The future now

Those retailers that offer sophisticated services today are best placed to offer the kinds of innovative services that will be mainstream in the future. Jonathan Wright considers what the numbers tell us about how IREU Top500 retailers are doing here

Strategic planning is not just about grand schemes for the future. Rather, for European retailers, it is about anticipating which developments may prove important and using this knowledge to set a course for the future while simultaneously delivering a joined-up, consistent and innovative offer – at scale and across many countries.

But how to measure which companies are performing best here? It is difficult to measure an intention to do better in the future or how successful a new initiative will be. Instead, our research focuses on companies’ use of cutting-edge technologies, solutions and offerings over the span of core multichannel retail disciplines, including logistics, customer service and localisation.

Time will reveal whether such retailers ultimately succeed but we suspect there is a strong link between trialling and implementing new approaches, and competing over the longer term in an industry so prone to change. In addition, our research reveals patterns of development across Europe. This means we can trace how consumer expectations for innovative solutions vary from country to country, based on the penetration of those services among each region’s dominant retailers.

Fulfilment services across Europe

One of the most competitive areas within European retail is fulfilment and it says much about how the overall market is developing. Customers increasingly expect choice in how they get hold of their purchases. They may want free delivery or, where an item is needed quickly, a choice of fast-delivery services.

They may prefer to pick up an item from a local branch or a locker. If an item does not meet their expectations, they may be frustrated if asked to post it back rather than return it through a store. They may select a retailer that offers a more generous returns policy.

So how are European retailers doing here? The majority of the IREU Top500 are improving their fulfilment offerings from the customer’s perspective. The number of delivery/fulfilment options has been increasing, as has the speed of fulfilment, while cost to the consumer has remained the same or decreased. This is an area that retailers are clearly prioritising.

However, performance here is not uniform across different countries. Western European retailers tend to have more sophisticated offerings, most likely a reflection of ecommerce at scale having a longer history in these territories.

In 2017, the gap was wide. However, this has narrowed over the past year with retailers in other territories, notably those in the former Eastern Bloc, far more likely to offer next-day delivery, same-day delivery, weekend delivery and click-and-collect services in 2018/19. In some countries, the number of IREU Top500 retailers offering these kinds of services has doubled.

Collection

Drilling down further into the figures for IREU Top500 retailers, the number of companies that offer collection is increasing. Already, around two-thirds of retailers – 65% – offer collection in at least one region. The service is most commonly offered in France, where the service is offered by 65% of retailers. The Netherlands, where the equivalent figure is 61%, and the UK, 57%, also perform strongly.

Conversely, Slovenia shows how some retailers in eastern Europe even now lag behind here, with collection service offered by just 16% of retailers. In Croatia, the equivalent figure is 24% and, in Bulgaria, 26%.

Turning to different sectors, there are significant differences too. Sports footwear (71%) and sports clothing (69%) retailers within the IREU Top500 are most likely to offer click and collect. Garden (68%) and homeware (66%) retailers also perform comparatively strongly, as do those in the fashion clothing (66%), footwear (66%) and accessories (65%) sectors.

Next-day delivery

Turning to deliveries, there are wide differences between different territories. Notably, next-day delivery is commonplace only in the UK, where it is offered by 40% of Top500 retailers. Even in the Benelux countries, the figure is nowhere close to this, with 19% of Top500 retailers in Luxembourg, 15% in the Netherlands and 13% in Belgium offering next-day delivery.

The equivalent figure in France and Germany is, respectively, 15% and 14%. Conversely, none of the retailers we surveyed operating in Cyprus offered next-day delivery, while the service is rare in Switzerland (5%), Norway (4%), and Romania (4%).

It may be that factors such as the typical layout of cities, the confidence with which consumers provide card details online, and other cultural and environmental factors drive some markets towards being competitive hotspots sooner. We do notice in the results that retailers within a country tend to move together. Once one fulfilment provider offers a relatively cheap, faster service, it is likely that many retailers will adopt it at the same time.

Other expedited delivery services

Curiously, same-day delivery is offered by 6% of Top500 retailers in Greece, a figure higher than the UK, France and Spain, where the equivalent figure is 5%. More generally, same-day delivery is always likely to be a service offered in urban areas where economies of scale make it economic.

The situation with weekend delivery corresponds more closely with next-day delivery, in that approximately one in four Top500 retailers operating in the UK offers Saturday delivery and one in 10 offers delivery on Sunday. In other countries, this figure ranges from 0%-5%.

Localisation

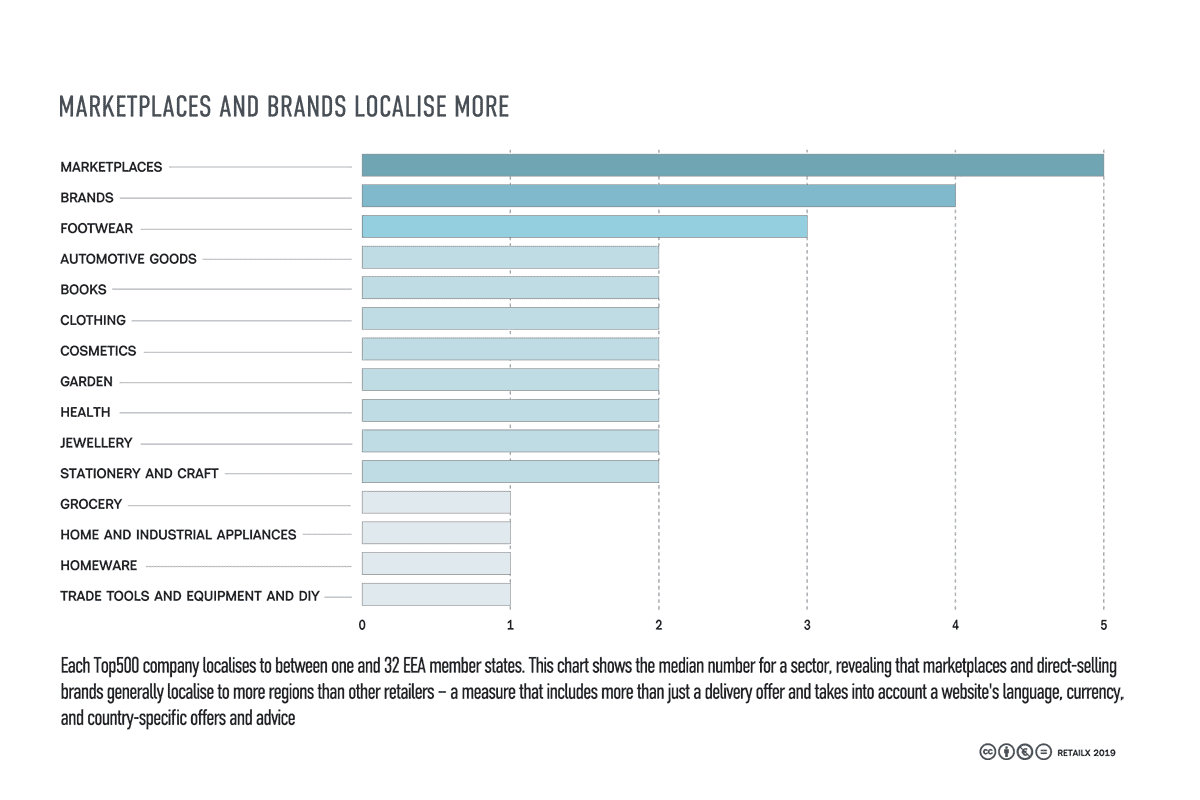

We also looked at the extent to which retailers adjust their digital presence for different markets. The median figure here for IREU Top500 retailers, based on analysis of the languages, currencies, and offers of website landing pages, is two regions, although there are significant outliers here, meaning the average is 3.9 territories.

Intriguingly, this is an area where brands perform strongly, with an equivalent median figure of four regions. Marketplaces perform better still, with a median figure of five regions. We suspect this may be partly rooted in the way both groups of businesses tend to plan expansions into new territories as part of an overall strategy rather than expanding piecemeal.

Looking at these figures by sector, of those retailers selling clothing and footwear, both fashion and sports localise to an average of five regions, although the median is two. In contrast, retailers selling groceries operate in the fewest regions, with a median of only one territory (average of 1.7). The situation is similar with home and industrial appliances, homeware, trade tools and equipment, and DIY, although again there are significant outliers in these regions.