Direct-To-Consumer (D2C) online purchases increased by +17% year-on-year (YOY) as behavioural shifts, formed in response to the Covid-19 pandemic, remained entrenched throughout 2021, data reveals.

This increase was powered by a +114% global increase in D2C luxury sales, with smaller sales increases reported across multi-brand retailers (+10% YOY) and single brand and specialist retailers (+10% YOY).

ESW’s ‘Global Voices: 2022’ survey of more than 14,000 consumers across 14 countries revealed Millennials remain the driving force behind increased D2C and cross-border shopping rates. YOY, the data show that 25 – 40-year-olds reported increased D2C purchasing across all eleven purchasing categories monitored as part of the survey.

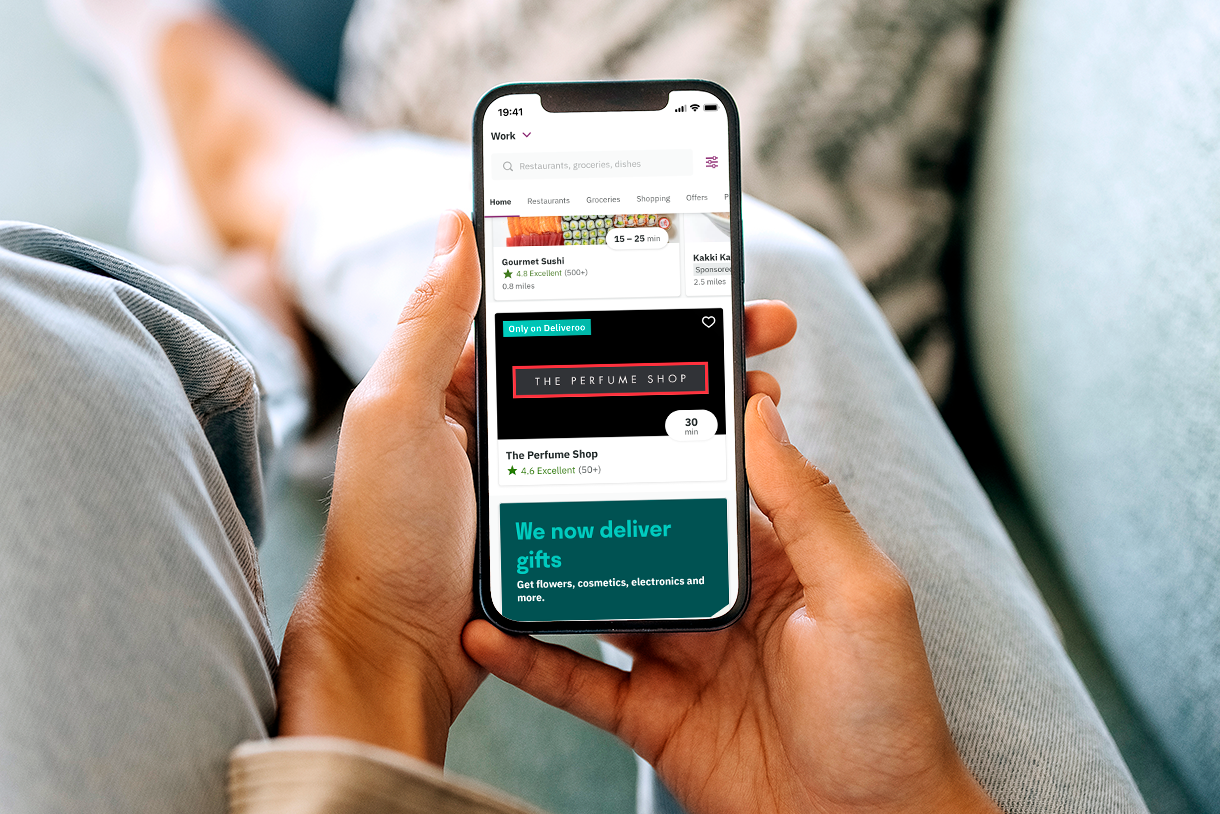

Domestic ecommerce sales of luxury products (+28%), sporting goods (+19%), cosmetics (19%), fragrance (+13%) and skin care (+10%) saw the highest rises in sales across all age brackets as consumers continue to purchase these traditionally ‘high contact’ items – that would have previously been validated either by trying on or testing in-store – online.

In 2021, over a third (37%) of Millennials made more than 11 online cross-border purchases, an increase of +12% YOY, followed by 30% of Gen Z, 26% of Gen X and 19% of Baby Boomers. Geographically, shoppers in the UAE (53%), China (50%) and India (41%) reported the highest rates of purchase frequency levels at 11 or more. By country, shoppers in Japan (51%), China (44%), the UAE (21%), South Korea (17%) and Mexico (16%) reported the highest rate of respondents spending more than GBP£1,100 (US$1,500) on cross-border purchases in 2021.

The top reasons respondents cited for buying cross-border include paying less for products than they would domestically (26%) and having a positive past experience buying from a foreign website (26%), highlighting the positive momentum brands and retailers who have improved their D2C and cross-border strategies over the past year have created amongst consumers.

While more than a quarter (26%) of global shoppers bought clothing online outside of their domestic market, making it the most popular shopped cross-border purchase in 2021, overall, the category only rose +4% YOY. Of the top five most popular cross-border ecommerce categories, luxury and fragrance grew the fastest over the past 12 months, both up +50% compared to the end of 2020, followed by footwear (+33%), and skincare and cosmetics (+31% respectively).

Looking ahead to 2022, consumer confidence remains buoyant with more than half of respondents (53%) expecting their online buying habits to remain roughly the same over the next 12 months. Nearly a fifth (19%) plan to increase their spend, while slightly more respondents (22%) may decrease their spend. Consumers in China (45%), India (27%), and Japan (25%) say they are more likely to increase shopping. By generation, 23% of Millennials and 20% of Gen Z expect to increase shopping, while 26% of Gen Z and 23% of Boomers expect to decrease their online spending.

Patrick Bousquet-Chavanne, President and CEO, Americas at ESW, comments: “2021 was the year of the Millennial, as this demographic cemented their position as the power shopping cohort driving demand for D2C and cross-border commerce. The data clearly demonstrate that previous positive D2C and cross-border purchasing experiences are working to create a virtuous cycle of growth in consumer confidence and those outlier brands and retailers, who have worked hard in the past two years to fine-tune their selling strategies in these areas, are reaping very significant rewards.”

Martim Avillez Oliveira, Chief Commercial Officer, EMEA at ESW, adds: “The much-vaunted D2C retail revolution is now a reality brands cannot afford to ignore. As consumer confidence continues to grow and global shoppers settle further into their new shopping routines retailers must focus on developing a deep understanding of what drives D2C demand – across all of sales channels and customer touchpoints – so they can capitalise on the appetite consumers have to connect with their favourite brands online and maintain both the loyalty of existing customers while attracting new ones.”