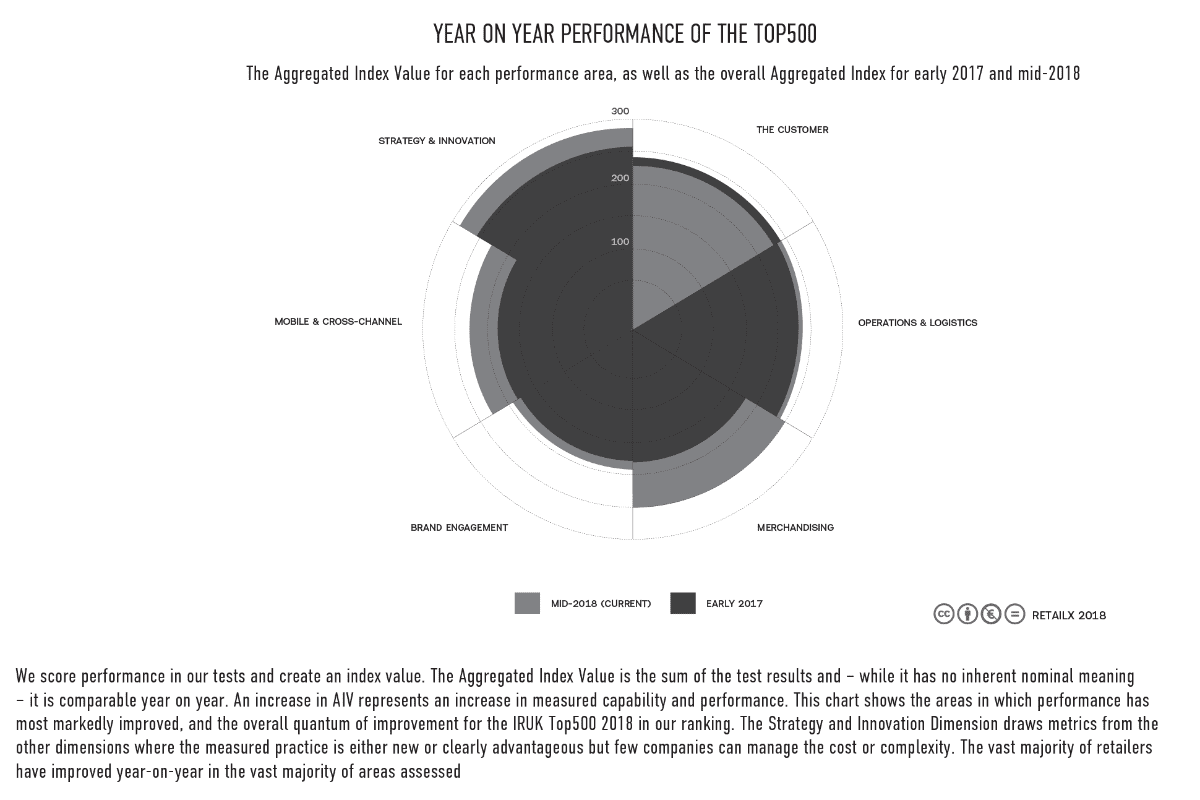

Top500 retailers are using the latest innovations to give shoppers the customer experience they want, writes Martin Shaw, head of the RetailX research team

Leading retailers in this dimension are constantly honing and improving their performance in order to give shoppers the kind of customer experience they now expect. This enables them to compete at the highest levels in this IRUK Top500 Strategy and Innovation Performance Dimension Report.

In this dimension we bring together the IRUK Top500 metrics that we consider the most strategic and innovative, including more than 40 different measures of retailer performance, covering delivery, collection and returns, how easy it is to load and use a website, and mobile app functionality. These are measures that help traders stand out from the crowd, and to compete in challenging markets.

Our definition of what ‘strategic’ and ‘innovative’ are have naturally changed over the last year. Last year we judged it innovative to offer click and collect services at all. This year we’re measuring how quickly retailers promise products can be collected, and we’ve found that traders are now offering faster delivery along with faster collection times. Delivery is also faster on desktop and mobile websites, offering consumers the speed of service that they now expect. All of this helps retailers, in turn, to give customers the experience that they would like to become accustomed to.

We’re also looking at features that improve the mobile experience from augmented reality, live chat and visual search in mobile apps, to predictive search (56% use this) and the ‘hamburger button’ (94%) that enables easier navigation. This analysis, measured by real people recording their experience on every Top500 website, focuses on the practical user experience, concentrating on the aspects that really make a difference. In particular, this year, we’ve focused on easy-to-use search that returns relevant results, along with simple navigation that helps shoppers get straight to the point. We’ve also looked to see how easily users can see and interact with visuals on the product pages of a website.

COLLECTION, DELIVERY AND RETURNS

Across the Top500, retailers appear to have simplified their delivery options, while ensuring that shoppers can collect their product. Click and collect is now almost as widely found as next-day delivery. Some 62% of Top500 retailers offer click and collect services in 2018. That’s up from 56% in 2017, with just over a fifth (22%) offering same-day pick-up, measured for the first time this year.

Nonetheless, the average time promised for a click and collect order to be ready for collection stands at 3.3 days after the order is placed online. Pick-up from in-store lockers is offered by a tiny minority, at 1.4%, of Top500 retailers.

Next-day delivery is offered by 59% of Top500 retailers, down from 65% in 2017, while the proportion offering same-day delivery has climbed to 6% from 4% last time. Saturday delivery, offered by 28% of Top500 retailers, was the most commonly found specific-day option. Fewer retailers now allow shoppers to name their delivery day: at 15% in 2018 this is down from 19% in 2017. But the same number (5%) enable shoppers to name their time. The number offering the option of Sunday delivery has fallen slightly to 11% from 12% in 2017. Those retailers that enable shoppers to name the time of delivery and to request same-day deliveries are real outliers – and those that offer a broad choice of options stand out.

Almost half (46%) enable shoppers to return an item they ordered online to a store, up from 39 in 2017, while 19% enabled returns via pick-up from the house. Top500 retailers processed refunds in a median 10 days.

Our take on these is that slightly more retailers are offering collection, and slightly more multichannel retailers are offering return of an ecommerce order to a physical store. At the same time, the same number of average delivery options (2.5) is the same this year as it was in 2017. On the flip-side, some metrics such as next-day delivery, same day delivery and weekend delivery show a slight decline in prevalence, though within our margin for error. With differences at this scale, it’s not so much a story of change as one of no change – perhaps due to market saturation.

MOBILE AND DESKTOP PERFORMANCE

The online shopping experience improves when web download times are faster. We measured web performance and whether retailers meet engineering standards across a range of load and design metrics on both mobile and desktop browsers. Top500 desktop sites started to render in a median of 1.9s, and were visually complete in 8.2s. Mobile websites started to render in a median 2.1s, and were visually complete in 7.2s, with page sizes a median 2.1MB in size. Researchers drew on data from InternetRetailing Knowledge Partners Hitwise and SimilarWeb to discover visitors spent a median time of was 4m 29s on a Top500 retail website in 2018.

Shoppers can get in touch with Top500 retailers using a median of eight communication channels in 2018, typically including phone, email and social media channels from Facebook to Snapchat, and less typically including LiveChat.

Researchers tested the online shopping experience and found that on average, shoppers using Top500 websites could see 3.6 product images and completed transactions in 2.3 checkout pages. More than two-thirds (69%) of retailers recommended similar products, while 66% enabled them to save a product they liked to a wishlist.

MOBILE APPS

More retailers have mobile apps. In the 2018 edition of our research we found that almost half (49%) of Top500 retailers offer their shoppers a mobile iOS app, and 46% an Android app. Since iOS apps are more common, and since retailers tend to duplicate functionality between their iOS and Android apps where they have both, we took the decision to focus on iOS apps for our analysis. We looked for the features that we consider to be cutting edge in 2018, from augmented reality to live chat and visual search. None of these features had widespread uptake, but some were more widely used than others. Barcode scanners, for example, are used by just over a quarter (26%) of the Top500 retailers with iOS apps. These enable shoppers to find out more about a product, including whether it’s in stock in a particular store, and to add it to a wishlist or shopping list. Store stock checkers were used by slightly fewer Top500 retailers, at 23%. But live chat can be used from just 6% of mobile apps, while visual search (3%) and augmented reality (3%) are, as yet, still very much at the cutting edge. Augmented reality is used, notably, by DIY and home furnishings retailers as well as those selling luxury goods and make-up. Shoppers using the DFS and Wayfair apps can see what furniture would look like in their home, while those using the Deluxe Decorator Centre app can visualise how paint colours would look on their walls. FeelUnique enables shoppers to try out lip, blush and eye shadow shades, while Tiffany enables users to try its rings on their fingers. Through their mobile apps, 37% offered daily deals, 48% showed a choice of product images – an average of four – on a product display page, 50% enabled zooming on images, and 27% offered predictive search.

WHAT LEADING RETAILERS DO

Argos stood out in InternetRetailing research because it offered some of the least common services. It was among the 4% of retailers that offered same-day delivery, and among the 22% with same-day collection. Returns can be made via a pick-up from the house, offered by 19% of Top500 retailers, while the retailer also enabled shoppers to check stock from the mobile app.

Shoppers buying from Halfords could pick-up their online order the same day or arrange a nominated day delivery. They could check store stock on the go, and learn more about products in the store using a barcode scanner.

Amazon performed strongly on logistics, with same-day delivery and in-store collection via lockers. Its mobile app was highly innovative, with features including live chat and visual search.

Morrisons stood out for offering convenient delivery and collection, with in-store collection lockers, nominated time and day delivery as well as same-day collection of online orders.

Next competed on logistics, offering options including same-day delivery and returns via pick-up from the house. It was easier for customers to find products from the app, using predictive search, and to check local availability, using a stock checker.

Screwfix was among the 22% that offer same day collection and the 11% that enable Sunday delivery. It also offered returns via a pick-up from the house, while its mobile app featured a store stock checker.

Tesco was among the 1.4% that have their own in-store collection lockers. It also offered same-day collection and delivery as well as nominated time delivery.

Sainsbury’s stood out for being among the 5% that offer nominated time delivery; it also offers same day and Sunday delivery, while its mobile app offers predictive search.

Wickes also had same day collection and nominated time delivery. It accepted online orders return to a store, and had an Android app.

Marks & Spencer’s mobile app featured a barcode scanner and predictive search. It enabled nominated day delivery and accepted online returns in store.

Among the 3% of retailers using augmented reality in their mobile apps were DFS, with a room planner app, Wayfair, with a ‘view in room’ product visualiser, Dulux, enabling paint buyers to see how different colours would look in their rooms, and Feelunique showing how make-up might look on the shopper’s face.