Using Social networks effectively is a skill that retailers increasingly need to master. Jonathan Wright considers how well G2K retailers are doing.

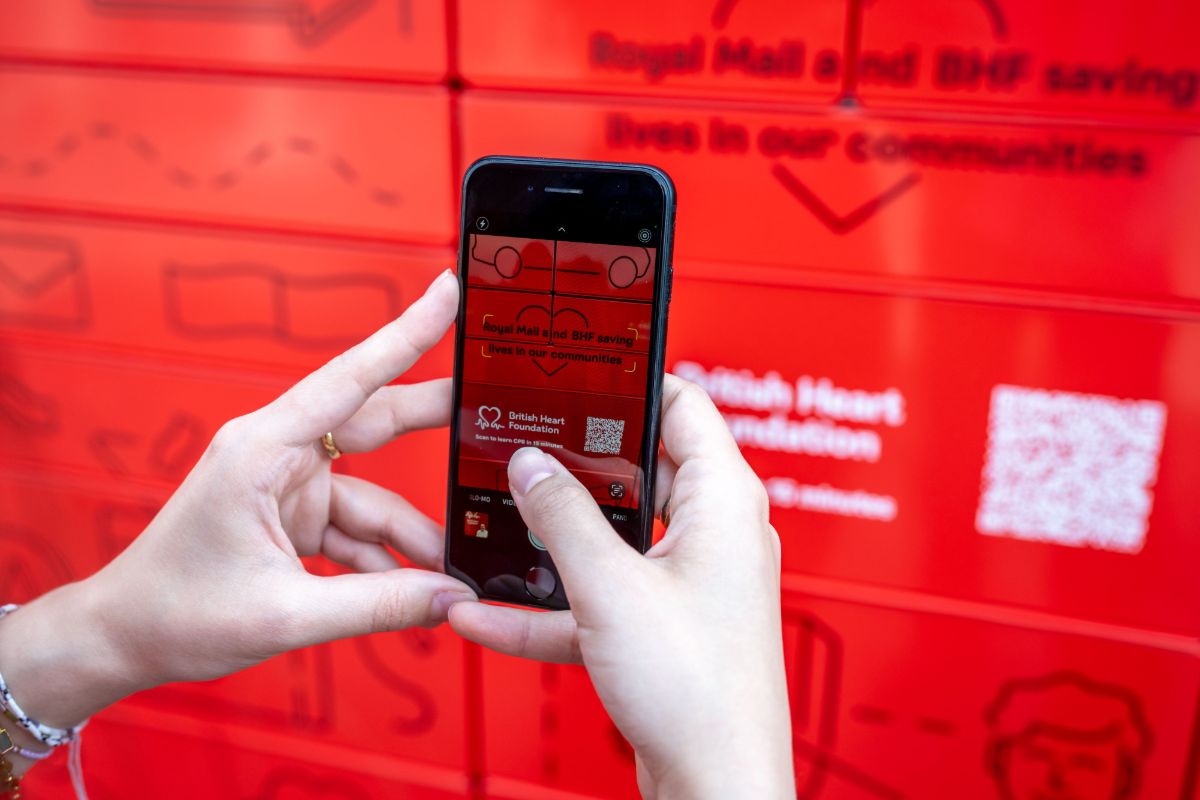

Modern retail is a conversation. In a connected, always-on world where communication is instantaneous, we have all grown used to the idea of being able to do research on a whim, or to fire off questions, or just to see if a friend is around. This can be daunting for retailers, since it’s clear that customers expect quick responses, and while positive feedback spreads quickly, so does negative feedback. This potentially puts pressure on resources because there’s a temptation both to try to deal with every enquiry quickly and to firefight when problems arise.

These are the wrong responses. Retailers should be more systematic, engaging with customers via social media, for sure, but also having a sense of priorities too. This, in turn, requires retailers to identify what needs dealing with urgently while also knowing what resources are needed to do this. Plus of course, customers volunteer information that can, in turn, help retailers to understand them better. Just as merchandising is now about personalising at scale, it’s also increasingly about navigating the world of user-generated content and social media.

To consider how the Growth 2000 are performing here, we looked at three main areas: retailers’ presence on different social networks; the use of third-party login and checkout (where shoppers who have a social account don’t have to register again with the retailer); and the integration of feedback and reviews on product pages, a key technique for building a sense of authenticity.

Social networks

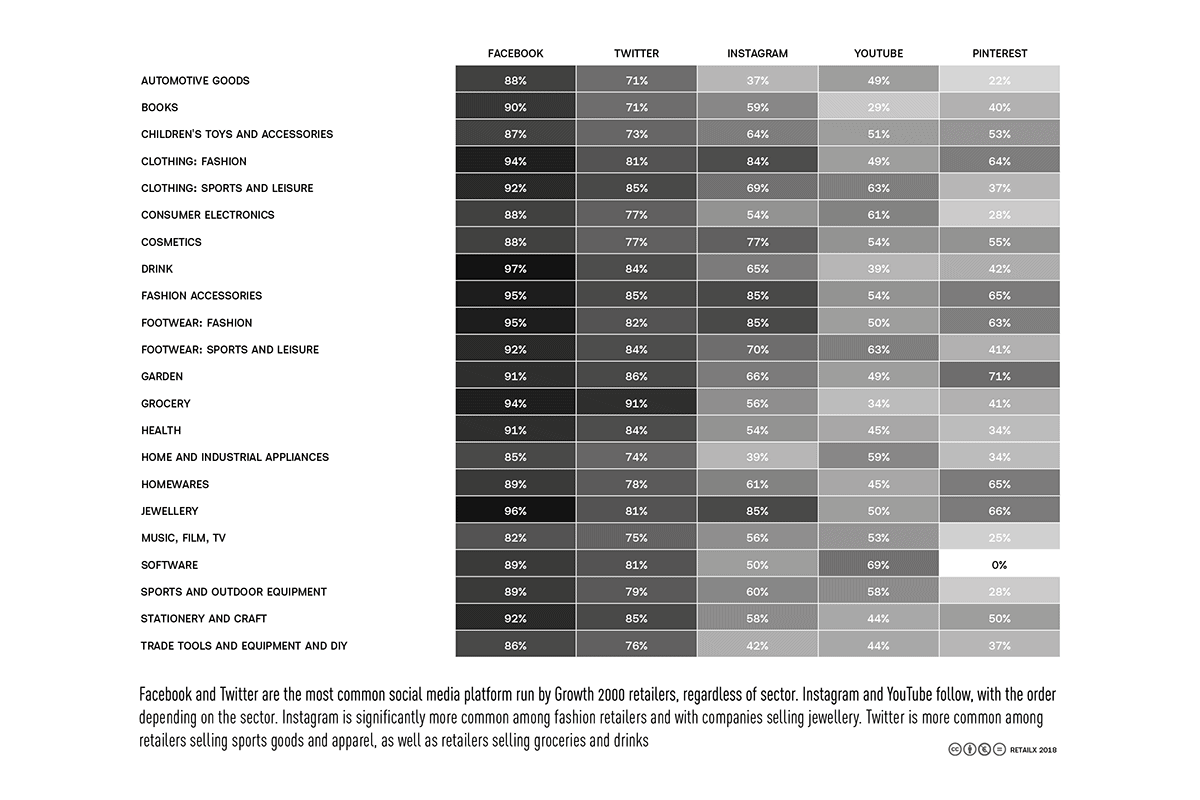

There’s clear evidence from RetailX research that G2K retailers are engaging with social media. Nine out of ten retailers have a Facebook ‘fan’ page, 78% operate Twitter accounts and two-thirds have Instagram accounts. Even where social media is less commonly used – 52% have a YouTube channel and 43% have Pinterest profiles – the figures are comparatively high.

With Facebook, drinks retailers lead the way, with 97% having a presence. Even when it comes to the comparative laggards of music, film and TV vendors, the comparable figure is 82%. With Twitter, retailers in the grocery sector lead the way, with 91% having an account. The same figure for those in the goods and automotive goods sectors, the slowest to adopt sector, is 71%.

There is more differentiation between sectors when it comes to Instagram. Unsurprisingly, those companies that most use visual merchandising are most likely to use Instagram – which principally means the apparel sector. Some 85% of footwear, jewellery and accessories retailers use Instagram, followed closely by retailers in the clothing sector (84%). In contrast, just 37% of retailers in the automotive goods sector use Instagram.

It’s a similar story with Pinterest, although here the gardening sector performs strongly, with 71% of retailers having an account, perhaps reflecting the way goods – and plants! – can be shown in situ. Similarly, the homewares sector also favours Pinterest, with 65% of retailers using the network.

With YouTube, it’s software retailers that lead the way, with 69% having a channel. This probably reflects the fact that many are videogame retailers that use the medium to showcase products. Close to two-thirds of sports retailers (footwear and clothing) and consumer electronics retailers have channels.

Finally, we were intrigued to note that customer service by live chat is utilised by just one in five retailers (19%). Could this be a place where size really does matter because live chat is such a resource-intensive service?

Checkout

Making the checkout process more streamlined is an effective way to reduce cart abandonment. However, a disadvantage can be a more limited knowledge of the customer. Some 55% of G2K retailers allow shoppers to checkout without registering, which suggests they think it’s worth the risk. There is also the possibility of checking out using third-party credentials, such as PayPal, serving as a payment method, used by 39% of the G2K.

Perhaps more surprising is that G2K retailers seem comparatively slow to enable third-party login – which can reduce friction for the customer but still provide the retailer with email addresses and other relevant information. Just 9%, for example, enable customers to create an account or checkout using Facebook credentials, a figure that drops to 5% for Google credentials.

Feedback and reviews

It’s outside the scope of this current research but we strongly suspect that many retailers in the G2K have much to gain from encouraging customers to leave products reviews. It’s a way of incorporating some aspects of social networks into the website itself, with user-generated content providing a boost to authenticity. In particular, specialist retailers can use reviews to help build a sense of their sites being sources of reliable and expert information, whether that’s information given by the retailer, or enthusiasts who share in-depth knowledge of their hobby with potential customers.

This is a subject we cover in more depth in the Search section but for now, it’s worth highlighting that product ratings are offered by a similar proportion of the G2K (51%) and the Top500 (57%), suggesting it’s something that all retailers can introduce.

Strong performers

Fashion retailers I Saw It First and Look of the Day did well on the metrics we measured, while B&H, Charterhouse Aquatics, EMP, Look of the Day, Music Store and Zee & Co were among other retailers that performed strongly.