Merchandisers at Top500 retailers are showing off their products across channels, writes RetailX head of research Martin Shaw.

In 2018 more Top500 retailers are thinking mobile as they find new ways to show that their products are relevant to shoppers. They’re using this channel because they understand that more of their audience are now using smartphones both to browse and to buy. The proportion of retailers using mobile apps is growing, but they are still in the minority, with less than half of leading retailers having an iOS app and a slightly smaller proportion having an Android app. Across the Top500, the average desktop website remains more developed than the average iOS mobile app as well as the average mobile website, specifically built for use via a mobile device.

In our RetailX research for the IRUK Top500 Merchandising Performance Dimension we focused on how leading retailers are extending their techniques to the mobile channel. We wanted to find out how leading retailers are enabling shoppers to navigate both desktop and mobile websites and iOS apps in search of the products they want to buy. We revisited metrics used in previous years to see whether and, if so, how retailers had changed the way they use images, product information, customer feedback through ratings and reviews, and social sharing to communicate products to shoppers. We assessed iOS apps to see whether, and how, they used emerging functionality such as augmented reality, native shopping and visual search alongside more established approaches such as product videos and recommendations.

InternetRetailing Knowledge Partner Edited contributed data on how quickly products sell out at 28 leading apparel retailers, and to what extent those retailers have discounted items in order to sell them. Knowledge Partners Hitwise and SimilarWeb showed how long shoppers spent on leading retail websites, and Brand View contributed data on selected retailers’ use of images, videos, reviews and promotions.

What the Top500 do: desktop websites

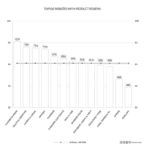

Retailers are making it easier for shoppers to navigate their desktop ecommerce sites. In our 2018 research we found that 75% of Top500 retailers offer drop-down search suggestions, offered once a shopper has started to type their search term. That’s up by 12 percentage points from 63% a year earlier.

Retailers have also developed their navigation further. Most Top500 retailers (91%) now enable filtering by product type on their desktop websites. That’s up by 32 percentage points from 59% last year. Eight out of 10 (84%) enable users to filter products by price – up from 70% in 2017 – and more than half (59%, from 46% last year) enable filtering by brand. When no results were found for a search, 34% of retailers offered something other than a blank page, whether that was alternative results or an information page. That’s up from 21% last time. For the first time we measured the use of visual search on desktop websites and found that 2% of sites featured this emerging functionality.

More retailers show shoppers how other customers rate their products (62% from 50% in 2017), and 61% (up from 53%) show product reviews. Sharing via social media is used tactically: 52% enable shoppers to share a product with friends (down from 54% in 2017), while 16% enable shoppers to ‘like’ a product on Facebook, and 18% enable social validation. Wishlists are now more commonly found: two thirds (66%) of Top500 retailers enable shoppers to save products to a list. That’s up from 48% in last year’s research.

There has been a move away from discounting: 51% had an obvious promotion when researchers visited their website, down by 17 percentage points from 68% a year earlier. At the same time, banner advertising lifted in popularity, used in 2018 by 80% of retailers. That’s up from 53% a year earlier. Slightly more retailers used the bestseller ribbon on product details – at 14% in 2018, this is up from 13% a year earlier. Almost a third (32%) use upselling techniques, up from 12% in 2017, while 69% (up from 66%) recommend similar products.

Checkouts are speedier to navigate, as Top500 retailers simplified their processes, slimming down the number of pages they have to complete by a median of 33%, from 3.5 pages to 2.1. More than a third (37%) require shoppers to register before they checkout.

On average shoppers viewed eight web pages in 309 seconds on each visit to an IRUK Top500 website – though almost a third of visits (30%) navigated away from the website after viewing only one page.

Across the Top500, traders used a median of four product images to illustrate their goods. Research from InternetRetailing Knowledge Partner Brand View focused on a small subset of around 30 retailers and found that those retailers use a median of three images per product, and that 13% of the range have product videos. At the time of its research 2% of the range was missing descriptions – narrowed from 4% a year earlier – while 11% of the range was out of stock. It also found that 42% of products were on promotion – an average of 4,651 per retailer – while 52% of the range had reviews.

Knowledge Partner Edited contributed a study focusing on another subset, this time of 28 retailers. It found those 28 traders took a median 99 days for a product to sell out. More than a quarter of products (26%) were discounted by at least 20%, while 5% were discounted by at least 69%. Fifteen per cent of products, across these retailers, were new in within the month prior to the Edited study.

What the Top500 do: mobile websites

We looked this year for the first time at the mobile web, and whether retailers took a different approach when building sites specifically for smartphones and other devices. We found that 57% feature dropdown search suggests – lower than the 75% who offer the feature on desktop websites. Looking at mobile specific features, 93% have a ‘hamburger’ button, a useful shortcut for mobile navigation. Retailers show a median of four product images – the same figure as for desktop websites – and 50% of retailers enable browsers to zoom in on those images. More than half (58%) of mobile websites have a store finder. Almost three-quarters (72%) have banner advertising – slightly lower than the 80% who feature banners on their desktop sites. A quarter enable infinite scrolling, which enables easier exploration of the range via a mobile phone.

What the Top500 do: mobile apps

In the 2018 edition of this RetailX research, almost half of IRUK Top500 retailers have mobile apps: 46% have an Android app, up from 38% a year earlier, while 49% have an iOS app, up from 42% in 2017. Newer apps, we found, are less likely to have a wide range of features and that brings down the average performance. Our research looks in more detail at iOS apps, since there are slightly more of them and those retailers that have both iOS and Android tend to duplicate features across both operating systems.

In 2018, just over a quarter (26%) of Top500 iOS apps offer native shopping. That’s down from 35% in 2017. Fewer also offer a choice of images (48%, from 54% in 2017), and zoomable images (46% from 52%). Push notifications are employed by 52% (54% in 2017) while fewer (42% from 48% in 2017) have a store finder. More than a quarter (26%) of Top500 retailers offer written product reviews within a mobile app, while 15% offer star-ratings for products.

Some features appear to be becoming more of a must-have for retailers with mobile apps: more offer a wishlist in their mobile app (47% from 46% in 2017). More than a third (38%) show product recommendations, while 24% show social media ‘likes’. The use of daily deals has increased quickly: 37% offered this feature in 2018, up by eight percentage points from 29% in 2017.

We measured features we consider cutting edge and are as yet not widely used by Top500 retailers. These include augmented reality, used by just 3% of Top500 retailers in their mobile apps. Product videos are used by 2% and visual search by 3%. It’s interesting to note that visual search is more widely used on mobile than desktop, where 2% of Top500 retailers have this technology. That may be because visual search is better suited to a mobile phone, which includes a camera. There’s faster uptake too for both barcode scanners, used by 26% in 2018, and predictive search (27%).

What the leaders do

Leaders in the merchandising dimension were more likely to stand out when they used a feature that was not commonly used by Top500 retailers, and this year’s leaders stand out when they use merchandising techniques in their mobile apps. General merchandiser Argos stood out for a sophisticated approach to merchandising in its mobile app, which offers product reviews and ratings alongside social media likes and scores highly for its use of personalisation.

Wickes was among the 25% that used infinite scrolling in their mobile website, and it also offered a choice of zoomable product images as well as store finder in its mobile app. The DIY specialist enabled shopper to use social validation from its desktop website.

Supermarket Morrisons was highly rated for its use of personalisation and for enabling social media likes and validation, while also offering infinite scrolling in its mobile app.

Mobile was also key for Marks & Spencer, Debenhams and Ocado, which all had barcode scanners and enabled social media likes. M&S and Ocado showed written product reviews, while Debenhams had predictive search.