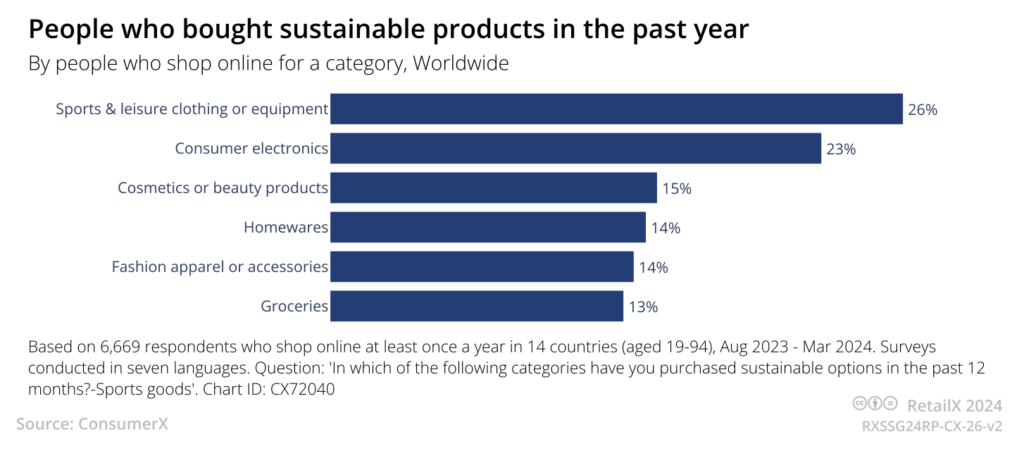

The RetailX Global Sports Goods 2024 report has highlighted that sports consumers are one of the largest demographics for purchasing sustainably. More than a quarter (26%) of them do so, ahead of consumer electronics (23%) and even fashion apparel – a sector at the forefront of trying to be more sustainable but one that sees only 14% of global shoppers buying a sustainable product in the past year.

As part of this, global sports goods consumers are a leading group in purchasing second-hand equipment and apparel, with 15% of them having done so at least once in the past year. This is again above fashion – regarded as a key second-hand market – where 10% of shoppers have purchased something second-hand in the past 12 months.

There are a number of influences on this purchasing behaviour. Many sports enthusiasts are highly aware of the climate and environment since they spend time outdoors in it. With so many sports taking place outdoors, not to mention the growing interest in outdoor pursuits such as hiking and adventure sports, there is a growing number of consumers that see the direct impact of climate change.

Age also plays a part. Those that buy sports fashion tend to be younger, who are also more sustainably minded than many older people.

The link between nature and the outdoors, health, wellbeing and growing thoughts of sustainable shopping are a power combination. Together, these factors help shape the way that consumers shop for sports goods, which drives the sector towards being one of the most sustainably shopped.

The rise of second-hand shares these same environmental and wellbeing drivers, along with a move towards looking for more affordable sports goods. Sports goods often have a high price point and, with rising inflation and cost-of-living pressures, many shoppers have turned to second-hand to find a more affordable way to buy the gear they need.

While many shoppers in developing markets are also drawn to second-hand sports purchases for affordability reasons and to temper the environmental impacts of their purchases, there is also a growing move for second-hand sports equipment and clothing in developing markets that’s driven entirely by affordability.

The final piece of the shift towards second-hand sports goods lies, as it does in fashion, with retro chic. There is a growing move among younger and older shoppers for vintage fashion, with sportswear increasingly falling into this area.

The rise of retro

While there are social and economic reasons why sports goods shoppers tend to buy more second-hand items than in other retail sectors, there is also the impact of the large market for vintage sportswear.

The nexus of sportswear and fashion is festooned with reissues of classic items from a panoply of well-known brands, as well as sites such as Depop and Vinted driving a strong market in true second-hand vintage sportswear, which can sell for a lot of money.

The appeal is universal. These pieces usually feature iconic branding and styling that signal taste and retro-cool among their wearers. They also, as is found in the second-hand luxury apparel market, offer an antidote to ubiquitous high street fashion, offering the comfort and style of sportswear, although with a knowing, retro edge.

Why is this so appealing? History. Many of the ‘classic’ sportswear looks echo sporting achievements that have gone down in sporting lore. John McEnroe’s Tacchini tracksuit top sported by the tennis star in the early 1980s has been reissued, while Adidas and Nike both run huge lines of reissued classic trainers, including the currently ubiquitous Nike Air Jordans.

The value of the vintage sportswear market is hard to quantify since it overlaps sportswear, fashion, luxury and second-hand. But with 15% of sports goods shoppers globally buying second-hand and with research in the UK pointing to 43% of shoppers there regularly buying vintage clothing, it is clear that the vintage sportswear market is very strong, both for new and for second-hand.

This feature, authored by Paul Skeldon, originally appeared in the RetailX Global Sports Goods 2024 report.

Inside the report we answer the most important questions about how shoppers are buying differently, as well as to reveal the main factors driving this change, what we might expect in the future and how retailers and brands can plan for that.

While the global sports goods market is dominated by enormous, well-known brands, we also discuss the wealth of localised players that attract a lot of sales and how they are utilising new channels to grow and reach their target customers.

Stay informed

Our editor carefully curates two newsletters a week filled with up-to-date news, analysis and research, click here to subscribe to the FREE newsletter sent straight to your inbox and why not follow us on LinkedIn to receive the latest updates on our research and analysis.