Polina Modenova explains how InternetRetailing researchers assessed IREU Top500 retailers’ success in showing customers the most relevant products

The retailers that lead in the Merchandising Performance Dimension stand out for a user-friendly approach to website navigation.

They make it easy for those shoppers that want to find specific products, as well as for those that want to browse the site.

They do this by deploying tools ranging from auto-suggest search and efficient navigational filters through to detailed product information and imagery. The research team set out to find how retailers across the European Economic Area (EEA), plus Switzerland, merchandised their websites. We assessed Top500 retailers’ performance by measuring how effectively they used imagery, detailed product information, search and navigation, fast checkouts, and social media.

What the Top500 do

It’s a quick and accurate job for shoppers who are buying from leaders in this field to find the items for which they are looking. Retailers at the cutting edge offer detailed product information, auto-suggest search and navigational filters that help visitors to cut quickly through the volume of items on offer. Social sharing is common and checkout can be as fast as one click.

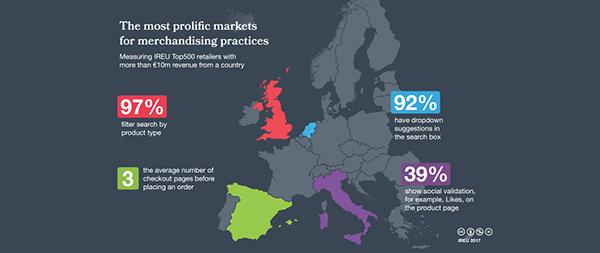

Some 62% of IREU retailers offered dropdown search suggestions, while 95% had at least one navigational filter. ‘Filter by product’ was the most popular option here, used by 69% of IREU retailers.

Top500 retailers showed an average of three (3.07) images – with Italian retailers showing 3.6 images – and enabled checkout in an average of four (3.67) pages. Social sharing was used by 51%.

It’s notable that some merchandising features have different levels of take-up in different countries. Dropdown search suggestions, for example, were most widely used in Austria, Hungary, Germany and Belgium, with the feature used by more than 70% of the traders that had a country-specific landing page for these markets.

Easy-to-use navigation was most widespread among retailers trading in the UK, followed by Spain and Germany, while product information was most comprehensive in Denmark, followed by Ireland, Sweden and Finland. Relevant search results were most commonly found among retailers selling in Latvia, Finland, Slovakia, Austria and Denmark.

Filtering search by brand was most common in Hungary, Ireland and Austria: more than 50% of retailers selling in these countries offered this filter.

One interesting metric analysed what happened when a ‘no results’ search was made. More than a third (37%) of the UK retailers in the IREU Top500 showed an alternative page, rather than returning a no results page. In Norway, 43% of traders had an alternative, with the Czech Republic, Denmark, Finland and Sweden all above 40%. But in the Netherlands, fewer than 30% of retailers took this approach. Three in five Austrian retail websites showed other products on the no results page. Retailers selling in Finland were most likely to use banner advertising: 70% of the 27 retailers selling in this market did so. A relatively modest 46% of the 265 retailers that sell in the UK took this approach.

The use of a ‘bestseller’ ribbon was most widespread in Austria, where 44 retailers sell, and Germany, where just over 100 sell. More than 10% of retailers in those two countries used the device.

Product reviews were most commonly found in the UK, where 53% of retailers showed them, followed by Sweden, Denmark, Finland and Hungary (48%). British retailers placed the highest emphasis on enabling customers to interact with the website, with 91% offering product recommendations, 67% product reviews, and 64% product ratings. At the other end of the spectrum, just under 30% of traders in Portugal and Greece showed reviews.

Italian retailers offered the quickest checkout to customers, and had the least number of websites that prompted customers to register before proceeding with the order.

Social media sharing was most widely used in Ireland (67%), Italy (60%) and Spain (57%). At the other end of the scale, around 40% of retailers selling in Norway, Switzerland and the Czech Republic offered this functionality. Wishlists, finally, were most widely offered in Greece (64%), Austria (56%) and Germany 55%. Some 47% of UK retailers offered the function, as did, at the bottom end of the scale, around a third of retailers in Finland, Denmark and Norway.

Leading the field

Brands from across the region stood out in this Performance Dimension. British retailer Sally Express, which operates local currency websites both in the UK and in the Republic of Ireland, led the way for a highly relevant use of product search that offered suggestions as shoppers typed in their search term, while a ‘no results’ search triggered alternative recommendations. Navigational filters enabled customers to drill down by price, brand and product type, while users of its websites were able to share the products they found on social media sites including Twitter and Google Plus. Ratings and reviews were clearly visible from the product page.

Bol.com was recognised for a top-quality product search that enabled customers to filter by price and product across all categories. An extra navigational filter in the electronics range meant customers could search by model. The company encouraged user interaction through reviews and ratings functionality. Bol.com trades in Belgium and the Netherlands and is owned by Dutch group Ahold.

German pureplay Baby-Markt has 12 EEA websites but sees most of its traffic from the German and Austrian markets. It scored consistently across all metrics, scoring highly for its use of promotions, detailed product information, and for the use of cross-selling and upselling recommendations, both from the product page and once the shopper reached the checkout.

German fashion retailer Zalando keeps merchandising consistent across all of its 15 EEA local-currency websites, and on its iOS and Android apps.

Searches produce relevant results, while navigation filters include price and bestseller filters. Products are shown through an average of six images and ratings are clearly visible. Shoppers can use TouchID to log into the app. The app also enables them to share style images.

German-based health and beauty retailer Mein dm trades through stores in nine EEA countries, with ecommerce websites in two of those, Germany and Austria. Searches produced highly-relevant results, with dropdown product suggestions appearing while the customer types. Five navigational filters make it easy to zero in on a particular item. Home page products show promotions, including extra loyalty points, alongside product ratings. Social validation is enabled through Facebook and Twitter while the checkout offers upselling opportunities.

Other standout retailers in the Merchandising Product Dimension include Amazon, which trades via five EEA websites; offers dropdown search suggestions as the customer types, alongside brand and customer rating filters; shows an average of four product images; and offers fingerprint sign-in to its mobile app. Littlewoods offers customers the ability to rate a product, write a review and share a product on social media both through local currency websites – for the UK and the Republic of Ireland – and through an iOS app. Shoppers can see how many other people are looking at an item and how many have already bought it. Swiss retailer M-Electronics Migros, which sells online in three languages, offers a particularly easy checkout, with just three steps, while shoppers can compare products based on price, specification and size.

The UK-based Body Shop sells to 10 EEA countries through six online stores, and stands out for an advanced iOS and Android app that enables purchases and sends push notifications to alert shoppers to deals. Furniture specialist XXXL, which sells online in Germany and Austria, and has stores in these two markets plus Sweden and the Czech Republic, gives a high level of product information and enables shoppers to reserve products in local stores.

Czech-owned Alza ships to 25 EEA countries and has five country-specific websites. Striking features include a ‘price watch’ reminder. Shoppers name their price for an item on the Alza website and, once it’s reached that, they are notified by email.

American Golf sells online in the UK and Republic of Ireland, and through 106 stores. Navigational filters include daily offers, as well as brand and price, while a sophisticated use of social media means shoppers can share products through Facebook, Google+ and Twitter, as well as being able to use their Facebook sign-in to enable one-click checkout.

Deichmann, which sells through stores in 17 EEA countries and local websites in nine, has an advanced iOS and Android app with a store stock checker. Where most of the retailers in the Top500 enable shoppers to share via one or two social networks, Deichmann offered seven.

What the Top500 brands do

We extended our research beyond pure retailers to cover the leading brands in Europe. We found that the largest brands outperformed retailers. Their websites were more likely to have advertising banners, and to be optimised to display alternative suggestions on the no-results page. They were also more likely to have auto-suggest recommendations in the dropdown menu, and to enable customers to save a product for later. Brands more commonly enabled customers to share products and to display other product recommendations.

Almost all Spanish brand websites offered product filter functionality, compared to 69% for the average Top500 offering.

Dutch brands offered more websites with sophisticated search bars, which allow customers to see product suggestions whilst they’re typing.