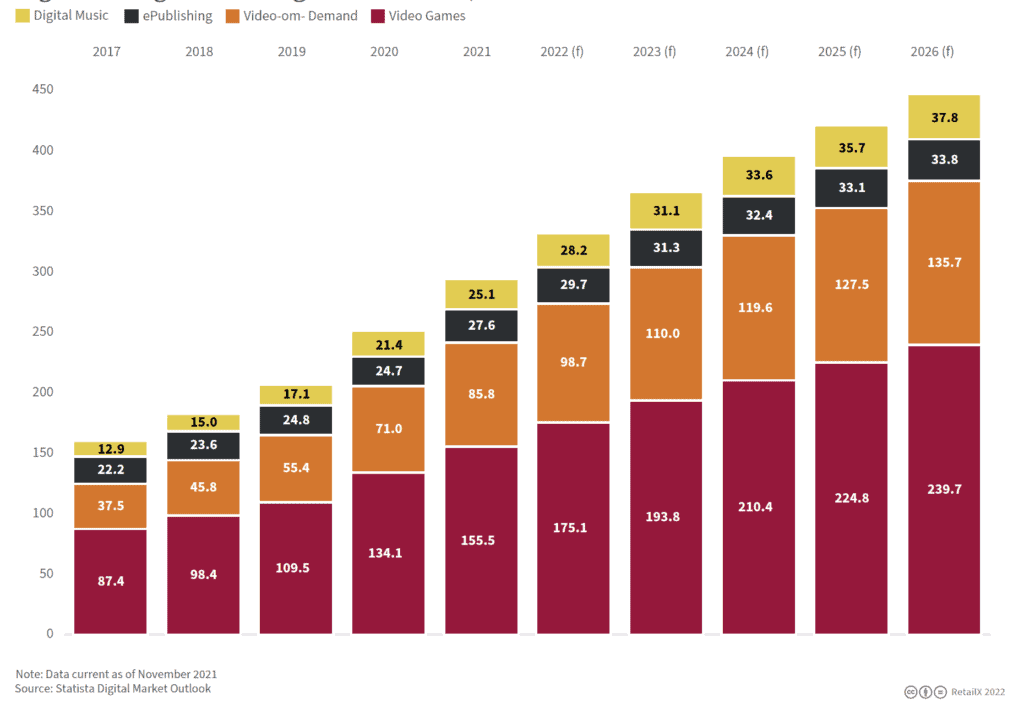

According to the RetailX Digital Media Sector report, the media sector can be broadly looked at as physical and digital sales of digital games, music, video and books. It generated $294bn in sales globally in 2021, accounting for around 80% of all sales of ‘media’, with the exception of books, where digital uptake is considerably lower.

Games dominate the sector, accounting for 53% of global digital media sales, with video streaming and service (video on demand, or VOD) accounting for the next-largest chunk of the market at 30%, by revenue.

It wasn’t always this way, though. Back in 2000, all these sectors were predominantly physical goods, sold in vast numbers in dedicated and general shops. Certainly, for music and games, there were numerous specialist outlets and a degree of tribalism around each sub-genre.

All that has changed in the intervening two decades, with technology upending these sectors by not only totally reshaping how they are sold and consumed but also completely altering the impact they now have on society.

Since the media sector has always been driven by technology, as technology has rapidly evolved, so too has the media sector and how it is consumed.

ROUTES TO MARKET

Much like mainstream retail, media finds itself being omnichannel. As a market, it has evolved over the past two decades and while some of the shift to digital has been at the expense of the physical, in 2020 it finds itself with a range of different business models, as well as varied routes to market.

Physical sales – Despite the digital revolution, physical sales of media content remains strong, turning in between 20 and 25% of global sales of both music and games. In books, the proportion is reversed, with physical books still accounting for the lion’s share of sales and digital taking around 18%.

Physical video and TV content sales are harder to quantify but data indicates that the DVD market for films and TV shows in the US had sales in the region of $15.3bn in 2018- 19. This is in addition to the $50bn market estimate for streamed content and is driven by sales of $10 and below DVDs, many of them second-hand[1].

The interesting thing about physical sales of media goods is that much of it is today carried out via ecommerce, so is, in fact, physical-digital. 31.6m music CDs were sold globally in 2021[2], with online music marketplace Discogs claiming that online sales of physical music CDs, cassettes and vinyl rose 34% in 2020.

Physical games sales have accounted for less than half of all games sales since 2018 and continued to decline during 2020 as the pandemic saw more players playing on mobile. This drove up the proportion of digital games. Like music, physical games do a brisk trade on marketplaces and sales are a mix of new and used.

DVDs and videos, as we have seen, are still a multi-billion dollar industry, even though physical sales are dwarfed by digital. Much of the physical DVDs and video content is sold through Amazon and eBay (new and used), with vintage boxsets accounting for a large proportion of sales. Specialist sites such as Zavvi, HMV and Simply Home Entertainment offer both online and physical retail.

Books are finding new ways to sell online. While Amazon dominates the sales of physical books, there is a growing number of start-ups that aim to take Amazon on, especially in the second-hand book market.

Digital downloads – The other route to market for media content is through digital download. Pioneered by Apple through the iPod, iTunes and the app ecosystem (see panel), downloading was the early digital replacement for physical media.

Digital downloading of music combined the digital world with physical ownership by the downloader paying to ‘own’ the track or album, which they stored as an actual file on their PC or device.

This model has been replicated across digital books, where the downloader again pays to download an actual digital file to store in perpetuity on their device. However, due to the large size of video files, the ‘download and own’ model never really took off for video and visual media,which skipped straight to streaming instead. Limited on-device storage space also played a role in this.

Yet as device storage has become cheaper and more plentiful, many streaming services have since allowed downloads of content. This targets a need for consumers who are travelling and have limited internet access to stream content, which often has a time limit of use and disappears from the device once viewed.

A more significant drag on the download model centres around sharing. While much of the downloading – and streaming – markets were initially characterised by free pirate sites such as Napster and PirateBay, the involvement of more legitimate brands such as Apple, Google and Amazon in the media publishing business initially put a stop to illegal downloading and file sharing.

That said, the first generation of early downloaders had grown up owning physical media and was used sharing vinyl or CDs by copying it to audio tapes, or compiling whole TV shows by recording them from TV broadcasts. Similarly, the idea of lending someone a book is built into our society. While such sharing had long been built into the business model of physical media, the lower price points of downloads didn’t cater for something being bought once and then shared.

Consequently, media content owners developed Digital Rights Management (DRM) tools that prevented this sharing from taking place, something that has had a downward pressure on downloading and can, in part, be seen as why the media content market has moved towards streaming.

Streaming – While downloading remained popular into the late 2010s, the development of better broadband networks, 3, 4 and 5G mobile networks and commoditised broadband deals for consumers has ushered in the streaming model. Increasingly, this has come to dominate the media content delivery market since 2019.

While downloading allows for the ownership of digital files stored locally, streaming is essentially monetised through a subscription model. Here, consumers pay to have access to usually unlimited content that they stream to their device on demand at the moment they want to use it.

Predominantly used in the music and video content businesses, it is also increasingly starting to be seen in gaming – which is leveraging the new super-high-speed fibre optic broadband, wifi6 and 5G networks that can deliver real-time, high resolution, interactive gaming experiences.

Music streaming, pioneered by Spotify and now underpinned by Apple, Google and Amazon, is becoming the way that many younger consumers access all music. It is quick and neatly gets around the sharing dilemma: users can all simply subscribe individually, usually at a low price point, and ‘share’ what they are listening by revealing what they are playing on social media. Their friends then find it themselves via their own subscription.

While subscriptions started in the music market, it is in video streaming where it has become mainstream. Netflix and Apple TV both offer a monthly flat fee, all-you-can eat subscription, while the likes of Amazon Prime offer a more mixed model, where Prime subscribers get access to some content for free but have to pay extra one-off charges to access other content, such as newer films and shows.

These services have proved so popular that the revenue these companies now accrue through subscriptions and payments goes towards funding lavish own-brand productions of not just TV series but also cinema-rivalling big-budget movies.

User-generated video streaming – Standing outside of these streaming companies are a varied bunch of other video streaming services that specialise in user-generated content (UGC), the most prominent being YouTube. Originally built as a means of consumers distributing their own content, YouTube now features a mixed range of UGC and professional content – although much of the content blurs the line between the two. While it is funded by some ad-free subscriptions, its main source of revenue is advertising.

The interesting thing about YouTube is that it not only funds itself using ads, it also shares part of that revenue with successful content creators. The more ad views each accrues, the more money they make. There are currently at least ten YouTubers who earn more than $15m a year.

While YouTube has dominated the UGC video sector for years, its hegemony has been eroded by those social media networks that have become video-driven platforms. Videos accounted for 15% of all Facebook posts in 2021[2]. Similarly, Twitter sees around 1.2bn video views per day, a number that doubled between 2019 and 2020[3].

This shift to social video has also spawned its own range of video-first social sites. Instagram, the best known, has two billion active users[4], while Snapchat had 319 million daily users by Q4 2021, up significantly from the 265 million it had the year previously[5].

TikTok, meanwhile, has stolen a march on them all, surpassing the one billion subscriber mark in September 2021 by growing 45% in a single year[6].

While these sites would appear to be focussed on non-commercial UGC, peer-to-peer video, such is their appeal – particularly with Gen Z, Y and Z – that they are attracting brands, retailers, media companies and content creators, all of which use these sites for marketing.

Many are also exploring how these sites could be commercialised, with all offering some form of ecommerce to the companies that use them to propagate content.

References

[1] Digital Entertainment Group: www.degonline.org/judith-mccourt-deg-expo-mid-year-report/

[2] Social Insider: https://financesonline.com/facebook-video-statistics/

[3] Omnicore: www.omnicoreagency.com/twitter-statistics/

[4] CNBC: www.cnbc.com/2021/12/14/instagram-surpasses-2-billion-monthly-users.html

[5] Hootsuite: https://blog.hootsuite.com/snapchat-statistics-for-business/

[6] Statista: www.statista.com/statistics/1267892/tiktok-global-mau/