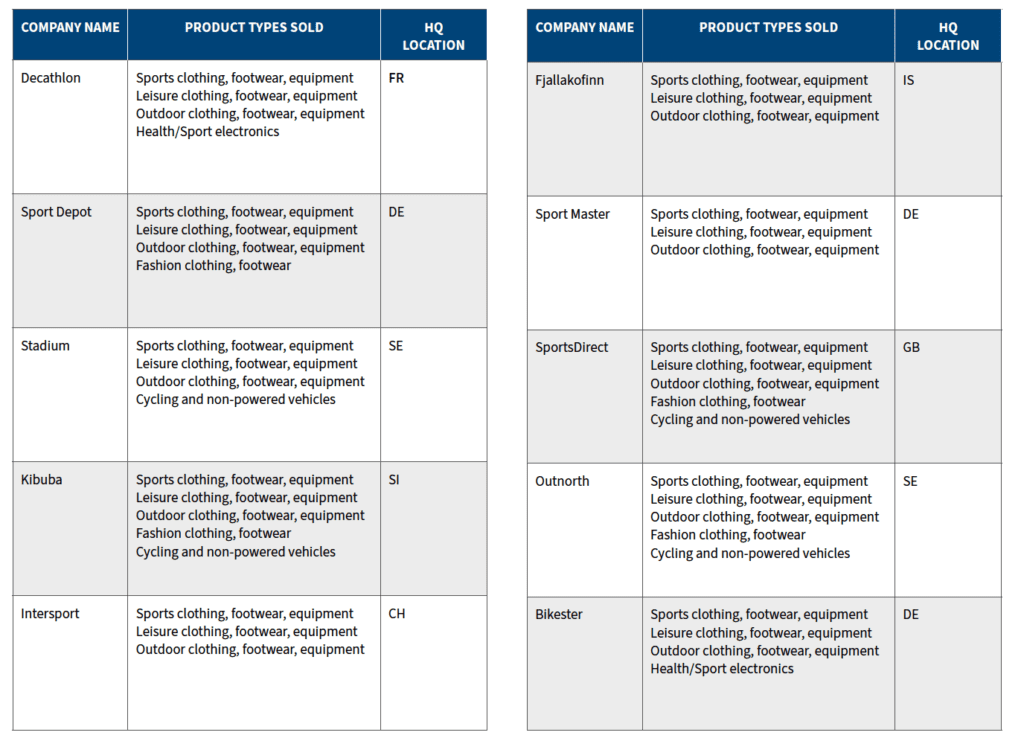

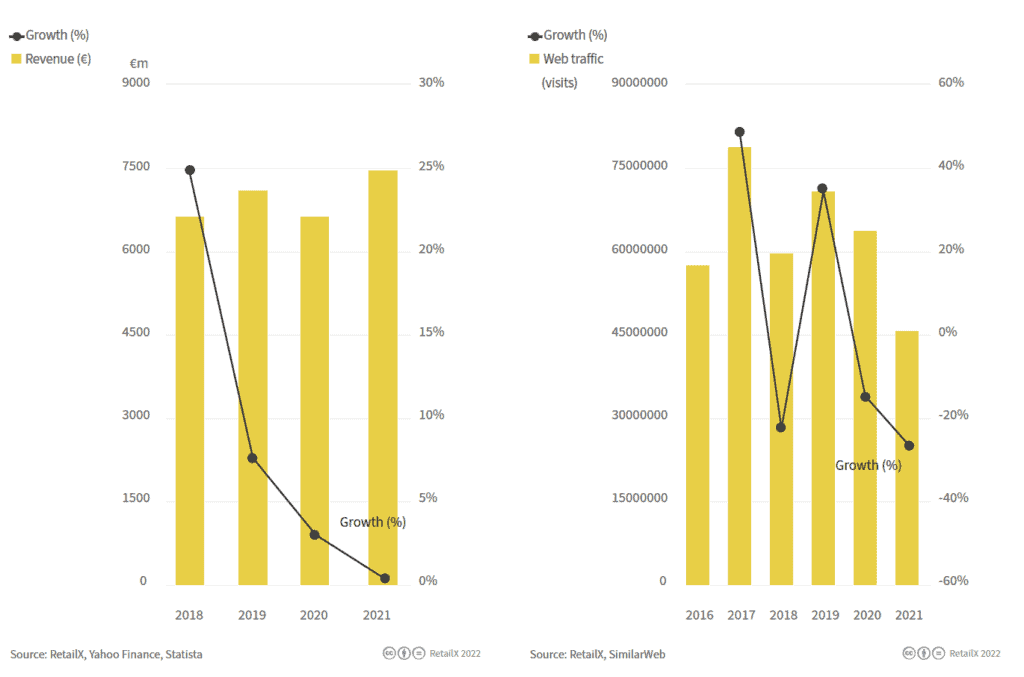

The European sports goods market is served by an array of online and omni-channel retailers, with each country having at least one major merchant in the Top 100. The Top 20 (see table, below) show a good spread also, however not all markets are represented.

Germany, for instance, has several players in the rankings. This is indicative of the size of the German market for sports and outdoors goods and equipment. It is also a result of cross-border ecommerce from elsewhere in Europe – typically near neighbours such as Switzerland, Austria, Poland and the Czech Republic – also sustaining these numerous retailers.

The UK, by contrast, has just one – Sports Direct – in the Top 20, the result of a strong domestic market, but limited pan-European cross-border appeal.

The distribution of retailers around the continent is also impacted by some leading brands, typically giants Nike and Adidas being internationally available through all of these other retailers and in branded stores everywhere.

Each of these retailers in the Top 20 is also characterised by selling a very wide range of sports, outdoor, leisure and fashion apparel, footwear and equipment. The chart on page XX shows that almost all of them sell across all these categories, as well as selling related equipment. Some additionally sell cycles and other non-motorised vehicles used for sport and leisure.

The sports goods market is also marked out by there being a segment of consumers that are deeply embedded in buying specific and specialist items. This would suggest that there is a market for smaller, specialist sports goods retailers. In reality, the market is dominated by these big multi-segment retailers that can combine the buying power of a large organisation with offering specialist item segmentation in-store and online.

Performance

Figure 2 (right) European web traffc to the largest 12 European sports goods retailers

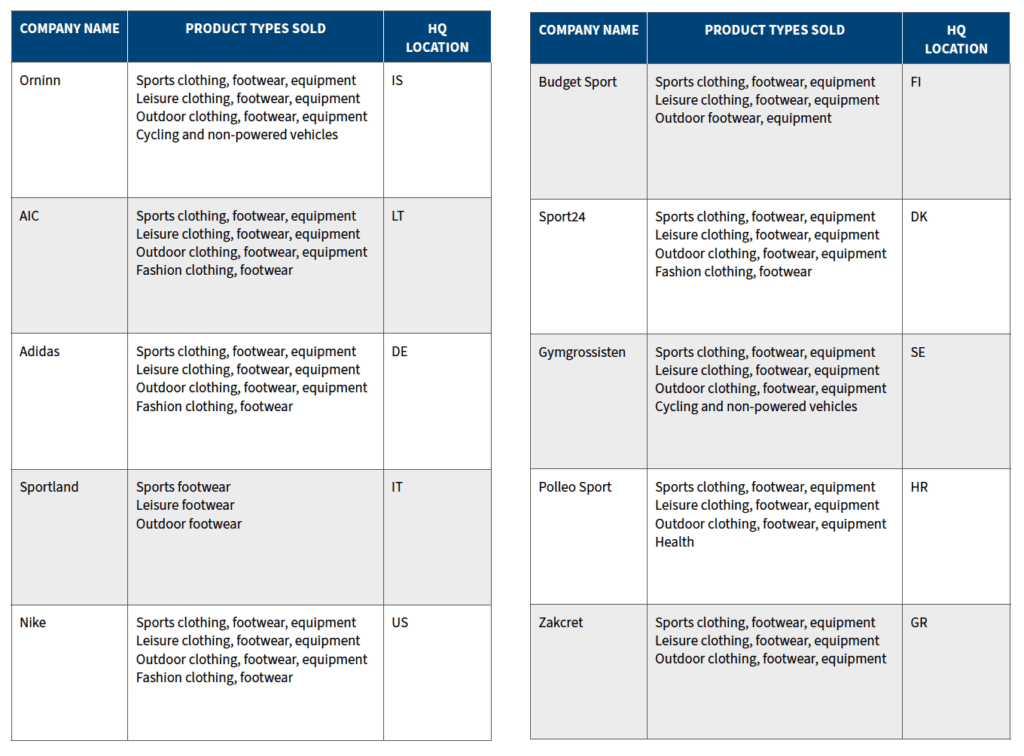

To garner a view of how the European sports goods sector performs, RetailX has looked at the top 10 retailers by traffic and averaged revenues and traffic across the past four years for revenue and five years in terms of traffic.

From a revenue perspective, the sector has seen growth across 2018 to 2021 that has slowed. 2020 saw a forced decline, generated by the pandemic as previously discussed, but 2021 saw revenue up from this year to reach 2019 levels (see Figure 1).

This seemingly sluggish return belies the fact that the sector has faced pandemic headwinds not experienced by other retail sectors. The sports goods sector is more dependent on social mixing and the physical locations – two things that were closed in 2020 and only saw sporadic returns in 2021. Instead, the sector has had to generate growth from switching to selling athleisurewear and sports and leisure wear for other pursuits. With this in mind, revenue growth for the sector looks impressive and is likely to strengthen through 2022 and beyond.

Traffic figures back this up (see Figure 2). Online sales across the sector have fluctuated between 2017 and 2019, driven by the performance sports goods and equipment shoppers’ tendency to buy in-store. As a result, the significant drop in traffic in 2020 shows that the switch to online shopping seen on other sectors during lockdown happened in a more limited way in sports goods.

Traffic continued to decline in 2021, however. This points to a return to physical retail among a large cohort of performance sports buyers. It may also indicate that many of those shopping for athleisurewear and sportswear for non-sport purposes had returned to work and more formal wear, reducing the amount of online shopping being done in the sports sector.

What this likely means for the key players going forwards is that, with the market awash with large retailers selling across all segments of the sector, competition on price, delivery and sustainability is only going to increase. This may see consolidation in the market, or it may see retailers take on other ranges of goods – perhaps branching out more towards health and wellbeing, nutrition and digital health gadgets.

Read more in the RetailX European Sports Goods Sector report, which you can download here