According to the RetailX Digital Media Sector report, the media marketplace is large and complex, made up of a raft of companies that produce the content, those that distribute it and those that actually sell it. The move across the market from selling physical media to downloads and streaming has also made it harder to quantify who the ‘retailers’ are of media content and services.

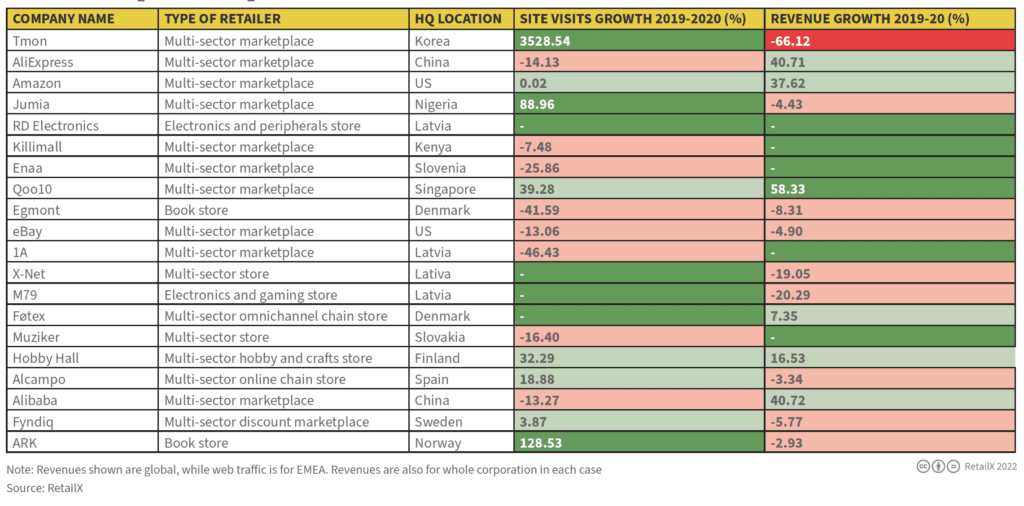

For the sake of this report, RetailX has looked at the top 20 retailers of all media by traffic (see table) to outline who, across the whole of Europe, are the key suppliers of games, video, music and publishing across all media.

Interestingly, while many of them are located in EMEA, a significant proportion – particularly in the top 10 – are not. It is also noteworthy that Amazon, which not only is a mixed marketplace selling a raft of media and peripherals, as well as being a content owner in its own right, is not the leading traffic site for media. That honour falls to Korea’s Tmon, closely followed by China’s AliExpress. This regional distribution of media retailers is dealt with in more detail in the next chapter, however, it reflects how the streaming and downloading business is now essentially borderless.

How they have performed individually as companies can be rudimentarily assessed by looking at revenue and traffic changes between 2019 and 2020. This offers an insight into how these businesses have performed across the pandemic, showing how growth or contraction has impacted each.

While figures are not available for all the 20 companies in the RetailX top 20, and while it is hard in many cases to pull out specific data on just media sales for multi-sector retailers, the comparison can show how the sector performed in a rapidly changing environment.

For most of the top 20, revenue growth has been largely positive, some such as Amazon and AliExpress seeing significant growth. It is worth noting here that these figures relate to total group revenues and so reflect the large swing to ecommerce across the pandemic. Within this, media sales played a significant role for both of these companies as both not only sell physical media – books, CDs and more – but also run their own extensive streaming services for video on demand and music.

Interestingly, many saw traffic rise through the pandemic, but saw revenues fall, a symptom of the market for digital media and ecommerce becoming highly competitive during the Covid-19 pandemic, forcing much more ruthless pricing.

Another standout is Ark, one of the only bookstores in the sample which saw large growth in traffic across the pandemic, an example of how even the use of books – both physical and digital – increased among bored, lockdown consumers. Revenues, however, also fell here, again a victim of ultra-competitive pricing.

Performance

Global revenues for the five most visited media sellers in the list show consistent growth between 2017 and 2021, with a spike in 2020. This is indicative of how media content and services has played an increasing role in consumer lives across the period as the uptake of mobile, the roll out of 4 and 5G and the ubiquity of broadband have come to make all these services more popular.

As a result, traffic growth across the period to these same five retailers has also seen extensive growth, growing around 90% in 2017-2018 and slowing to ‘only’ 5 to 10% across subsequent years.

This is indicative of the sudden surge in use of digital content use back in 2017-2018 as more users started to see the benefits of using on demand services over subscription services, particularly in games, video and to a lesser extent music.

The penetration of devices with bigger screens, better network connectivity, contributed to this, but the real driver has been the commoditisation of data. Broadband packages – both fixed line and mobile – lumped in more data per unit price as the market became more competitive and so users found themselves able to use these services more consistently.

The overall profitability of these services has also risen as traffic growth has slowed. These services have generated increased revenues, however, as the growing number of users have signed up to broader packages of services and have purchased more services and spin-offs as a result. For the multi-category marketplaces among the sample, the increased number of users of media services will have had a halo effect on sales across their sites – vindicating Amazon’s move to use Prime as a way to offer content and increase overall ecommerce sales, a model now aped by many of these players.

Media producers and distributers

The media market is marked out by being one that has a complex value chain of content producers, distributors and retailers. While the analysis in this section focusses on digital retailers, it is also worth looking at the top creators and distributors of content.

To assess the performance of the media market across physical, download and streaming for the games, music, video and books sector we have picked 10 of the best-known companies in the market to garner a snap-shot of revenue, profit and traffic performance across 2015 to 2020 – as well as investigating some of the figures for 2021 where they have, at the time of writing, been published.

The overall market for media content across these sectors and delivery channels is worth some $236bn in 2020, with around $194bn of it digital, accounting for 18% as an aggregate, although it varies across the sectors.

A breakdown by sector shows what each is worth and the percentage of physical to digital sales in 2020:

• Games $160bn (80% digital = $128bn)

• Music $22bn (75% digital = $16bn)

• Video & TV content $50bn (100% digital)

• Books $6.3bn (18% digital = $1.13bn)

The key players across these sectors analysed in this report give a view of how these services delivery revenues and traffic. The 10 we have selected from the Top500 are: Amazon, Apple, Disney, eBay, Gamestop, Microsoft, Netflix, Ninetendo, Spotify and QiYi.

Some of these companies – Amazon, eBay and Apple – operate across multiple sectors and delivery channels, supplying games, music, video and books for physical retail, download and streaming, as well as creating their own content. Others, such as Netflix and Spotify, operate within one area only, video streaming and music streaming respectively, the former making its own content, the latter being a distributor.

This naturally makes any direct comparisons more difficult, but the figures running across each company’s performance gives a good view of how the sector or sectors that that retailer is operating in has performed across time.

Traffic growth for these players paints a picture of the nuances and complexities of these markets. While growth across the board has been positive in 2019-2020, 2021 and beyond has seen some of this change again.

2020 witnessed massive growth in online consumption of services as the pandemic saw more people stuck inside and many furloughed and looking for in-home entertainment.

For others, the decline in physical media sales wasn’t immediately replaced by the uptake of their digital services. For example, eBay has seen traffic decline across 2016 to 2019 as it is far more dependent on physical item sales than digital services.

Conversely, Netflix has ridden the wave of streaming that has grown markedly across the same period, only to start to see a drop off in subscribers in 2022.

Ninetendo, similarly has seen its traffic eroded by the arrival of other gaming platforms, typically mobile games. As a response, it has started to fight back with its more connected and interactive Switch device.

The interesting one is Apple. It has seen revenues stay reasonably static across the period, despite traffic dropping. The traffic drop is explained by falling downloads of music and movies and increased competition across a streaming. It may also indicate that the increasing number of people switching to its music streaming services – and abandoning its iTunes download offering – is not only less lucrative for the company, but also less popular.