Google is the world’s biggest advertising company. Of the $237.9 billion Google generated in ad revenue in 2023, $175.0 billion, or 73.6%, came from Google Search. Search remains the primary driver of both revenue and profits. After Search, it brought in $31.5 billion, or 13.3%, via YouTube. Google Network, its third-party ads that are served on partner websites, brought in $31.3 billion, about the same percentage as YouTube.

When it launched on 23 October 2000, AdWords had 350 customers who paid per thousand impressions. In 2002, AdWords opened in the UK; the first advertiser was a live lobster mail order firm.

The search advertising business, more than any other under Alphabet’s umbrella, has helped give the company a valuation of around $2.4 trillion.

Amazon Advertising 2024 revenues are forecast to be $56 billion – almost higher than the major advertising holding companies: Publicis, Omnicom and WPP annual revenues combined.

What is the major part of Amazon Advertising revenues? Sponsored Search also known as “Sponsored Product”.

In other words, the two of the largest – and fastest growing advertising network on earth are 70% dependent on one type of (very powerful) ad unit – based on search.

And it’s not slowing down: during the Q32024 earnings call, Amazon Advertising Management indicated “Sponsored Product growth continued to be the main driver with Streaming TV an exciting development, but still very early in advertiser adoption”

Search based auctions explained

Both Google and Amazon run their two key advertising types – Google AdWords and Amazon Sponsored Products – based on an auction to decide which ads appear in search results and how much advertisers pay per click. Winning isn’t just about having the highest bid—Amazon also evaluates ad relevance based on keywords and other unknown factors. Google also uses an auction but factors in Ad Rank, a score based on bid amount and ad relevance as well as users context such as location and device.

Retailers have adopted these auction based advertising models for their retail media networks. As Jordan Witmer of Nectar First points out “rather than relying on organic algorithms to surface the most relevant products, retailer ad networks prioritise paid placements in search results and category pages. Retailers can deploy two main approaches to sponsored products: keyword-first, which prioritises bidding on search terms, or product-first, which focuses on visibility for specific SKUs.

Keyword First systems are what they sound like – bids are placed on the keyword, either by exact or phrase. Product First systems have advertisers placing bids on a specific product – then the retailer system determines what placement and keyword to spend that bid on based on campaign objectives (and maximizing the value for the retailer).

What if it’s just begun?

The lesson from Google and Amazon is that there is a lot more to be done with Search. One would think that Google and Amazon’s search business would have diminished in importance, but the opposite is true.

This contrasts with the amount of industry virtual ink given over to the new, different types of ad units such as offsite, video, programmatic and so on.

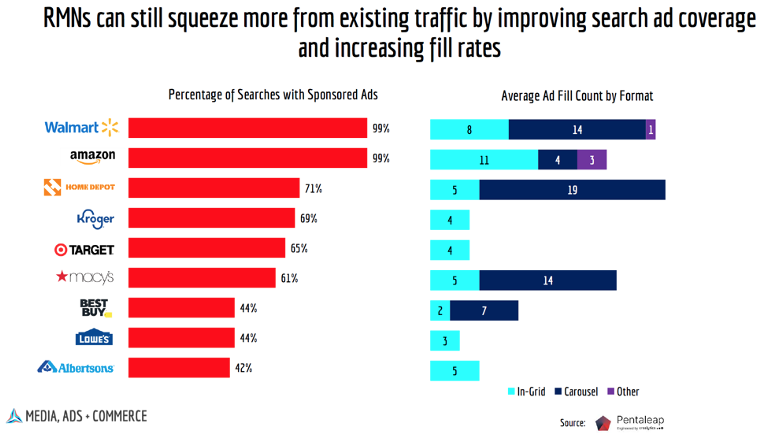

Andrew Lipsman of Media Ads and Commerce points out the error in this thing: “ There’s a misconception that most of the juice has already been squeezed from on-site advertising, when the reality is there’s still so much value to be unlocked. Once RMNs understand how others are monetising, they can devise strategies to improve their own. That could include reconfiguring existing ad slots, adding new formats, improving site experience, or driving more competition among brands. “

Drawing on data from Pentaleap, Andrew and Daniel Knapp, Chief Economist of IAB Europe show the data that in fact retailers are not ‘squeezing’ all they can from existing traffic in terms of search advertising coverage and fill rates.

How to grow search advertising with retail media networks

#1 Look the search technology being used: Sarah Mackinnon, product marketing director, Pentaleap says that: “Retail media networks use similar sophisticated tech to Google for organic products, combining keywords with contextual and behavioural data to ensure relevance”. However, “ads on these networks are often delivered through basic ad servers, detached from this advanced organic search tech”. In other words, when a user enters a complex search, the ad server, relying solely on keywords, may miss relevant matches—resulting in lost ad revenue.

#2 Adjustable ad placements: adjust ad positions within the grid based on a mix of ad relevance and organic content. Data from Pentaleap shows these “fluid” placements can more than double click-through rates compared to static, fixed placements. Retailers using dynamic placements often have more available space per page, allowing for a greater number of ads without disrupting the shopping experience.

#3 Never forget the ‘keyword’ that matters – relevance: Shoppers don’t mind sponsored product advertising as long as those products meet their needs. When relevance is prioritised, engagement increases, click-through rates improve, and conversions rise. Advertisers also benefit, as their ads reach a more targeted, engaged audience, driving higher returns on their investment.

Relevance is more than just a filter on which products to show—it’s about keeping the customer experience central to every decision. Without relevance, even the most sophisticated retail media efforts will struggle to maintain long-term value.

For retailers, go back to the future

Despite the buzz around offsite ads, video, and programmatic, search remains the foundation of retail media growth. The dominance of Google and Amazon proves that search-based advertising is far from mature—it’s still expanding, and retailers have barely begun to unlock its full potential. Retailer should go back to where it all started, search based advertising – and think through their product strategy.