Amazon has become the yardstick by which other ecommerce and multichannel retailers measure themselves. It has largely delivered on its mission of becoming the “most customer-centric company on Earth” and enjoys a clear lead in the UK market.

The Amazon Prime subscription initiative is key to brand engagement. It’s hard for outsiders to say how many members have signed up to the service, but what is certain is that this club is getting bigger all the time as perks get more attractive. For their £79 annual subscription, members currently enjoy free delivery, access to the Amazon Pantry grocery delivery service and to a vast library of film, television, ebook and music downloads, including a number of exclusive and hit TV series.

Prime members get exclusive access to deals – both at peak times such as Black Friday and in Amazon’s own Prime Day, held for the first time last year – and they can store videos and photos in Amazon’s cloud.

It’s an approach that’s working. According to Amazon’s full-year trading update, published in January 2016, Prime membership numbers grew by 51% in 2015. The rate of expansion stood at 47% in the US, and was higher still in other markets. InternetRetailing analysis of Amazon’s social media reach gives an alternative insight: Amazon had 5.5m Facebook Likes at the time of analysis – five times higher than the average for the Top500 – and 40% more monthly posts than the Top500 average.

Amazon has made it as easy as possible for customers to move from thinking about a purchase to making it. Customers engage via the Amazon Wishlist app to scan the barcode of an item to find and then buy the item from Amazon. Alternatively, they can click to buy direct from a tweet. Buying is made easy – and delivery is as fast as possible.

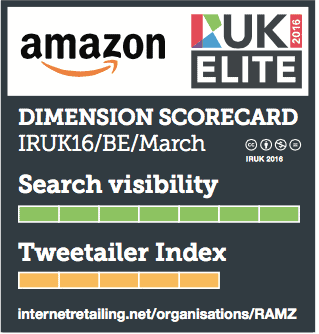

The result is an ease of shopping that goes beyond engagement with the brand, into simply being the easiest and most convenient way to ‘get’ an item. Complex operations lie behind this surface simplicity. A network of logistics hubs enables same-day delivery and collection, while a vast range of inventory, held both in Amazon’s cavernous warehouses and by sellers on its Marketplace, gives it a strong search reach, measured by InternetRetailing Knowledge Partner OneHydra at 40.6%.

Google’s executive chairman Eric Schmidt is on record as naming Amazon as its main competition. “People don’t think of Amazon as search,” he said, back in 2014, “but f you are looking for something to buy, you are more often than not looking for it on Amazon.”