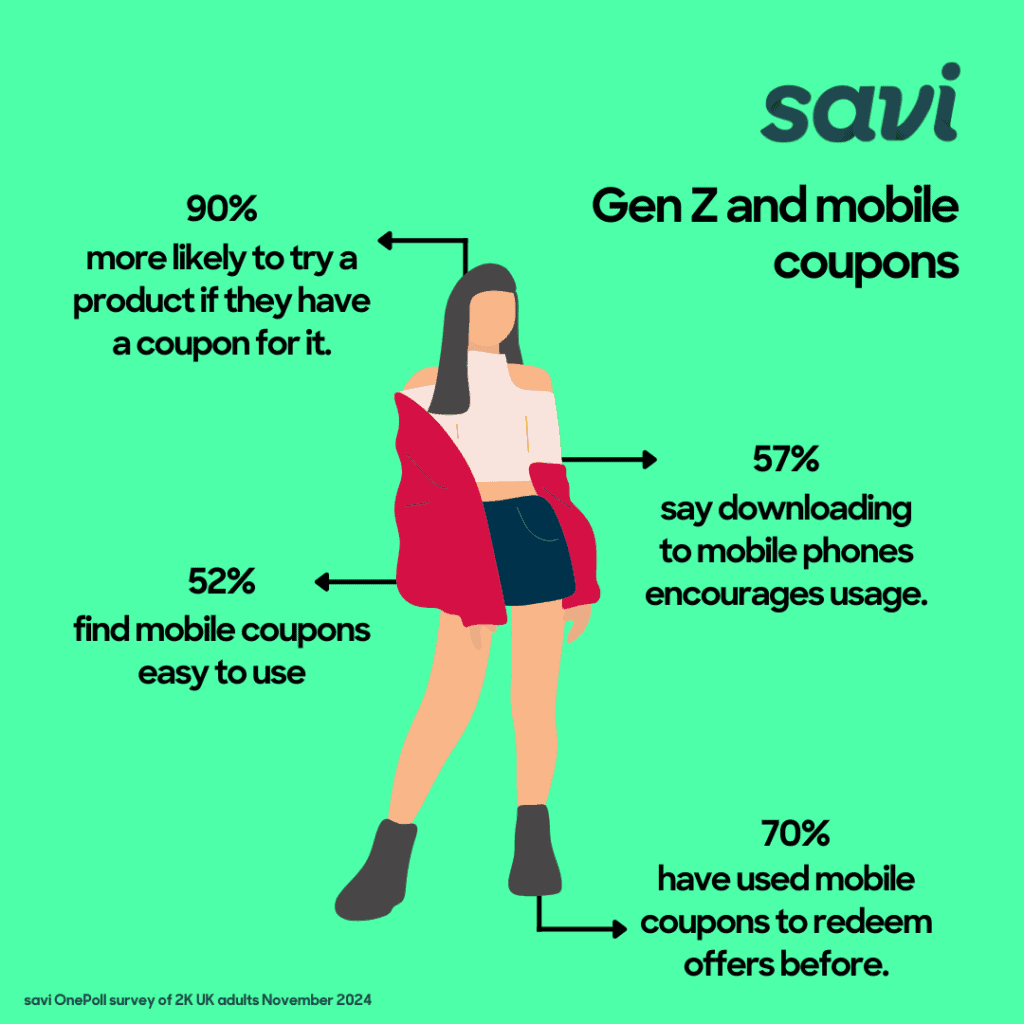

For Generation Z, money-saving coupons have become a way of life – to the extent that 90% of shoppers in this age bracket (18–25-year-olds) say they are now more likely to try a product if they have a coupon for it. 70% say they have used mobile coupons on their smartphone to redeem offers.

According to a study into shopper behaviour by marketing technology company savi, while GenZ leads the way, the trend towards mobile money-saving is clear across all ages with 70% of all shoppers saying they preferred mobile coupons over paper ones, and 57% having used mobile coupons.

And retail media is proving to be the ideal place to launch these coupons. The research showed that the top place for consumers to search for coupons is retailer websites and apps (48%) and 42% from instore promotional displays.

“Coupons, particularly mobile coupons, dovetail perfectly with retail media in a mutually beneficial way. Retail media is ideal for helping brands deliver coupons directly to shoppers when they are in ‘shopper mode’ enabling them to optimise campaign performance – driving better engagement and sales whilst providing a way for brands to measure performance, ROI and understand shopper behaviour.

For retail media, by adding mobile coupons to the media it provides a call-to-action from the media driving better engagement, consideration and activation rates – including the ability to capture shopper data and insights from the journey,” says to Steve Smith, Chief Commercial Officer at savi .

Smith believes that, by adding mobile coupons to the media it provides a call-to-action from the media driving better engagement, consideration and activation rates – including the ability to capture shopper data and insights from the journey.

“Although there are many factors that impact campaign performance, coupon campaigns that savi have run in combination with retail media typically see above average redemptions which is probably down to proximity of products,” he says.

What do coupons mean for brands?

The influence of coupons on shoppers’ brand choices and loyalty is also growing, with 76% saying they would be likely to try a new product if they had a coupon for it – up from 60% in 2022.

The study (carried out in November 2024) of 2,000 UK adults, found that more than half of shoppers (57%) state that coupons have the biggest influence on the way they shop, with 68% of shoppers claiming they would consider switching from their preferred supermarket if they couldn’t redeem a coupon there, an increase of 4% compared to the previous year.

Shoppers now want and expect coupons for a number of product categories and reasons. Savings on food remains the most desired category of coupon (71%), followed by household goods

(54%), clothing (51%), dining out (46%) and fuel (42%).

savi’s research also found a broad range of instances where shoppers expect to be rewarded including thank you for loyalty (46%), birthdays (37%), invitations to try new products (35%), Christmas treats (31%), and for sharing feedback (25%).

Privacy transactions

The study also revealed a clear majority of all shoppers (69%) were happy to trade their privacy to benefit from brand coupons through loyalty schemes. Shoppers are also prepared to share significant personal information in exchange for coupons, such as email address (63%), shopping habits (46%) and what their favourite brands are (39%).

The biggest deterrents to shoppers using coupons were if they were only valid for a short time (37%), or in some retailers, or the risk of retailer rejection (both 30%).

Smith adds: “Mobile coupons are becoming a currency in daily life and a key influence on how consumers perceive brands and retailers. Our latest research shows shoppers are coping with the cost of living (particularly food inflation) by regularly using coupons and increasingly want the easiest way to redeem them which is via their smartphones.

“Our findings should also influence how brands invest in retail media strategies and illustrate the importance of value-orientated retailing. Where once retail experiences, service, product ranges and pricing were considered key to supermarket loyalty, our research over the last few years is showing that promotions, particularly digital coupons, have become a powerful factor in the way we shop”.