How are UK retailers using click and collect to serve shoppers buying from different retail categories? Martin Shaw, RetailX head of research, interrogates the IRUK Top500 data to find out

Click and Collect has proved an effective way for retailers to encourage shoppers into stores. Not only does it give shoppers a convenient way to pick up their online order when they know they will be out of the house and unable to take a delivery, but traders also find that shoppers spend more while they are there. IRUK Leading retailer Debenhams recently said that when it trialled Doddle click and collect, which enables shoppers to collect goods from a range of online retailers, not only did it see around 60,000 new shoppers coming into the 50 stores where the service was trialled, but 30% of users made instore purchases, averaging £25, when they picked up their orders. The department store is now adopting the service across all its 165 stores as a result. But despite its growing popularity, click and collect isn’t being rolled out uniformly across retail. We took a look at IRUK Top500 data, analysed by RetailX, for clues as to how retailers selling different categories of goods are adopting it.

SETTING THE CONTEXT

It’s clear from the RetailX analysis that IRUK Top500 retailers are fast adopting click and collect. In 2018, 62% of Top500 retailers offered the service – up from 57% in 2017, and a rise of five percentage points. The service is still more commonly found among Top100 retailers: 90% offer it. However it’s slightly less commonly found among those brands selling direct that are listed in the IRUK Top500: 58% of this group offers the service.

Our European data also shows that the service is more commonly found in the UK than elsewhere in the European Economic Area (EEA). Just under two-thirds (65%) of the UK retailers listed in the IREU Top500 have it, followed by France (63% – after growth of 18 percentage points since 2017) and the Netherlands (61%). Availability across the wider European Economic Area (EEA) stands at 61%.

As to how fast retailers offer collection, IRUK research shows four in 10 (44%) promise next-day collection while just over a fifth (22%) enable same-day pick up. The median promise, however, stood at three days. Most don’t charge their shoppers to pick up their item, with a median charge of just 83p for standard click and collect. (Interestingly, IREU data shows that 18% of Republic of Ireland retailers which offer click and collect also make same-day collection available, making Ireland the leader in fast collection.)

HOW THE USE OF CLICK AND COLLECT VARIES BY CATEGORY IN THE UK

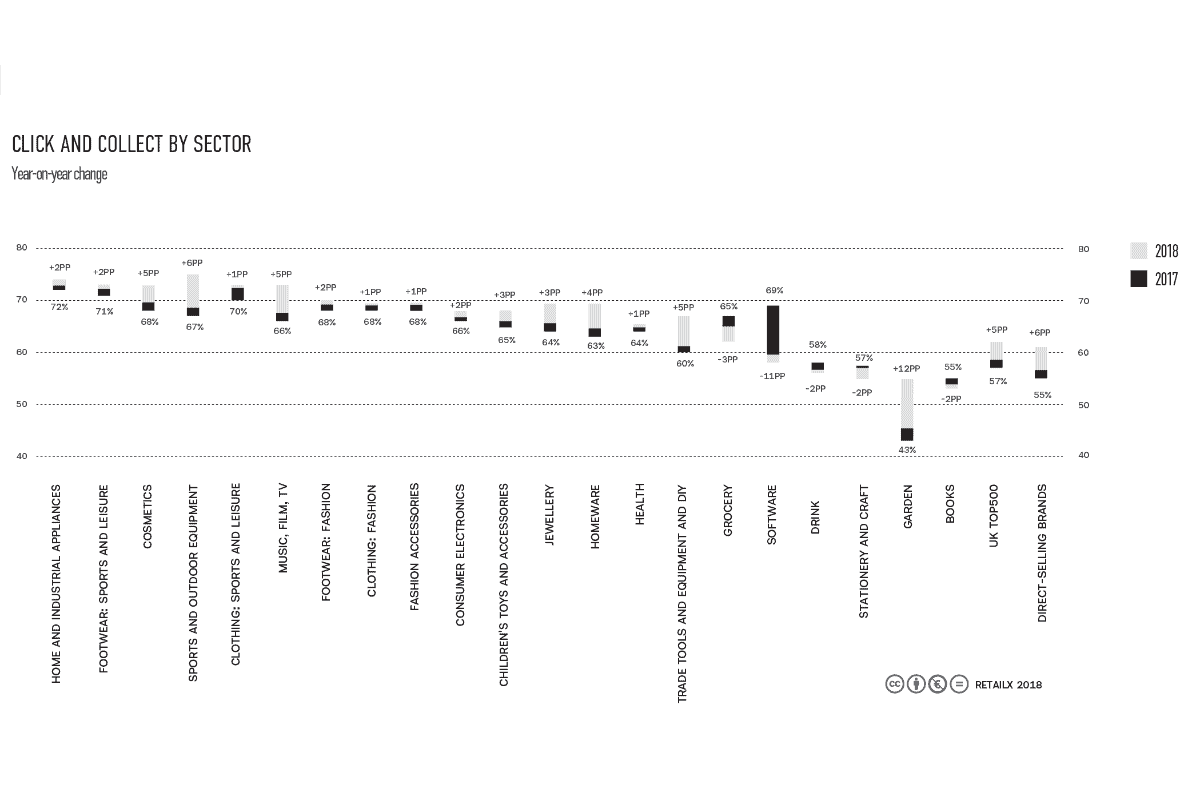

We focused on retail categories to find out which products were the most widely available for in-store pick up, and how that has changed since last year. It’s worth noting that the analysis is by product category rather than type of store. Department stores, for example, sell products that cross a range of categories, but they don’t appear here in their own right.

Home and industrial appliances are the items that are most likely to be available for click and collect, with 74% of IRUK Top500 retailers that sell these items offering the service. That’s up by two percentage points since last year. Footwear for sports and leisure is also widely available for in-store pick up: 73% of retailers offer the service, again up by two percentage points on last year. Click and collect has grown faster for the cosmetics (+5pp to 73%) and sports and outdoor equipment (+6pp to 73%) categories, now reaching the same levels.

Most categories show steadier growth, with increases of between one and four percentage points over last year. Clothing and footwear – whether fashion or sports – is among the categories most likely to be available for in-store pick up. Fashion clothing (+1pp to 69%), footwear (+2pp to 70%) and accessories (+1pp to 69%) were both widely available through the service. This seems likely to reflect the fact that sales in this category are moving online faster than in others. ONS figures for July 2018 show online sales of textiles, clothing and footwear grew by 17.4% that month, to account for 17.5% of sales. As more people buy these goods online it seems likely that the retailers selling them will enable convenient delivery options such as in-store collection, especially when that option also encourages customers into their stores.

Categories growing faster than the underlying trend of gradual growth include trade tools and equipment and DIY (+5pp to 65%) and garden (+12pp to 55%). Here the growth may have come as shoppers started to buy online more frequently.

A few sectors saw click and collect become less widely available than previously. This was most striking in software (-11pp to 58%). It seems likely this reduction came as software retailers move from selling their products as a physical item towards enabling it to be downloaded. Categories where click and collect levels fell slightly included grocery (-3pp to 62%), drink (-2pp to 56%), stationery and craft (-2pp to 55%) and books (-2pp to 53%).

Conclusions

Overall, most product categories appear to have seen a steady rise in the use of click and collect between 2017 and 2018, according to IRUK Top500 data. This is likely to have come as retailers working in a competitive market offer customer experience features that are proven to have returns. Even those without stores can benefit from others’ stores via third-party collection services. This levels the playing field with even the smallest online-only retailers able to provide some level of tangible, multichannel retail albeit outside their direct control.

It will be interesting to review how the Top500’s performance compares to the forthcoming Growth 2000 when the latter list’s collection and other fulfilment metrics are analysed in a soon-to-be published report. Watch the research section on the InternetRetailing website for more.