With peak just around the corner, a new study finds that more than half of UK consumers feel that Black Friday, Cyber Monday (BFCM) discounts are never as good as they expect them to be and 58% report that the products they really want are never discounted.

According to The New Discounting Playbook – a report commissioned by data-driven loyalty and engagement platform, LoyaltyLion – finds that shoppers, while open to a good deal, are increasingly chaffing at discounting around peak season days and suggests that Black Friday rules “need rewriting to attract long term revenue”.

“Once a feel-good Friday of deals, our research found that the now month-long BFCM event is one that customers no longer altogether trust,” warns Charlie Casey, CEO at LoyaltyLion. “Traditionally a golden opportunity to acquire new shoppers, the retail event is in danger of leaving existing customers feeling undervalued, underappreciated and deprioritised. Whilst it is fair to say that there will no doubt be some good bargains out there, a worrying proportion of shoppers feel that the discounts aren’t all they’re cracked up to be.”

The research found that over half (57%) of consumers feel that BFCM discounts are never as good as they expect them to be and 58% reported that products they want aren’t usually discounted making the retail event less relevant to them. A significant number (58%) also felt that BFCM discounts pressure them into making purchases they wouldn’t otherwise have made.

Even more concerning than shopper sentiment towards discounts, were the feelings targeted at brands peddling these reductions. 54% of UK consumers expect brands to push lower quality products during BFCM and 53% said that the deals and offers provided during this period impacted their trust in brands.

Just over half (56%) of the consumers surveyed felt that brands care more about selling products over supporting causes or living their values during BFCM, disappointing given the rise in conscious consumerism.

Furthermore, 55% felt that brands focus on winning new customers over making their existing customers feel special during BFCM.

Despite the months of planning that go into BFCM preparation and strategy, consumers still don’t feel brands have got it right. 54% feel that brands don’t do enough to prepare for the rush of orders they’ll receive during BFCM and 50% believe that they don’t communicate enough post-BFCM purchase with them. On the flip side, 54% feel that brands send too many promotional messages in the run up and during the BFCM period.

Alternatives to discounting

Traditionally, retailers have relied on heavy discounting during the BFCM period, but this often comes at a cost to a business. The research findings indicate that it is possible to replicate the surge of oxytocin that comes with bagging a discounted bargain and garner a feel good factor towards a brand, but through alternative methods that won’t harm profit margins.

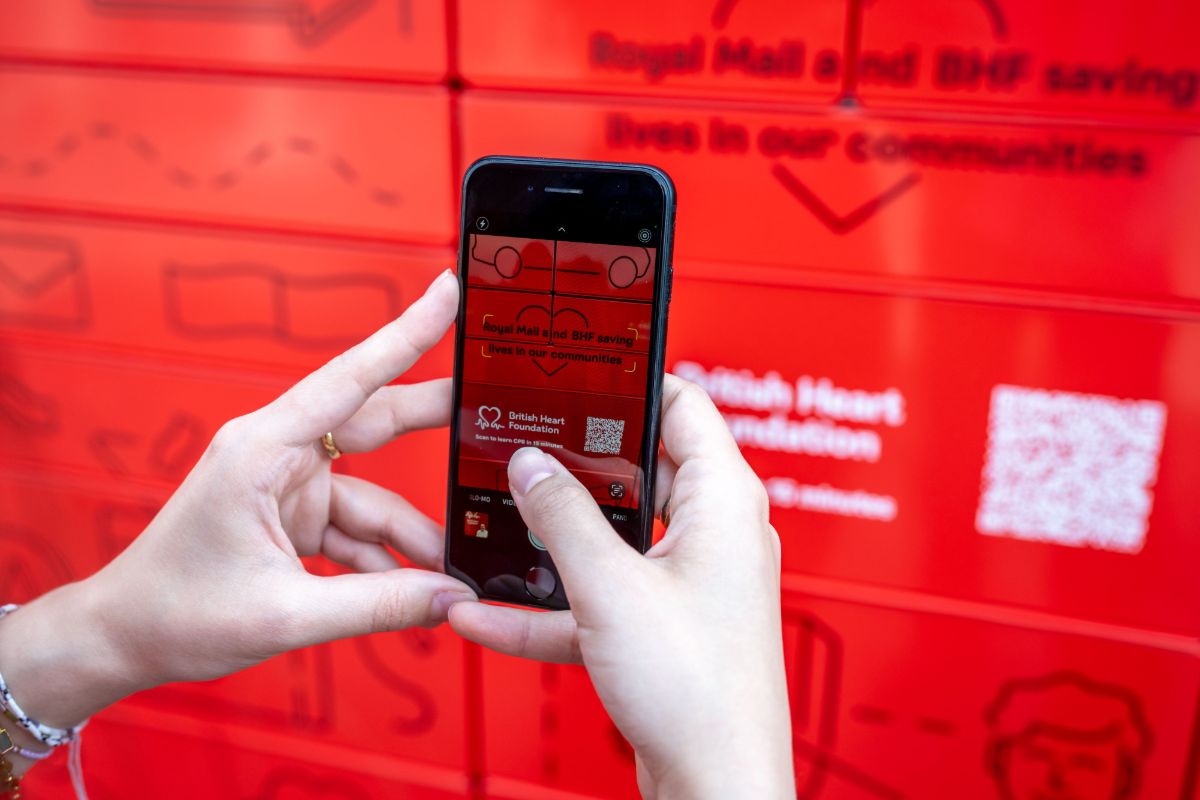

Brands would do well to note that 61% of consumers cited that they’d feel positive towards those that offered the opportunity to contribute to a charity or initiative aligned with their values.

While 78% said that offering free or discounted delivery would encourage positive sentiment towards a brand, as would giving out loyalty points that consumers could redeem against future purchases (73%).

Special birthday offers (72%), promotions offering early access to sales (66%) and early access to new products (65%) were also cited as ways to enhance sentiment.

Casey concludes: “Consumers expect discounts over BFCM, however as it stands today, they’re also expecting a negative shopping experience. This might result in attracting new customers and shoppers in the short term, but it’s unlikely to generate a long-term relationship and repeat business. Brands need to rewrite the rules this year and balance the impact of BFCM discounts by using alternative incentives to build emotional connections. This will in turn increase the chance of customers returning to spend with a retailer again, even when the peak trading period is over. This strategy can be just as effective as discounts in encouraging customers who have abandoned their carts to return, winning back at-risk customers who haven’t visited the site for a while, and encouraging customers to make a commitment in the form of either starting a subscription or joining a loyalty programme.”

He adds: “Gone are the days where brands can afford to rely on heavy loss-making discounting. The focus must be on creating positive sentiments AND driving BFCM sales to result in stronger, long-term customer relationships that keep both profits and customer lifetime value high, all year round.”