underpinning positive free cash flow guidance for FY 2024.”