Of the nearly 70% of UK shoppers regularly shopping online, more than half are doing so via marketplaces, with Amazon being four-times more popular than retailer sites and apps.

Research by Adobe finds that 57% of shoppers are buying from marketplaces, compared to 13% on retailer websites – Adobe’s inference being that, even with more time on their hands and restrictions to shopping in-store, consumers were drawn to the broad product ranges, robust delivery infrastructure and limited steps between logging-on and checking-out that characterise marketplaces.

Additionally, between March and June, the average online shopper made 11 purchases from an online marketplace, and just three from an online retailer.

Commenting on the findings, Peter Bell, Marketing Director, EMEA, at Adobe, says: “The rapid increase in demand for online shopping in the first few weeks of the pandemic, together with rapidly migrating business online and supply chain issues, made it an exceptionally challenging time for all retailers. Marketplaces were able to get ahead of other retailers and brands, thanks to their ability to scale quickly and establish a reputation for reliability that saw them become the first port-of-call for a wide range of goods.”

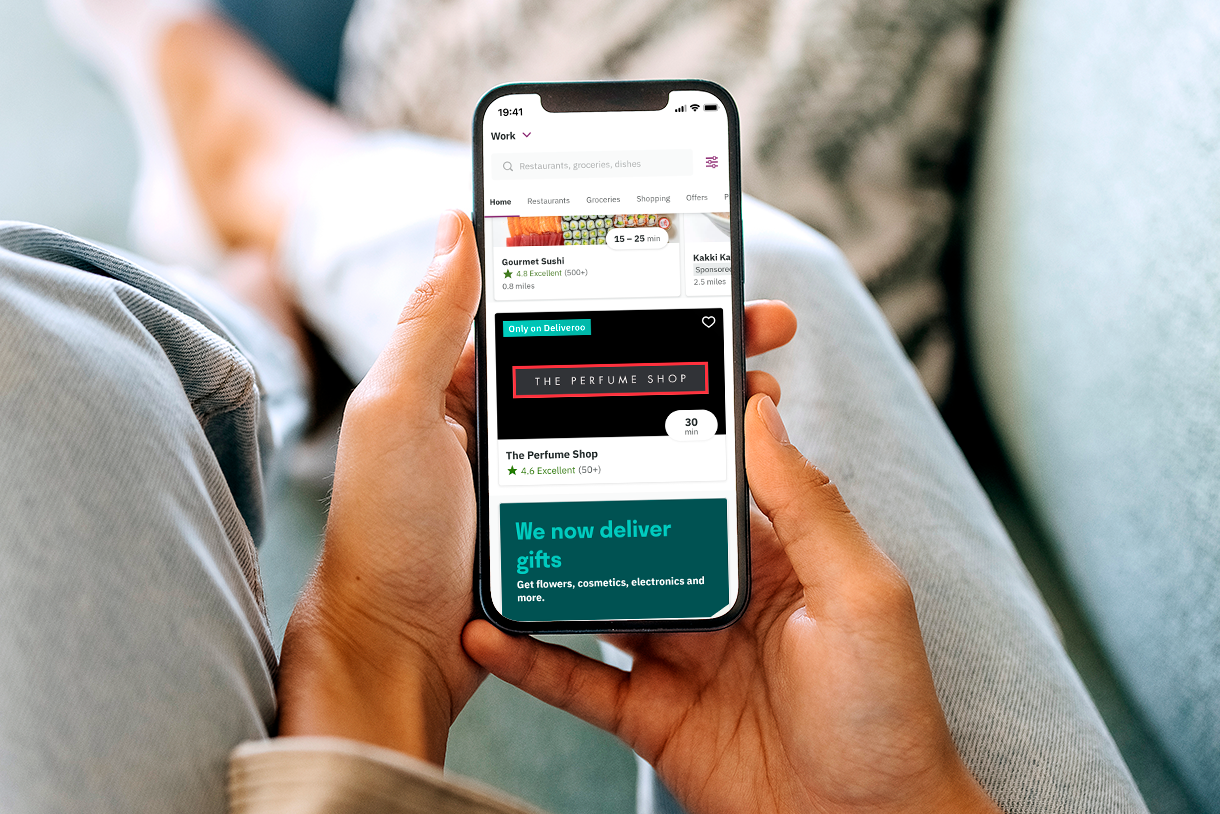

Bell adds: “Many brands and retailers already deliver great digital experiences, but to break the dominance of the marketplaces and attract customers to their sites and apps, they need to capture their attention in ways that marketplaces can’t. That could be through hosting exclusive content, giving early access to sales or specific products, or even offering subscription or membership options that make the shopping experience even more convenient and seamless. Our data shows that consumers are sold on shopping online, so the onus is on retailers and brands to find new ways to stand out and deliver value.”

Online sales surge but support for the high-street remains

The growth in online shopping at the start of the pandemic shows little signs of reversal, even as physical shops start to re-open their doors. More than half (54%) of consumers said they would continue to shop online for the foreseeable future.

Even with this clear shift, the research also found that respondents were keen to support the high street, with a third calling for a Value Added Tax cut for high street retailers and one-in-seven favouring a fixed fee for deliveries to level the playing field for independent retailers and promote more sustainable online shopping practices.

The survey also revealed that alongside essential items such as groceries and hygiene products, nearly a quarter of consumers (24%) also purchased items to support their health and wellbeing. One-in-five (22%) bought products to improve their physical fitness, and the same proportion also bought products to support their mental well-being.